A company that specializes in manufacturing electronics for defense purposes. Mercury Systems is a company that focuses on creating advanced technology solutions. ( MRCY 17.65% ) The company had a strong quarter with results exceeding expectations, and the management is optimistic that this positive trend can continue into the upcoming fiscal year.

Investors are enthusiastic, causing a 22% increase in Mercury’s shares by 11 a.m. Eastern Time on Wednesday.

Making a positive change after facing challenges for a while

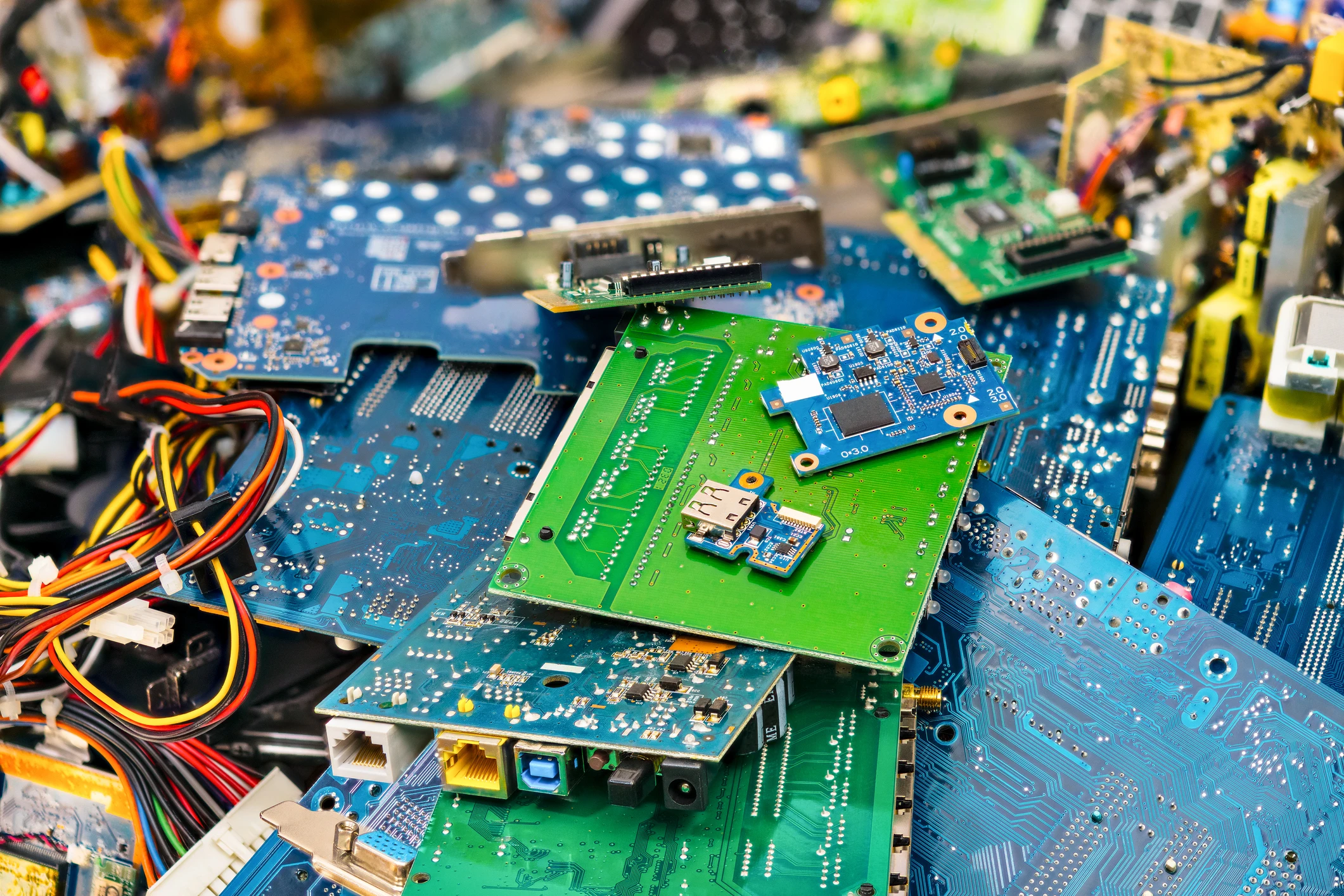

Mercury produces sensors, communication devices, and various electronic parts for the industry. aerospace and defense industries.

The stock price has experienced a significant decline in the last five years as a result of supply chain challenges and other operational issues. However, the latest data indicates that Mercury’s stock is starting to recover.

In the fiscal fourth quarter, which concluded on June 28, the company reported earnings of $0.23 per share. Its sales amounted to $248.6 million, surpassing the expectations of Wall Street analysts who had forecasted earnings of $0.01 per share on sales of $230 million. Although revenue remained steady compared to the previous year, the company’s bookings reached $284.4 million, indicating that Mercury secured more future business during the quarter than it invoiced.

Earnings before interest, taxes, depreciation, and amortization were modified. EBITDA) The revenue for the quarter reached $31.2 million, showing an increase from $21.9 million in the fourth quarter of fiscal 2023. The total amount of anticipated business in the pipeline at the end of the quarter was $1.33 billion.

Should I consider purchasing shares of Mercury Systems?

While the stock’s increase is positive, investors who plan to hold long-term will require several more successful quarters similar to this one to reach the break-even point. CEO Bill Ballhaus mentioned that the company is now moving in the right direction.

Ballhaus stated that significant advancements were made in fiscal year 2024 to tackle temporary obstacles in the business. As a result, the company is now entering fiscal year 2025 with assurance in its strategic position as a frontrunner in mission-critical processing at the edge. Additionally, they are confident in their capability to achieve consistent organic growth with improved profit margins and strong free cash flow.

Over the past few years, the company has been phasing out some of its problematic product lines and making its operations more efficient.

There is still more work that needs to be completed, however, Mercury is in a good position to achieve additional advancements in the future.