New York Community Bancorp is a financial institution based in New York. ( NYCB -2.14% ) Recently, the company faced significant challenges and had to reduce its dividend significantly, as well as receive a $1 billion rescue package. Despite currently showing less than favorable financial results, the company is actively working towards a complete transformation. The management is focused on achieving performance comparable to industry peers by the conclusion of 2026. Given this situation, what actions should investors consider taking?

New York Community Bancorp is reporting poor financial figures.

When reviewing the financial performance of New York Community Bancorp in the second quarter of 2024, you may be alarmed. The company reported a significant net loss of $323 million, an improvement from the first quarter’s $327 million loss but a decline from the positive net income of $413 million in the second quarter of 2023. This resulted in a loss per share of $1.14 in Q2 2024, $1.36 in Q1, and a profit of $1.66 per share in Q2 2023.

It is evident that the current situation at New York Community Bancorp is not positive, which was expected.

Credit: Getty Images.

In early 2023, the bank encountered significant problems with its operations and performance as a result of two major incidents. bank In recent years, New York Community Bancorp has made several acquisitions, leading to rapid growth. However, this expansion resulted in the bank facing heightened regulatory scrutiny that it was unprepared for. Additionally, the performance of the bank was negatively impacted by the souring of several large loans, raising concerns among investors about the overall health of the loan portfolio. As a result, the stock price plummeted, dividends were significantly reduced, and the bank had to receive a $1 billion bailout to navigate through a period of transformation.

The transformation of New York Community Bancorp is still ongoing.

Although challenging to interpret, the Q2 outcomes of New York Community Bancorp were essentially a reflection of its endeavors to realign the business. As per CEO Joseph Otting:

In essence, management is taking necessary actions, such as appointing “nine experienced leaders to the executive management team.” A significant number of these new recruits were hired from different organizations, indicating that they are likely receiving generous compensation to join a bank that is currently navigating a recovery process.

Expenses are likely increasing while performance has declined in this area. However, the $1 billion in cash injection received by New York Community Bancorp has provided it with a strong financial base to revamp its operations. Consequently, it is reasonable that experienced executives may be inclined to take on a position at the bank.

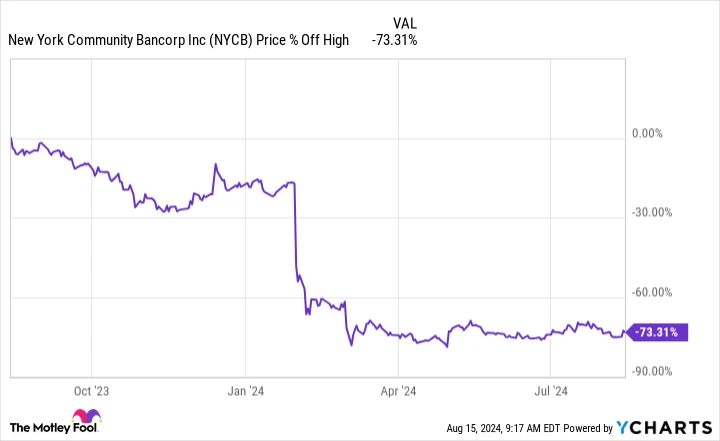

Aggressive investors looking for opportunities in turnaround stocks may find New York Community Bancorp’s situation appealing. The stock has declined by over 70% in the last year, indicating significant potential for an increase in value.

However, this can only be achieved if the management continues to make tough decisions, as they have been doing for the past few quarters. Considering that the CEO was hired with the specific goal of revitalizing the bank’s operations, it appears probable that An attempt to reverse a situation or outcome. The journey ahead is expected to be challenging for about two more years. Only the most daring investors looking for a quick turnaround may be interested in the stock, understanding that the bank is still in the early stages of recovery.

The majority of investors will likely steer clear of investing in New York Community Bancorp.

Investors may not be interested in including a struggling bank like New York Community Bancorp in their portfolios, as it is selling assets, improving its financial situation, evaluating its loan quality, bringing in new leadership, and experiencing significant losses. This stock is considered a turnaround opportunity suitable for only very aggressive investors who are prepared to endure poor earnings reports for some time. For those with a lower risk tolerance, it may be wise to wait for more visible improvements before considering an investment in this bank.