Remember when blockchain technology, the metaverse, and SPACs were all touted as the “next big things” in the world of investing? The excitement—and the stock valuations—seemed to run a bit ahead of reality in those instances.

Perhaps as a consequence, recent years have seen technology sector analysts casting a skeptical eye on companies claiming to harness the potential of artificial intelligence (AI). It makes sense—whenever a major trend appears to be taking shape, some companies inevitably attempt to jump on the bandwagon, even if their ties to the trend are weak. Case in point: Long Island Iced Tea Corp., which rebranded itself as Long Blockchain Corp.

For quite some time, one particular company aspiring to make its mark in the AI sector has been the subject of many pessimistic narratives. Yet, it has persevered and made a strong reputation for itself. Now, it is set to join one of the most prestigious circles in the business world: the S&P 500.

Let’s delve into how a once-obscure software developer has taken on tech giants and emerged as a rising star in the AI domain.

It Was Labeled an AI Imposter

In June 2023, The Bear Cave, a publisher known for its short reports, branded a certain software firm as an “AI imposter.” The publication argued that the company was merely a “glorified consultant pretending to be an AI leader.”

Although the company was positioning itself as an enterprise software specialist, a significant degree of skepticism surrounded this narrative, leading to mixed opinions on its investment potential. At the time, its shares were valued at just $14—less than half of their current price.

The distinction between a high-margin software company and consulting entities like Booz Allen Hamilton or Accenture is significant.

Critics Argued It Was Too Dependent on Government Contracts

Another major criticism from skeptics was that this AI firm was overly reliant on defense contracts with the U.S. military and intelligence agencies, as well as those of allied nations. Given the company’s substantial footprint in the public sector, this narrative wasn’t entirely baseless.

To clarify, being a government contractor isn’t inherently negative. However, the business flows and opportunities from the public sector tend to be more sporadic compared to those from the private sector.

Excessive dependence on government contracts can complicate revenue and cash flow forecasting, prompting some investors to question the business’s long-term sustainability.

Next Stop? The S&P 500

Enough with the preamble. The company that has been labeled an AI imposter and merely a government consulting operation is Palantir Technologies (0.17%).

Palantir is known for its three main software platforms: Foundry, Gotham, and Apollo. These platforms boast various data analytics capabilities and are employed in diverse applications, including supply chain logistics and financial fraud detection.

It wasn’t until April 2023 that perceptions about Palantir began to change. The company unveiled its fourth flagship product—the Palantir Artificial Intelligence Platform (AIP). While it’s promising to see innovation from a smaller enterprise, Palantir faced a challenge: it was overshadowed by big tech “Magnificent Seven” giants like Microsoft (which invested in ChatGPT creator OpenAI), and Amazon and Alphabet (both of whom backed AI start-up Anthropic).

How could Palantir demonstrate its legitimacy as a player in AI software?

Palantir took a creative approach to lead generation, allowing potential clients to demo the AIP platform by applying it to their unique use cases. These AIP “boot camps” significantly boosted Palantir’s deal pipeline as businesses began recognizing AIP’s potential and developing AI-driven use cases.

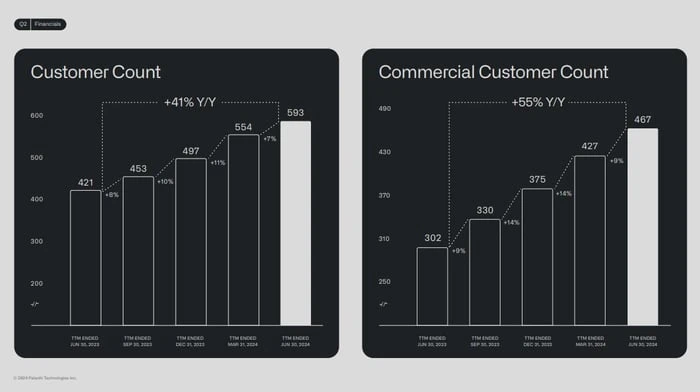

These initiatives are yielding dividends in various ways. Following AIP’s release, Palantir has seen a notable uptick in private sector demand, helping it diversify its revenue streams and alleviate concerns about its reliance on public sector contracts.

Moreover, gaining traction in the commercial sector has fueled an acceleration in Palantir’s revenue. Coupled with its cost-effective marketing strategy, including the boot camps, Palantir has achieved solid unit economics. Expanding operating margins and increasing profits have long characterized its financial profile.

By fundamental criteria, Palantir has been eligible for inclusion in the S&P 500 for several quarters. Yet, even with AIP’s advent and its positive impact on the business, it initially wasn’t enough to secure a spot in the index. Critics claimed that Palantir’s stock price might be riding the AI boom and that its growth trajectory wasn’t sustainable.

Those arguments might finally be put to rest. Recently, investors learned that Palantir has been selected for inclusion in the index and will officially begin trading as an S&P 500 member on Sept. 23.

Additionally, with more tech heavyweights like Microsoft and Oracle collaborating with Palantir, I am optimistic about the company’s long-term prospects in both public and private sectors. Overall, I view Palantir as an attractive investment for those with extended investment horizons, and I believe its entry into the S&P 500 is far from its final milestone.

Should You Invest $1,000 in Palantir Technologies Right Now?

Before you consider buying shares in Palantir Technologies, think about this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now, and Palantir Technologies wasn’t among them. The 10 stocks that made the list have the potential to deliver substantial returns in the coming years.

Consider when Nvidia was added to this list on April 15, 2005… if you had invested $1,000 at that time, your investment would be worth $716,375 today!*

It’s important to note that Stock Advisor’s total average return stands at 741%—a remarkable outperformance compared to the S&P 500’s 162%. Don’t miss the latest top 10 list.

See the 10 stocks

*Stock Advisor returns as of September 9, 2024