Contents

Realty Income and W.P. Carey: A Tale of Two REITs

Realty Income stands as an undisputed leader in the realm of net lease real estate investment trusts (REITs), boasting a size nearly four times that of its closest competitor, W.P. Carey. This dynamic between the two REITs is particularly intriguing, especially as W.P. Carey seeks to emulate its larger counterpart, a shift that marks a significant change in strategy.

Understanding Realty Income’s Model

Realty Income specializes in single-tenant properties where the tenants shoulder the majority of property-level operating costs, a model known as a net lease. While the reliance on a single tenant per property poses high risks, the expansive scale of Realty Income’s portfolio mitigates these risks effectively. As the preeminent net lease REIT, Realty Income commands a market capitalization of approximately $54 billion, with a diverse portfolio exceeding 15,400 properties.

The net lease model encompasses various property types, but Realty Income primarily focuses on retail assets, which compose about 73% of its rental income. The remainder is divided between industrial properties, accounting for 17%, and an “other” category. Additionally, Realty Income has strategically diversified its geographic reach, holding properties in Europe that contribute 13.5% of its rents across different property types.

The REIT’s substantial scale affords it investment-grade access to capital markets, enhancing both debt and equity capabilities. Furthermore, its diversified portfolio provides multiple growth avenues across distinct property types and geographies. Despite its vast size suggesting a trajectory of slow yet steady growth, this aligns well with Realty Income’s strategy. The REIT has consistently raised its dividend for 29 consecutive years, averaging an annual increase of about 4.3%, offering a roughly 5% dividend yield that is appealing to conservative income investors.

W.P. Carey: A Shift in Strategy

W.P. Carey, with a market capitalization nearing $14 billion and a portfolio of around 1,300 properties, is the second-largest net lease REIT. Despite its smaller size, W.P. Carey offers a higher dividend yield of 5.5%, capturing the interest of yield-focused investors.

Interestingly, there was a time when Realty Income sought to emulate W.P. Carey. For over 20 years, W.P. Carey has been investing in Europe, pioneering the net lease model in a region where it remains relatively novel. It was only recently that Realty Income ventured into Europe, aiming to leverage a market that W.P. Carey had essentially nurtured.

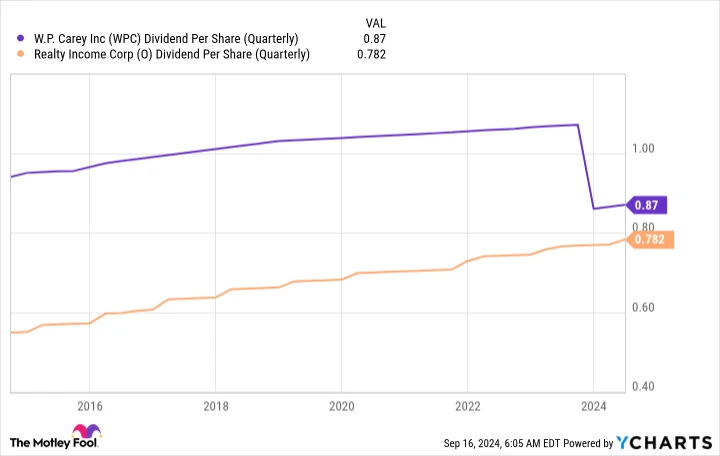

However, Realty Income later diverged by spinning off its office properties, opting to exit a sector with less growth potential—a move W.P. Carey has recently mirrored, albeit with different consequences. Unlike Realty Income, which maintained its dividend trajectory, W.P. Carey faced investor dissatisfaction after cutting its dividend post-office sector exit. Currently, W.P. Carey’s portfolio consists of 64% industrial properties, 21% retail, and 15% “other,” with European assets accounting for about 35% of its rent.

In a twist of roles, W.P. Carey is now seeking to increase its retail exposure, mirroring Realty Income’s strategy after the latter expanded into Europe.

The Future of W.P. Carey

For investors considering W.P. Carey’s higher yield, the pivotal question is whether the potential reward justifies the risk, especially after the recent dividend cut. The answer might be affirmative, as W.P. Carey resumed its dividend increases in the subsequent quarter, effectively treating the cut as a reset.

Despite these challenges, W.P. Carey is likely to remain heavily invested in the industrial sector and may never rival Realty Income’s scale. Nonetheless, its strategic direction is promising. Following the office sector exit, W.P. Carey possesses unprecedented liquidity, poised for investment in new properties. As long as the dividend continues its annual growth, W.P. Carey could complement Realty Income or stand as a strong independent investment. Chasing an industry leader, even without surpassing it, can yield substantial shareholder returns.

Investment Consideration: W.P. Carey

Before committing $1,000 to W.P. Carey, consider this: The Motley Fool Stock Advisor analyst team has recently identified what they regard as the 10 best stocks for investors to buy now, and W.P. Carey was not among them. These 10 stocks, they believe, hold the potential for significant returns in the coming years.

Reflect on when Nvidia appeared on this list on April 15, 2005. A $1,000 investment at that time would have grown to $710,860!*

The Stock Advisor service offers a comprehensive strategy for success, providing guidance on portfolio building, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.*

Discover the 10 stocks ›

*Stock Advisor returns as of September 17, 2024.