Berkshire Hathaway is a multinational conglomerate holding company. ( BRK.A 1.24% ) ( BRK.B 1.40% ) The conglomerate holding company’s latest financial report disclosed a remarkable $277 billion in cash and similar assets by the conclusion of the second quarter of 2024. This substantial cash reserve has piqued the interest of investors, who are curious to understand the reasons behind it, especially pertaining to the Chairman and Chief Executive Officer. Warren Buffett is gathering it.

Now, let’s analyze the methods Berkshire used to accumulate its substantial cash reserves and speculate on Buffett’s potential strategies for utilizing it in order to decide whether it is advisable to purchase, sell, or retain this high-quality stock.

Contents

The accumulation of cash at Berkshire Hathaway by Warren Buffett.

Prior to diving into Berkshire Hathaway’s quarterly report, it is crucial to understand the reasons behind its substantial cash reserves. Serving as a conglomerate, Berkshire holds a controlling interest in over 60 different companies, which include insurance firms such as Geico and well-known brands like Dairy Queen and See’s Candies.

Berkshire gathers premiums in advance from its insurance companies such as Alleghany Corporation and Geico, which it then uses for investment. This amount, referred to as the float, has enabled Berkshire to create a notable stock portfolio, currently consisting of approximately 40 stocks valued at around $300 billion.

In 2024, Berkshire Hathaway has notably reduced its stock holdings, along with maintaining its solid financial position. earnings from core business operations During the first six months of 2024, Berkshire Hathaway’s cash and cash equivalents reached $22.8 billion, reflecting a 26% increase compared to the previous year. By June 30, the company’s cash reserves had surpassed the previous levels. market capitalization refers to the total value of a company’s outstanding shares of stock. such as corporations AMD and Pepsico .

This is how Buffett is utilizing the cash held by Berkshire.

Buffett’s decision to hold onto cash is probably influenced, at least to some extent, by the appealing returns – reaching up to 5.4% – currently available. Treasury bills , Treasury bills are short-term debt securities issued by the U.S. government with durations of one year or less. Berkshire Hathaway disclosed in its most recent quarterly financial report that it possessed $237.6 billion worth of Treasury bills, surpassing the $195.3 billion held by the U.S. administration. The Federal Reserve can be referred to as the central bank of the United States. as of the end of July, in the current year.

Previously, Buffett has highlighted that Berkshire’s top choice for the company’s cash is Treasury bills when there are no compelling investment opportunities available. He mentioned that the safety and ease of converting them into cash are key benefits.

By projecting the potential interest earnings from investing in Treasury bills, Berkshire Hathaway could make approximately $12 billion over the upcoming year, based on a 5% return, with minimal risk involved.

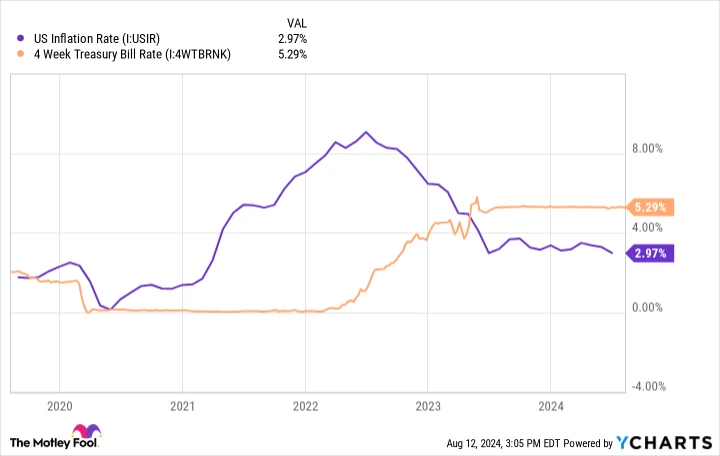

Due to historical fiscal performance of the U.S. government, the main concern for Treasury bills is the potential loss of value due to inflation. Warren Buffett stated in a shareholder letter that Treasury bills are riskier in the long run compared to diversified stock portfolios acquired gradually. However, with the current inflation rate in the U.S. standing at 2.97% over the past year, the immediate risk to Treasury bills seems low.

Rate of inflation in the United States data by YCharts .

What other options does Buffett have for using Berkshire’s cash?

Buffett doesn’t see Treasury bills as a good long-term investment, so it’s doubtful he will keep holding $237.6 billion of it indefinitely. Berkshire has a track record of making acquisitions, with the latest one being the remaining 20% of Pilot Flying J, a chain of truck stops, purchased for $13.6 billion spread out over a few years. Prior to that, Berkshire bought Alleghany Corporation, an insurer, for about $11.6 billion in 2022.

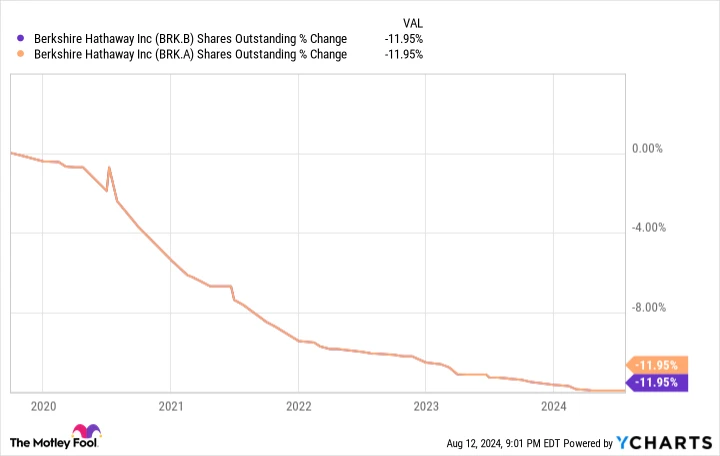

Another option for Buffett would be to distribute its funds to Berkshire’s stockholders in the form of dividends. buying back shares While Warren Buffett holds a strong preference for dividend-paying stocks in Berkshire’s stock portfolio, he has never distributed dividends to Berkshire shareholders, making this scenario improbable. Buffett instead leans towards share buybacks at advantageous prices and has bought back approximately 12% of Berkshire’s shares. number of shares available to be traded on the stock market Over the last five years, existing shareholders have experienced an increase in their ownership of Berkshire by buying back shares, without needing to purchase more shares.

Number of BRK.B shares available on the market. data by YCharts .

Regardless of the decisions made by Buffett or his investment managers regarding Berkshire’s cash reserves in the future, the company will maintain at least $30 billion in cash and cash equivalents at all times. This commitment stems from Buffett’s dedication to exercising “extreme financial prudence” for the benefit of the shareholders, in addition to fulfilling its obligations as an insurance provider.

In his latest yearly shareholder letter, Buffett stated that although being cautious may seem unnecessary most of the time, it is like having an insurance policy for a building that is believed to be fireproof. Berkshire Hathaway aims to avoid causing long-lasting financial harm.

Should one consider purchasing Berkshire Hathaway stock?

In 2024, Berkshire Hathaway’s stock has increased by approximately 21%, with an impressive compound annual growth rate of 19.8% since Warren Buffett assumed leadership in 1965. While some critics may view Buffett’s conservative management of the company’s cash reserves unfavorably, this cautious strategy actually prepares Berkshire to capitalize on market declines, making it an attractive option for investors looking to mitigate risks.