The stock market reacted negatively to the machine vision company. Cognex Corp. ‘s ( CGNX -0.03% ) The company’s recent financial report for the second quarter showed a decline in its target markets for 2024. There is little chance of an increase in orders during the second and third quarters, which are crucial as customers get ready for the fourth quarter. Despite this, most of the negative information has already affected the stock price. Cognex remains a promising investment with excellent growth potential in the long term. This makes it an appealing stock to consider purchasing at the moment.

Contents

Cognex’s earnings falling short of expectations.

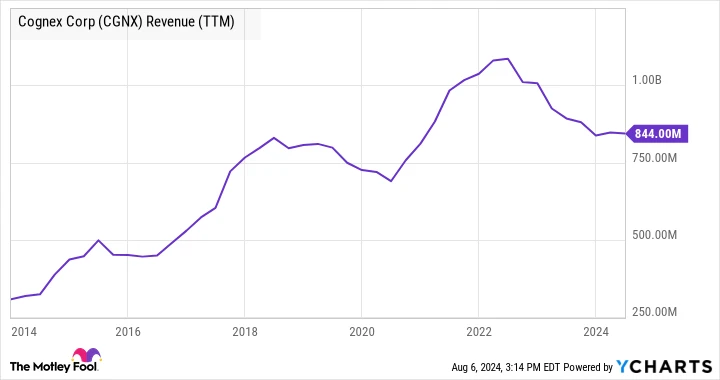

In 2023, the company experienced a 17% decrease in revenue, and the expected recovery in 2024 is not anticipated to meet investors’ expectations. Cognex saw a 1% decline in revenue in the second quarter, and without the contributions from acquisitions and fluctuations in foreign currency, the decline was 7%.

Additionally, the revenue forecast provided by management for the third quarter, ranging from $225 million to $240 million, fell short of market predictions and was seen as unsatisfactory, especially given that second-quarter revenue amounted to $239 million.

In simple terms, Cognex is expected to have another year of disappointments, and management wasted no time in explaining the reasons for this.

During the earnings presentations, management talked about these end markets. Regrettably, only logistics and the semiconductor market in the “others” category have positive factors driving them at present. The remaining markets have negative drivers.

Softness in the market in 2024

Cognex’s CEO, Rob Willett, mentioned a decline in their automotive business, especially in Europe, due to cautiousness among their automotive clients caused by sluggish auto sales and political instability.

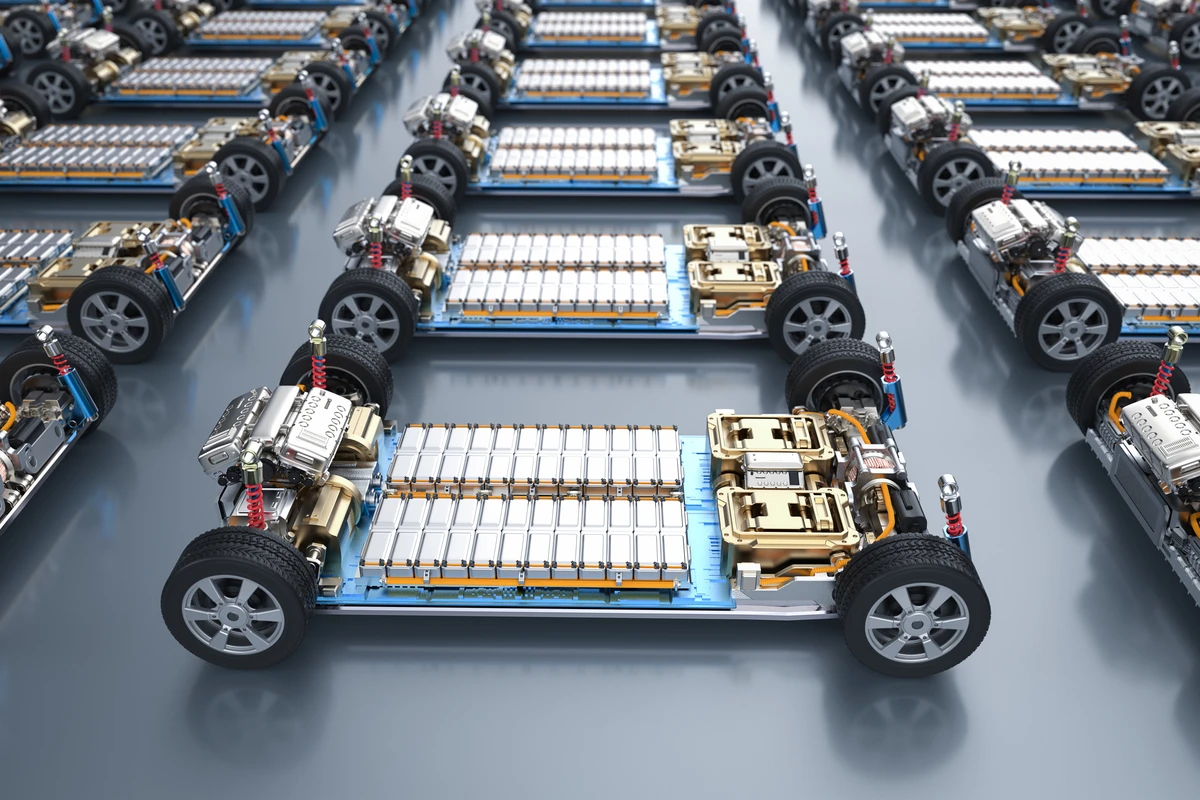

To make matters worse, Willett also mentioned electric cars. EV During the second quarter, Cognex experienced a reduction in revenue as a result of battery customers scaling back on projects. This decline is concerning since the battery sector was expected to be a source of growth for the company.

Management also reduced their growth projections for consumer electronics. Apple Willett mentioned a decline in consumer demand and specific challenges in the Chinese market as reasons for the decreased business from a key customer. The company also highlighted uncertainty regarding when and how much its customers would be investing.

Credit: Getty Images.

In e-commerce fulfillment centers, machine vision technology is being utilized in the logistics sector, showing promising results with a significant increase in revenue during the first half of the year. This growth follows a sharp decline after the surge in spending observed during the lockdown periods of the pandemic.

What makes Cognex a great investment option to consider purchasing

There is no denying that Cognex is currently facing difficulties in its markets. However, it is important for investors to recognize that the company’s revenue growth has been unpredictable. The fluctuations in revenue can be attributed to periods of substantial order increases, like with Apple in 2014, or the expansion in its logistics sector during lockdowns. These periods of growth are often followed by slowdowns as they are not sustainable in the long term.

However, this is the typical operation of growing businesses, and the current temporary decline in their target markets is mainly due to their connection to relatively elevated interest rates. Increased interest rates lead to higher costs for buying cars and put a strain on consumer expenditure for non-essential items like electronics.

Revenue for CGNX over the trailing twelve months. data by YCharts

Therefore, Cognex’s target markets are expected to experience growth in a favorable interest rate climate.

Furthermore, the enduring factors that promote the use of machine vision are robust. This technology plays a crucial role in the automated functions within manufacturing facilities and storage spaces, aiding in the examination and supervision of more intricate tasks. Additionally, the progress in artificial intelligence, with Cognex integrating additional AI features into its products, will enhance image identification capabilities and facilitate more sophisticated activities.

A stock to buy

Management anticipates a 13% annual growth in its target markets in the long run, with Cognex expected to grow at a rate of 15% per year. The company’s past performance indicates that this trend is likely to continue, and the current period of low performance is temporary. Therefore, the significant 62% drop in the stock price from its peak presents a great opportunity to invest in a promising stock at a discounted price.