In 2024, the share prices of Palantir Technologies have nearly doubled, and coincidentally, Peter Thiel, the company’s co-founder and Chairman, has filed to sell his shares in Palantir, valued at almost $1 billion. Thiel, who also co-founded PayPal, is utilizing a Rule 10b5-1 plan to sell around 28.6 million shares by the end of 2025.

Thiel seems to be seizing this opportunity to secure the gains his shares have amassed. This raises an important question for investors: should they consider doing the same?

Understanding Thiel’s Rule 10b5-1 Plan

Before delving into the investment prospects of Palantir, it’s essential to understand Thiel’s strategy with the Rule 10b5-1 plan. This rule is designed to enable company insiders to sell shares without facing accusations of insider trading. The plan involves insiders giving predetermined selling instructions to a brokerage, some of which are made public. These instructions can specify conditions, such as the stock reaching a certain price or specific dates for selling. Insiders can determine the number of shares or the dollar amount to be sold.

Once the plan is in place, a cooling-off period occurs before any trades can begin. Modifications to the plan can only be made during an open trading window when the insider has no material non-public information that might influence the stock price. Thiel’s sales will be conducted through Rivendell 7, one of his four investment vehicles holding Palantir shares.

Thiel has previously set up Rule 10b5-1 plans to sell Palantir stock. In December 2023, he initiated a plan to sell 20 million shares, disclosed in February 2024. The first trade under this plan involved over 7 million shares at an average price of $24.79 on March 12, followed by a trade of nearly 13 million shares at an average price of $21.11 on May 10. Although this plan was supposed to end in March 2025, it was completed earlier.

Currently, through Rivendell 7, Rivendell 25, PLTR Holdings, and STS Holdings, Thiel owns about 99.5 million shares of Palantir. If the new plan is executed, his holdings will be reduced by nearly 29% to 70.9 million shares. At the beginning of 2024, Thiel held 148.9 million Palantir shares, indicating his intent to significantly reduce his stake over the next 16 months.

Should Investors Consider Taking Profits Like Thiel?

Palantir’s stock has experienced a remarkable surge, climbing from approximately $6 a share at the beginning of 2023 to around $35 a share. Given this impressive performance, it’s understandable why Thiel is cashing in on some of his profits. For investors with substantial gains in the stock, it might be wise to consider similar portfolio management strategies.

Palantir has demonstrated its capability with advanced technology, supporting government initiatives in critical areas like counter-terrorism and COVID-19 tracking. Additionally, its AI platform is gaining traction across various industries.

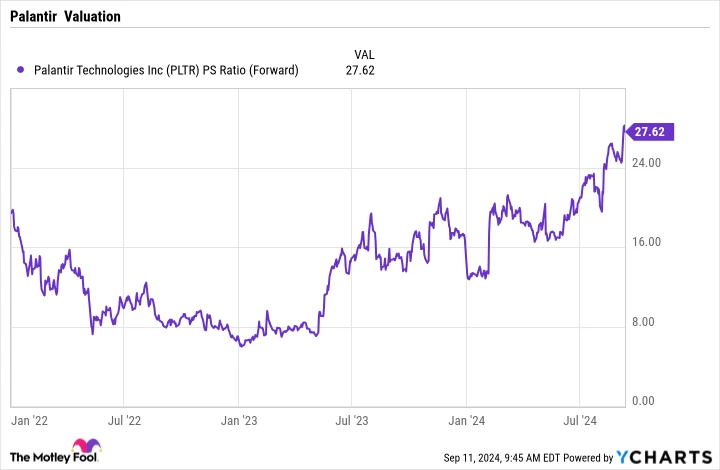

However, the company’s current valuation appears to be ahead of its fundamentals. Following its substantial rise, Palantir’s stock trades at a forward price-to-sales ratio exceeding 27.5, based on analysts’ estimates for 2024. This high multiple is typically reserved for companies experiencing hypergrowth, which Palantir is not.

Palantir’s government business segment has shown volatility, with government revenue growth at just 14% last year, limiting overall revenue growth to 17%. While government revenue growth has accelerated, boosting overall revenue growth by 27% year over year in the last quarter, Palantir still falls short of the hypergrowth necessary to justify its current valuation.

Palantir has the potential to be a great company, but valuation is crucial. Current investors might consider taking a cue from the co-founder and reducing their positions to secure profits.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Ever felt like you missed out on buying the most successful stocks? Then this is something you need to hear.

Occasionally, our expert team of analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’re worried about missing your investment opportunity, now is the ideal time to buy before it’s too late. The numbers speak volumes:

– Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $308,911!*

– Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,142!*

– Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $370,385!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and this opportunity might not come around again soon.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/14/2024