Contents

- 1 Unlikely Connections: A Podcast Star and a Legendary Investor

- 2 The Rise of Alex Cooper

- 3 Warren Buffett’s Investment Legacy

- 4 A Surprising Intersection

- 5 The Challenge of Reviving Subscriber Growth

- 6 The Alex Cooper Effect

- 7 The Potential Impact of One Podcast

- 8 A Second Chance for Investment Opportunities

Unlikely Connections: A Podcast Star and a Legendary Investor

What could a 30-year-old podcast sensation possibly share with a 94-year-old investment icon? At first glance, the answer seems to be very little. Yet, Alex Cooper, known for her wildly successful Call Her Daddy podcast, and Warren Buffett, the renowned investor behind Berkshire Hathaway, are now linked in an unexpected way.

The Rise of Alex Cooper

Alex Cooper made her mark in the media world through her creation of the Call Her Daddy podcast. The show, which features interviews with celebrities and covers topics such as sex, relationships, and mental health, has amassed a large following.

Warren Buffett’s Investment Legacy

Warren Buffett’s reputation as a master stock-picker is well-earned through his leadership of Berkshire Hathaway, a conglomerate with an equity portfolio exceeding $300 billion. Buffett’s investment strategies have made him an enduring figure in the world of finance.

A Surprising Intersection

The connection between Cooper and Buffett emerges through a recent deal with Sirius XM Holdings. Sirius XM, a satellite media company, signed Cooper and her burgeoning podcast network for a deal reportedly valued at up to $125 million over three years. Notably, Sirius XM ranks as the 16th largest holding in Berkshire Hathaway’s investment portfolio, a position Berkshire first acquired in 2016, now owning approximately 31%.

Despite this significant investment, Sirius XM’s stock performance has been lackluster, having dropped nearly 50% since its public debut in 1994, and declined about 62% over the past five years. The question arises: can Cooper and her dedicated followers, known as the “Daddy Gang,” help turn the tide for this Buffett stock?

The Challenge of Reviving Subscriber Growth

Sirius XM, known for its extensive audio services, boasts a combined monthly audience of 150 million listeners. While its satellite radio offerings are well-known, the company also owns Pandora, a digital music streaming service, and is expanding its podcast network.

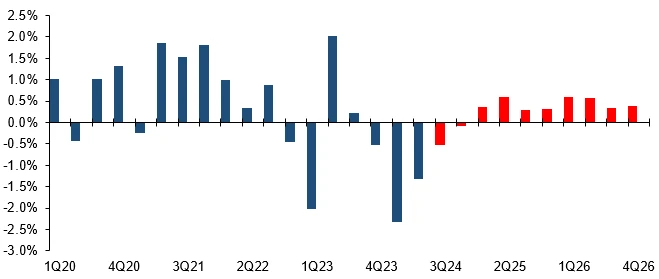

A significant portion of Sirius XM’s revenue, around 76% in the second quarter, comes from subscriptions. However, subscriber revenue has been on a downward trend. According to Visible Alpha, projections for future revenue growth are not particularly promising.

The Alex Cooper Effect

Enter Alex Cooper and her Call Her Daddy podcast. The deal with Sirius XM provides exclusive advertising and distribution rights to Cooper’s content, as well as to creators like Alix Earle and Madeline Argy, who boast millions of followers on social media. Although exact figures are elusive, Cooper’s podcast reportedly attracts 5 million listeners each week, making it Spotify’s second-largest podcast in 2023, only trailing Joe Rogan.

Sirius XM CEO Jennifer Witz expressed optimism at an industry conference, noting that acquiring talent like Cooper could help draw younger audiences and create more advertising opportunities across various platforms, including live events, video, and social media. Cooper’s move to Sirius came after completing a three-year, $60 million contract with Spotify. Interestingly, Spotify’s 2022 Investor Day revealed that video-streaming episodes of Call Her Daddy doubled its audience compared to audio-only episodes.

In addition to Cooper, Sirius XM has secured other notable podcasts, such as Smartless with Jason Bateman, Sean Hayes, and Will Arnett, reportedly valued at $100 million, and a weekly show featuring former South Carolina governor and U.N. ambassador Nikki Haley. Analysts have responded positively to these strategic moves, with some upgrades citing improving subscriber trends.

The Potential Impact of One Podcast

During Spotify’s 2022 Investor Day, Tony Jebara, VP of engineering and head of machine learning, emphasized the company’s focus on evaluating the lifetime value of individual podcasts. By assessing their financial impact and cost-effectiveness, Spotify aims to renew only those shows that offer significant returns.

This perspective suggests that Call Her Daddy may not have met Spotify’s renewal criteria at Cooper’s desired price point. Nonetheless, Spotify has shifted its strategy, and the company has performed well since Cooper’s initial signing in 2020. From 2020 to 2023, Spotify achieved a 15% compound annual growth rate in premium subscribers, totaling 236 million by the end of 2023. Spotify’s stock has surged nearly 200% over the past five years.

While Sirius XM faces challenges, such as a significant debt load, its current strategy appears sound. Broadening its appeal to listeners could be pivotal, and securing deals with popular podcasts like Call Her Daddy may help rejuvenate the company’s image and attract a new subscriber base.

A Second Chance for Investment Opportunities

Have you ever felt like you’ve missed out on the chance to invest in top-performing stocks? If so, you’ll want to pay attention.

Occasionally, our expert team of analysts identifies a “Double Down” stock recommendation for companies poised for significant growth. If you’re concerned about missing your investment opportunity, now is the ideal time to act before it’s too late. The numbers speak volumes:

– Nvidia: A $1,000 investment when we doubled down in 2009 would be worth $314,770!*

– Apple: A $1,000 investment when we doubled down in 2008 would be worth $43,092!*

– Netflix: A $1,000 investment when we doubled down in 2004 would be worth $381,468!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and such an opportunity may not come again soon.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 10/01/2024