Contents

The AI Revolution: A Boon for Semiconductor Giants

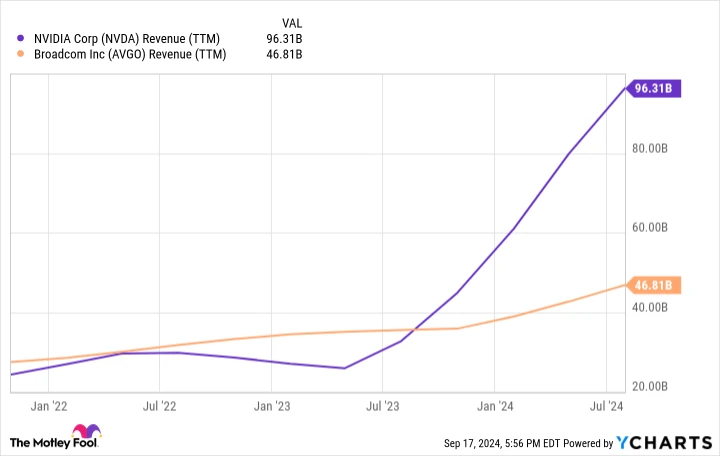

In the past year, the surge in artificial intelligence (AI) technologies has led businesses to rapidly adopt these advancements, significantly boosting sales for semiconductor chip makers such as Nvidia and Broadcom. These companies provide essential components for implementing AI in data centers optimized for cloud computing, an ideal environment to cater to AI’s extensive computational demands.

Given the industry’s rapid growth—from a global market size of $136 billion in 2023 to a projected $827 billion by 2030—both Broadcom and Nvidia are strategically positioned to reap long-term benefits. Investing in these companies offers a promising avenue to capitalize on the AI sector’s secular trend. But if an investor had to choose just one, which semiconductor giant would be the superior AI investment? Let’s examine each company’s approach.

Broadcom’s Approach to AI

Broadcom has adopted a multifaceted strategy to penetrate the AI market, offering a diverse range of products across various tech sectors, including data centers, wireless networks, and industrial applications. Their approach combines both hardware and software solutions to address AI infrastructure needs.

Hardware Advancements

On the hardware front, Broadcom’s portfolio includes AI accelerators, which are critical for enhancing AI processing speeds. The company’s custom AI accelerator business experienced a threefold year-over-year growth in its fiscal third quarter ending on August 4.

This heightened demand for AI-related products propelled Broadcom’s semiconductor division’s fiscal Q3 sales to $7.3 billion, up from $6.9 billion the previous year.

Software Integration

In the software domain, Broadcom’s acquisition of VMware in late 2023 significantly bolstered its capabilities, driving the software division’s Q3 revenue from $1.9 billion to $5.8 billion year-over-year. This acquisition facilitated a 47% increase in total Q3 revenue, reaching $13.1 billion.

Leveraging the VMware Cloud Foundation (VCF) platform, Broadcom targets businesses seeking private or hybrid cloud solutions for their AI systems. This strategy has proven successful, with VCF accounting for 80% of VMware’s Q3 product bookings.

Financial Health

Broadcom concluded its fiscal third quarter with strong financials, boasting a free cash flow (FCF) of $4.8 billion. The company’s balance sheet reflected total assets of $168 billion, with $10 billion in cash and equivalents, and total liabilities of $102.3 billion, including $70 billion in debt.

Nvidia’s AI Strategy

Nvidia has gained prominence in the AI sector through its pioneering work in graphics processing units (GPUs), which are crucial for executing complex AI computations. The company offers an extensive array of software and services, including a robotics platform, to empower businesses in leveraging AI.

GPU Innovation

Since introducing the GPU in 1999, Nvidia has continuously refined its technology. Today, its chips are the preferred choice in the AI computing landscape. The company is advancing its processors with the introduction of the Blackwell GPUs, touted as the world’s largest and most powerful, featuring over 200 billion transistors.

This GPU leadership enabled Nvidia to achieve record revenue of $30 billion in its fiscal second quarter, ending on July 28—a 122% increase from the previous year. The company forecasts further growth, predicting fiscal Q3 revenue of $32.5 billion, up from $18.1 billion the prior year.

Expanding AI Applications

Nvidia’s AI strategy extends its GPU prowess into various sectors, including automotive, to support self-driving vehicle initiatives. CEO Jensen Huang anticipates a shift in the nearly $600 billion cloud computing market in 2023 towards AI infrastructure, presenting a significant opportunity for Nvidia.

Financial Overview

Nvidia’s financial performance is robust, with a fiscal Q2 FCF of $13.5 billion. The company’s balance sheet for Q2 showed total assets of $85.2 billion, with $34.8 billion in cash, cash equivalents, and marketable securities, and total liabilities of $27.1 billion, including $8.5 billion in debt.

Comparing Broadcom and Nvidia as AI Investments

With the AI market expanding, both Broadcom and Nvidia are poised for continued sales growth. However, Nvidia has demonstrated superior revenue growth in the past year, reflecting strong customer demand for its products.

Valuation Insights

A key metric for evaluating these stocks is the price-to-earnings (P/E) ratio. Broadcom’s P/E multiple stands at 141, significantly higher than Nvidia’s 54, indicating Nvidia offers better value.

Currently, both companies’ shares are trading below their 52-week highs. Nevertheless, Nvidia’s leadership in AI chips, solid financials, and favorable valuation make it the more attractive long-term investment among these semiconductor giants.

Should You Invest $1,000 in Nvidia Now?

Before purchasing Nvidia stock, consider this: The Motley Fool’s Stock Advisor analyst team has pinpointed what they believe are the 10 best stocks for investors to buy now, and Nvidia wasn’t on the list. The selected 10 stocks are poised to deliver substantial returns in the coming years.

Reflect on when Nvidia made this list on April 15, 2005—if you invested $1,000 based on their recommendation, you would have $710,860 today!*

Stock Advisor provides investors with a straightforward blueprint for success, including portfolio-building guidance, regular analyst updates, and two new stock picks monthly. The Stock Advisor service has outperformed the S&P 500 by more than four times since 2002.*

Discover the 10 stocks ›

*Stock Advisor returns as of September 17, 2024.