Oracle first launched its relational database, which can be visualized through tables of rows and columns, in the late 1970s. Over the decades, Oracle’s database met user demands, but as computing power advanced, the nature of data evolved. This shift led to the introduction of Atlas by MongoDB, a non-relational database capable of handling unstructured data types. In response, Oracle developed its own non-relational database and shifted its focus to the rapidly expanding cloud infrastructure sector. This strategic move raises the question: Is Oracle still the superior software-as-a-service (SaaS) stock for investors, or should they consider MongoDB, which is leading a significant transformation in the industry?

Contents

The Case for Oracle

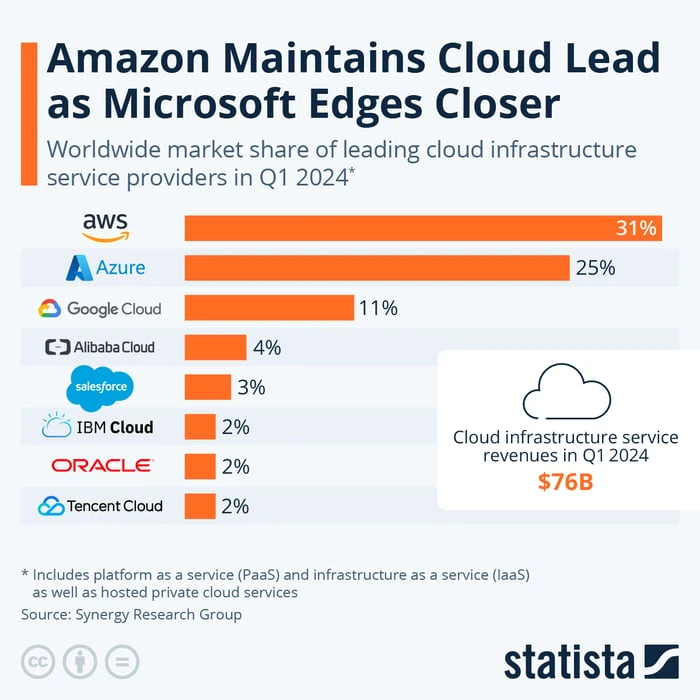

With Oracle’s extensive history in the tech sector, it stands as the more stable stock between the two. As the globe’s largest database management enterprise, Oracle has consistently catered to customers and shareholders with a variety of IT services. The majority of its revenue stems from its cloud services and license support segment, encompassing database services, applications like its e-business suite and PeopleSoft enterprise, as well as its cloud infrastructure services. Although not among the top cloud companies, Oracle commands approximately 2% of the cloud market share, according to Statista. Given the crucial role of cloud computing in supporting artificial intelligence (AI), Oracle is unlikely to see a decline and might harness AI to maintain its relevance in the database market.

For the first quarter of fiscal 2025, which concluded on August 31, Oracle reported a revenue of $13 billion, marking a 6% increase from the previous year. This growth rate matched the 6% revenue increase for fiscal 2024. By keeping operating expense growth below 2%, Oracle achieved a net income of $2.9 billion for fiscal Q1, a 21% rise compared to the same period last year. This enhanced value proposition has propelled its stock approximately 25% higher over the past year. However, the stock’s valuation has become steeper, with a price-to-earnings (P/E) ratio of 42 and a price-to-sales (P/S) ratio of 8. Despite earnings growth exceeding 20%, investors might question its valuation given its recent history of single-digit revenue growth. Nonetheless, the sustained popularity of its database and software capabilities should help the stock remain robust.

Why Investors Might Consider MongoDB

In contrast, MongoDB, established in 2007, is relatively new. It primarily generates revenue from its non-relational database, which could potentially disrupt the database industry as Oracle’s traditional model becomes obsolete. Non-relational databases are noted for their ability to store and manage data types that do not fit into conventional structures. This enables users to store data such as videos or abstract text, which would be challenging for a more structured database to handle. MongoDB’s Atlas database has been downloaded over 85 million times and has numerous Atlas clusters. Furthermore, its community includes over 1 million developers, with many leading corporations worldwide utilizing its services. Nevertheless, MongoDB has experienced a significant slowdown in growth in recent quarters, as fewer multiyear licensing deals, which recognize revenue upfront, have matured. In the second quarter of fiscal 2025, ending July 31, revenue reached $478 million, a 13% increase compared to the same period the previous year. This was below the 17% growth for fiscal 2025 and a 31% rise in the prior fiscal year. Additionally, the $55 million loss in fiscal Q2 was higher than the $38 million loss in the second quarter of fiscal 2024. The deceleration in revenue growth has negatively impacted the stock, which has fallen more than 20% over the past year. As a company currently not turning a profit, MongoDB lacks a P/E ratio, and investors may question whether its P/S ratio of 12 is appealing given the slowdown in growth from last year. Investors might opt to wait on the sidelines until there are signs of recovery.

Oracle or MongoDB?

Considering the current circumstances of both companies, Oracle seems to be the preferable choice for investors. While MongoDB’s non-relational database may eventually challenge Oracle’s long-established database business, Oracle continues to expand its software operations and its presence in the cloud sector, ensuring its AI capabilities remain competitive in the tech market. Furthermore, Oracle is profitable and offers a more attractive valuation to investors, despite its rising stock price. Ultimately, unless MongoDB can address its slowing growth, its stock is unlikely to gain momentum at its current valuation.

Buy Alert: Double Down on These Stocks Today

The Motley Fool Stock Advisor service has exceeded the performance of the S&P 500 by more than four times since its inception in 2002*, and the analyst team is adept at knowing when to double down. They have re-recommended select stocks in the past, resulting in substantial returns. For instance, investing $1,000 in Nvidia when the team doubled down in 2009 would have grown to $308,807! Similarly, a $1,000 investment in Netflix in 2004 would now be worth $375,918, and the same amount invested in Apple in 2008 would have reached $42,091!

Opportunity is knocking once again. Interested in answering the call?

Discover 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/15/2024