As the COVID-19 pandemic fades from memory for many investors, Pfizer ( PFE -0.73% ) The company has faced challenges in surpassing the exceptional vaccine sales and profits achieved in 2021 and 2022. Its stock has declined by approximately 53% from its peak, as investors question the ability of the pharmaceutical company to discover another highly successful drug.

Positive updates reveal that the company’s most recent performance showed an increase in growth. The sales momentum generated by various new product releases is contributing to a more optimistic future. With Pfizer stock currently offering an attractive dividend yield of 5.8%, is it worth considering adding it to your investment portfolio? Here are the key details you should be aware of.

A promising beginning to the year 2024.

Currently, Pfizer faces the task of regaining the trust of investors by demonstrating that it is focused on executing its long-term plans effectively. Thankfully, the company’s financial results for the second quarter show progress in this regard. Revenue increased by 3% compared to the previous year, and when excluding the impact of the decreasing Comirnaty and Paxlovid COVID-19 initiatives, the growth was even more remarkable at 14%.

Besides the support from Seagen, which was acquired by Pfizer towards the end of 2023, the growth this quarter was fueled by high demand for top-selling products such as Vyndaqel and Eliquis. Additionally, sales of Nurtec as a treatment for acute migraines have also increased.

Pfizer has focused on achieving financial savings by restructuring costs, aiming to achieve savings of at least $4 billion by the end of the year. It seems that their efforts are proving to be successful, as seen in their second-quarter results. EPS The earnings per share (EPS) of $0.60 exceeded the average Wall Street estimate by $0.14.

Management was able to increase their full-year guidance at Pfizer. The company now anticipates an adjusted EPS for 2024 to be in the range of $2.45 to $2.65, which is higher than the previous estimate of $2.25. Additionally, the revenue forecast has been raised to between $59.5 billion and $62.5 billion, representing a 4% increase at the midpoint compared to 2023.

Picture credit: Getty Images.

Pfizer’s appealing dividend with a high yield

A company that successfully turns around its performance is usually well-received by the market. Pfizer is well-positioned to bounce back and become even stronger following a challenging period. The appeal of investing in Pfizer’s stock lies in its prominent position in the industry and established track record of being innovative.

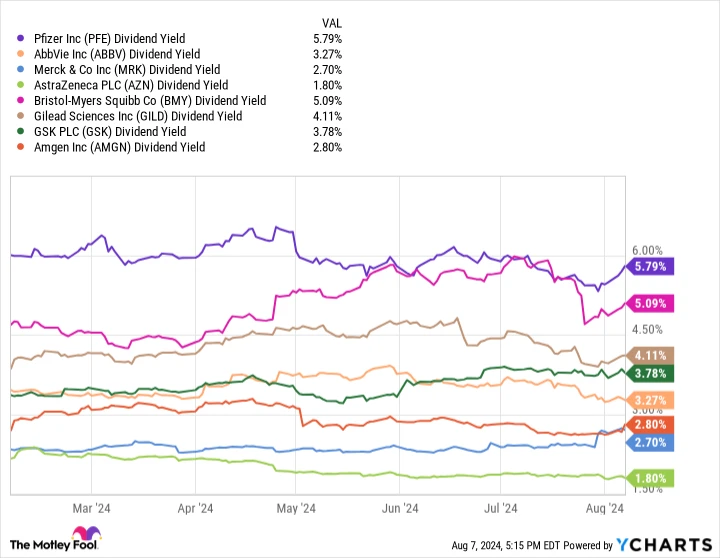

I appreciate Pfizer for its attractive value, as indicated by a low forward price-to-earnings (P/E) ratio of 11 times the company’s projected earnings per share (EPS) for 2024. Pfizer also stands out for its generous dividend yield compared to other global pharmaceutical companies, currently at 5.8% thanks to its quarterly dividend of $0.42 per share. This dividend yield surpasses that of many competitors in the industry. AbbVie yielding 3.3% GSK at a rate of 3.8%, or possibly Bristol Myers Squibb is the name of a pharmaceutical company. at 5.1%.

PFE Dividend Yield refers to the percentage of the annual dividend payment that a shareholder receives relative to the current stock price of the company Pfizer Inc. data by YCharts .

The key points to consider regarding Pfizer’s stock

The key point from the financial report for the second quarter is that the company is now moving on from the uncertain period during the latter stages of the pandemic. In my opinion, Pfizer’s stocks should be considered for purchase.

Several drug programs are currently undergoing clinical trials and results are anticipated by the end of the year. These programs focus on weight management, oncology, and hematology. Positive outcomes from these treatments could drive the stock price up. However, it is important to be aware that regulatory decisions also pose potential risks, as any delays in Pfizer’s drug development could lead to fluctuations in the stock market.

In the grand scheme of things, Pfizer appears to be priced lower than its actual value, taking into account the future possibilities within its current range of products and upcoming drugs. The company’s potential to return to a path of profitable growth is likely to have a beneficial impact on its stock. This should be encouraging for investors who are focused on the long run. Pfizer might be a suitable option within a varied investment portfolio.