Platform for cloud computing DigitalOcean ( DOCN 1.16% ) On August 8, the financial results for the second quarter of 2024 were announced, leading to an increase in the stock price as investors reacted positively to the report.

Undoubtedly, DigitalOcean performed well in important areas during the second quarter. One notable achievement is the 13% year-over-year growth in revenue, marking the company’s second consecutive quarter of increasing growth. Additionally, it made adjusted improvements. free cash flow A significant indicator of profitability amounted to $37 million. While this figure may have decreased compared to the previous year, it still represents a robust margin of 19%.

The increase in DigitalOcean’s stock price after the report indicates positive prospects for the company. Yet, it is important to consider that investors may have exaggerated reactions. Thus, further investigation is necessary to evaluate whether buying DigitalOcean stock is advisable.

One worrying pattern

I think DigitalOcean is experiencing a concerning decline in customers, and I will elaborate on this.

During the second quarter, DigitalOcean had a net dollar retention rate of 97%, marking the fourth quarter in a row where it was below 100%. This rate assesses the amount spent by customers in a year compared to the previous year. A retention rate below 100% suggests a decline in revenue due to customer attrition and downgrades, which is considered concerning.

Understanding this metric is crucial, although it can be challenging. It is worth noting that the metric does not include new customers acquired in the previous year. However, new customers do impact the average revenue generated per customer. In the second quarter, DigitalOcean’s average revenue per customer increased by 9% compared to the previous year and by 25% compared to two years ago, reaching $99.45.

Another significant aspect to consider is the total number of customers using DigitalOcean’s services. At the end of the second quarter, the company had 638,000 customers, showing a 3% increase compared to the previous year.

By combining these three measurements, investors can observe that DigitalOcean has achieved a higher number of customers and an increase in average customer spending. However, the company has attracted many new customers while losing some of its loyal long-term customers, as shown by the decreasing retention rate. This pattern is worrisome.

What makes this a potential issue.

In 2022, DigitalOcean saw an increase in its customer retention rate following a rise in prices for its cloud computing services. The higher prices led to more spending, but a year later, the retention rate fell below 100%, indicating that the company lost customers due to the price adjustments.

DigitalOcean is competing with some of the largest companies in the technology industry. Amazon , Alphabet , and Microsoft The company has established a specialized market position through counter-positioning, targeting small and medium-sized businesses that are considered too insignificant for larger competitors to pursue.

DigitalOcean has experienced a decline in customers who spend $50 or less per month when analyzing the numbers. This suggests that recent modifications to the platform have shifted the company’s focus away from lower-spending customers towards competing directly with larger tech companies. This shift may lead to increased competition in the future.

Reasons why purchasing DigitalOcean stock could be a good decision

The reasoning behind the investment DigitalOcean’s strategy was to target small users who were ignored by larger cloud-computing platforms. By supporting the growth and success of these small users, DigitalOcean expected them to expand their usage and spending on the platform.

DigitalOcean is losing smaller customers but gaining larger ones who spend more money. This shifts the focus of the company and increases its competition with larger competitors. However, it could still be a worthwhile investment despite this challenge.

DigitalOcean’s revenue is increasing at a faster rate, which is positive news. Management believes that the release of 24 new products in Q2 has contributed to this growth, showing a significant increase in the speed at which new products are being introduced. costs associated with conducting research and developing new products or services There was an 11% decrease in sales during the first half of 2024 as compared to the same period in 2023, despite the anticipation of a rise due to the introduction of numerous new products.

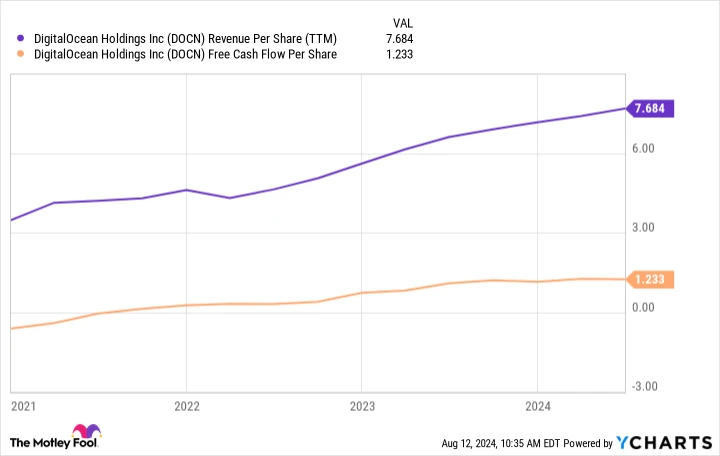

This highlights a long-standing characteristic of DigitalOcean: the company has expanded while being financially cautious. As a result, it consistently produces good free cash flow.

The trailing twelve months (TTM) Revenue Per Share of DOCN. data by YCharts

Granted, The management at DigitalOcean anticipates a decrease in profit margins. The company is placing a greater emphasis on artificial intelligence investments. However, its primary focus remains on achieving sustainable growth and profitability in the long run, which is expected to benefit the company in the future. times sales The stock is reasonably priced.

Due to the worrying pattern I pointed out, I don’t believe that DigitalOcean stock is a clear choice at the moment – it’s not my top pick for significant stock gains. However, for certain investors, it shows enough potential to be considered as part of a varied investment portfolio.