American Express is a financial services corporation that offers credit cards, charge cards, and traveler’s cheques. ( AXP 0.57% ) ranks as the third-largest stock in Berkshire Hathaway is a well-known multinational conglomerate holding company. By the end of the second quarter, the portfolio had a fair value of $35 billion, which Chief Executive Officer Warren Buffett and his team find notable due to its significant competitive edge and strong economic protection.

However, in recent months, investors have become more worried about a decrease in consumer spending and an increase in charge-offs and delinquencies in the banking industry. With American Express stock having increased by approximately 60% since last November, is this a favorable moment to invest in the company? Let’s analyze the company’s operations to determine.

The strengths that set American Express apart from its competitors.

One of the initial characteristics that is noticeable about American Express is its strong brand The company has dedicated a significant amount of time to develop its reputation as a symbol of luxury and sophistication. During an interview with Bloomberg a few years back, Buffett mentioned that it is impossible to replicate the prestige and perception that American Express holds in people’s minds, despite having the resources to start various other ventures.

The powerful brand of American Express allows it to appeal to customers who spend a lot and retain them as loyal customers for a long time. Black Card that is exclusive Customers must have a minimum spending of $250,000 on their current American Express cards and are subject to a significant initial fee of $10,000 along with an annual fee of $5,000. Platinum Card Priced at $695 per year, this option offers a more budget-friendly choice and includes perks such as access to airport lounges, hotel advantages, travel incentives, and credits for dining and entertainment.

American Express experiences positive network effects due to its large customer base of 144 million cardholders and wide acceptance at 80 million merchant locations. Visa and Mastercard Furthermore, it retains its credit card debt, which enables it to generate net interest revenue along with fees for processing and transactions.

Monitor consumer expenditure and credit behavior closely.

In the second quarter, American Express reported strong results with earnings per share of $3.49, surpassing the average prediction of $3.26 by analysts.

It saw an increase in net interest income of $3.7 billion, which grew by 20% compared to the previous year, thanks to the higher interest rates. Nevertheless, this growth was not as significant as in the first quarter, indicating that the effect of the higher interest rates is starting to diminish, similar to what other banks experienced in the same period.

Investors should keep an eye on the performance of consumer credit. Banks have observed fluctuations in this aspect over the last few quarters. Charge-offs of loans and rates of delinquent payments Interest rates on credit card loans are increasing. This is partly because credit conditions are returning to normal, but there is also worry that consumer spending is starting to decrease.

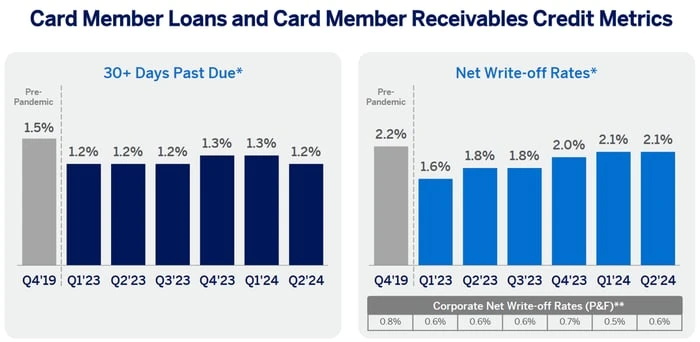

Picture credit: American Express.

In the quarter, American Express maintained a net write-off rate of 2.1% on its card member loans and receivables, which was consistent with the first quarter. The percentage of accounts that were 30 days or more overdue decreased from 1.4% to 1.3% compared to the previous quarter, suggesting a potential slowdown in the increasing rate of charge-offs. Chief Financial Officer Christophe Le Caillec informed investors that they anticipate the write-off rates to stay relatively unchanged for the rest of 2024.

Management has increased its 2024 earnings-per-share estimate to $13.55 at the midpoint, which is higher than the previous forecast of $12.90.

Should I purchase American Express today?

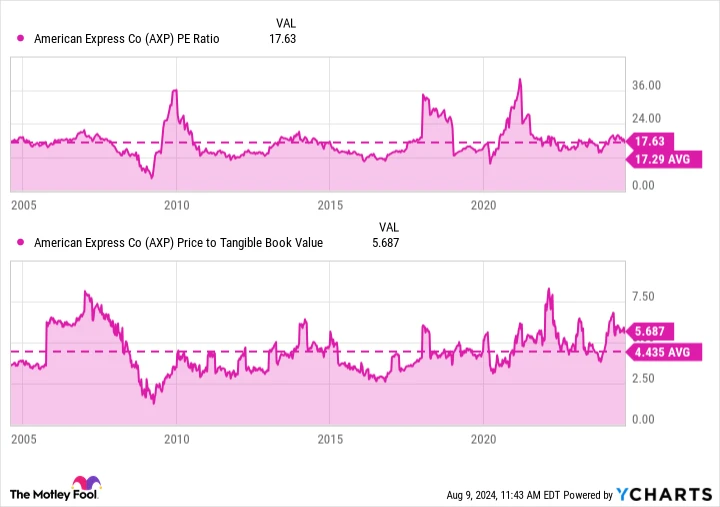

The stock price has risen by approximately 60% since November of the previous year, with a price-to-earnings ratio of 17.6 and a 5.7 ratio. times its physical assets value Its value is somewhat high compared to the last twenty years.

AXP PE Ratio data by YCharts

There is no urgent need to purchase the stock today, as it is not overly costly. However, it is recommended to keep an eye on the financial status of American consumers, as any additional weakening and failures to make payments could negatively impact American Express in the short run.

Nevertheless, American Express is not as severely impacted by increasing charge-offs and delinquencies due to its affluent customer base with high spending power and income levels, which can better weather economic downturns. Should the stock price decrease, it may present a favorable chance for investors with a long-term perspective to purchase shares.