The notion of investing during a recession can seem paradoxical, yet recessions often present remarkably profitable opportunities. Why is this the case? Not all companies are equally affected by economic downturns. For instance, I view these two artificial intelligence (AI) stocks as essentially recession-resistant due to their robust resilience.

1. Microsoft

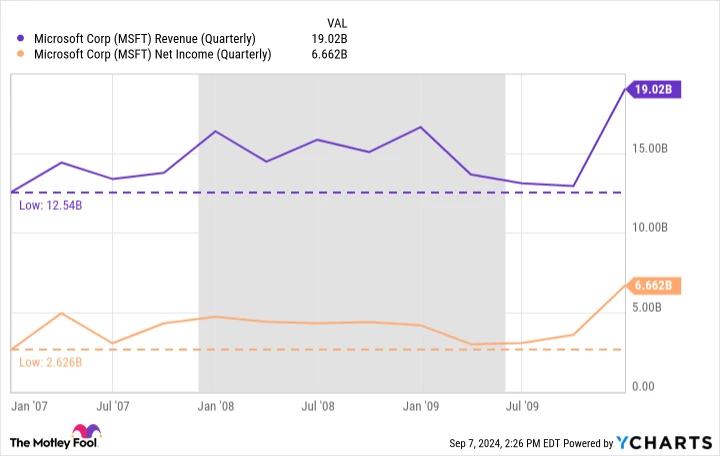

The chart below showcases Microsoft’s (1.21%) revenue and net income patterns from January 2007 to December 2009. This timeframe is purposefully selected as it encompasses the period leading up to, during, and following the Great Recession, which spanned from December 2007 to June 2009 (as depicted by the grey-shaded area).

Do you notice anything intriguing about Microsoft’s performance during the Great Recession?

MSFT Revenue (Quarterly) data by YCharts.

Although Microsoft’s revenue exhibited some fluctuations throughout the Great Recession, its sales generally remained higher in most quarters during the downturn compared to the period just before it. More significantly, its profitability did not suffer a substantial blow.

The only notable setback for Microsoft during this period occurred with a sharp decline in the quarter ending June 30, 2009, coinciding with the conclusion of the Great Recession. However, the company made a remarkable recovery just six months later, with $19 billion in sales and $6.7 billion in profit in the second quarter of fiscal 2010, partly due to the successful launch of Windows 7.

Microsoft’s capacity to grow even amid widespread economic crises and emerge stronger highlights its success in its unwavering commitment to innovation. Over recent decades, Microsoft has transformed from a PC software leader into a diversified enterprise with divisions spanning hardware devices, workplace productivity software, cloud computing, gaming, social media, and AI.

In my opinion, Microsoft stands as one of the top stock picks in the tech sector and remains a wise investment choice even during recessionary periods.

2. CrowdStrike

You might find it puzzling to consider that a volatile growth stock like CrowdStrike (-0.51%) could be deemed recession-proof. However, one way to identify recession-resistant businesses is by examining what the company sells. Does it offer essential services or products, or are its offerings merely nice additions?

I would contend that CrowdStrike’s services fall firmly into the “essential” category. Businesses cannot afford to compromise on data and identity protection or network security, even amidst an economic downturn.

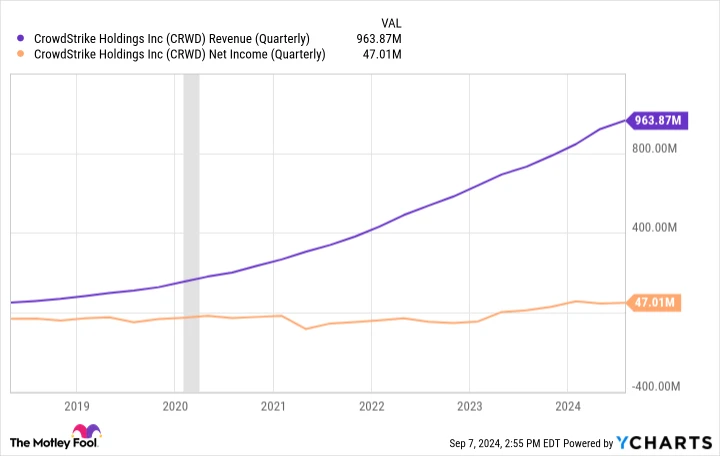

This makes cybersecurity platforms like CrowdStrike more resistant to economic downturns than other software market segments. Need evidence? The narrow grey-shaded column in the graph below illustrates the COVID-19 recession, which lasted from February 2020 to April 2020.

CRWD Revenue (Quarterly) data by YCharts.

Around the time the pandemic began, CrowdStrike experienced a phase of accelerated sales growth. This surge was heavily influenced by organizations’ increased need for robust cybersecurity as employees transitioned from office spaces to remote work environments. Even after the pandemic’s crisis phase ended and social distancing measures subsided, CrowdStrike’s revenue continued to climb, and the company is now consistently profitable.

Image Source: Getty Images

Consider CrowdStrike’s recent software update glitch, which led to significant IT outages for many of its customers worldwide. For weeks, the company made headlines, and the narratives were not flattering. However, last week, investors learned the extent of the IT outage’s impact on CrowdStrike.

CrowdStrike quickly implemented strategies like flexible payment plans to retain customers. Overall, management anticipates a $60 million revenue impact due to these retention efforts. Given that CrowdStrike has $3.9 billion in annual recurring revenue (ARR), the $60 million setback seems manageable. This underscores both the general necessity of cybersecurity services and CrowdStrike’s specific competencies.

Considering CrowdStrike’s ability to navigate two Black Swan-style events in recent years while maintaining solid revenue and profit levels, I view the stock as a strong opportunity, even in economically uncertain times.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you’ve missed the boat on investing in the most successful stocks? Then you’ll want to pay attention.

Occasionally, our expert team of analysts issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re concerned about missing your chance to invest, now is the perfect time to buy before it’s too late. The numbers are compelling:

Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $276,036!*

Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,791!*

Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $364,248!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and there might not be another opportunity like this in the near future.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/10/2024