Contents

Nvidia’s Dominance and Current Challenges

For quite some time, Nvidia has been the talk of the stock market, and rightly so. With a commanding 80% market share in the artificial intelligence (AI) chip sector, the company has achieved record-breaking earnings. Nvidia’s relentless focus on innovation suggests that its dominance is here to stay.

However, the stock’s high valuation and recent dips in price raise questions. Over the past month, Nvidia’s stock has fallen by approximately 7% and is down about 15% from its summer peak. Despite this loss of momentum, I believe this is only a temporary setback, and Nvidia remains a stellar long-term investment.

Yet, there’s another stock gaining traction that deserves attention. It’s a company in the early stages of its growth trajectory, offering an affordable entry point. This stock also promises substantial long-term gains, making it an appealing alternative to Nvidia.

Oracle’s Transformation and Growth

Shifting Focus to Cloud Infrastructure

The company in question is Oracle, historically known for its database software. Recently, Oracle has pivoted towards becoming a significant player in AI, focusing heavily on cloud infrastructure and services amid the AI boom. This strategic shift has proven to be prudent.

Currently, cloud services represent Oracle’s largest business segment, with notable increases in operating income and earnings per share. The company is experiencing impressive growth across several financial metrics. For example, cloud infrastructure revenue surged by 45% year over year, reaching $2.2 billion in the first quarter of fiscal 2024. Additionally, remaining performance obligations—a key indicator of future growth—jumped 53% to $99 billion.

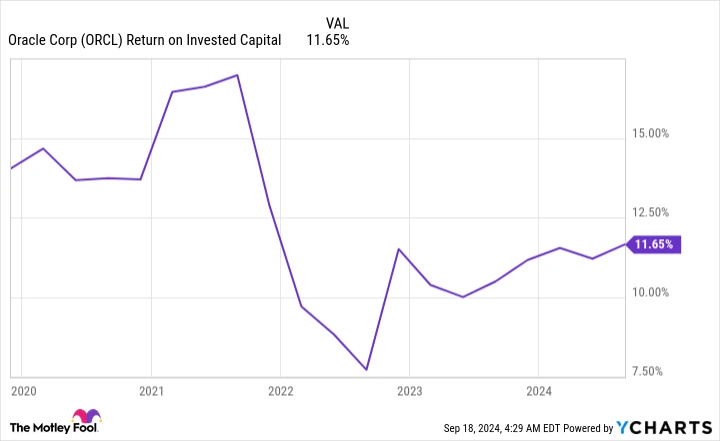

Oracle’s return on invested capital, which had declined in recent years, is on the rise again, signalling the successful impact of its growth-oriented investments.

Oracle’s Competitive Edge

Despite being smaller than cloud giants like Amazon Web Services (AWS) and Microsoft Azure, Oracle is succeeding due to its versatility. The company allows customers to utilize its services directly through Oracle and across other cloud platforms. Recent partnerships with AWS, Microsoft, and Google Cloud are accelerating the growth of Oracle’s database business.

In the most recent quarter, cloud database services revenue increased by over 20%. Oracle anticipates this segment will become its third major growth driver alongside cloud infrastructure and strategic software as a service.

Expanded Access Through AWS

These partnerships with leading cloud infrastructure providers offer Oracle a unique advantage. Customers can integrate Oracle products across multiple cloud services, a flexibility that appeals to those with diverse workloads. The AWS partnership is particularly significant, providing Oracle access to AWS’s vast customer base.

Oracle CEO Safra Catz noted, “AWS customers will get easy and convenient access to the Oracle database when we go live in December later this year.”

Future Prospects in the AI Market

It’s crucial to recognize that the AI industry is still in its infancy. MarketsandMarkets forecasts the AI market will expand from approximately $215 billion this year to over $1.3 trillion by the decade’s end. This projection suggests Oracle has substantial growth potential ahead.

Valuation and Investment Consideration

Oracle currently trades at 26 times forward earnings estimates, while Nvidia’s multiple is at 40. Given Oracle’s recent achievements and future prospects, its stock seems reasonably priced, even after a 58% increase this year as investors cheer its advancement in the AI sector.

Conclusion: A Strong Case for Oracle

At this juncture, if you’re considering adding an AI stock to your portfolio, Oracle presents a compelling case. Its attractive valuation and growth potential make it a worthy consideration over Nvidia, both in the short and long term.

Investment Advisory

Before making a decision to invest $1,000 in Oracle, consider this:

The Motley Fool Stock Advisor team has recently identified what they believe are the 10 best stocks for investors to buy now, and Oracle wasn’t one of them. These top picks could deliver substantial returns in the future.

Reflect on Nvidia’s inclusion on this list back on April 15, 2005. A $1,000 investment at that time would now be worth $694,743!

Stock Advisor offers a straightforward blueprint for investing success, providing guidance on portfolio building, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.

Explore the 10 stocks ›

Stock Advisor returns as of September 17, 2024