Given that the S&P 500 Having dropped almost 7% from its highest point in mid-July, it is clear that many investors are feeling nervous. This is understandable given that the global economy is not performing as strongly as previously thought, which can lead to fluctuations in stock prices.

Experienced investors understand that the current decrease in stock prices presents a chance to buy at a lower cost. Many stocks are now available at a significant discount because of the widespread market decline. This opportunity to purchase stocks at reduced prices may not be available for long. If you are considering investing, it may be wise to act promptly.

If you are interested in finding a new growth stock with high potential rewards but also high risks at a discounted price, consider investing in. Celsius Holdings is the name of the company. ( CELH -3.81% ) Shares have experienced a significant 56% decrease from their peak in May.

Reasons why Celsius may be difficult to stop

While not widely recognized, if it sounds familiar, there’s a purpose behind it. Celsius is an up-and-coming energy drink company targeting a market that is currently controlled by popular brands such as Red Bull. Monster Beverage is a company that produces and sells energy drinks. .

Celsius is taking a unique approach compared to the top competitors in the industry. The company promotes its beverages as sugar-free and containing a special combination of ingredients that trigger thermogenesis to boost metabolism and enhance calorie burning. Celsius has tailored its offerings for health-conscious individuals, who are showing a growing interest in the brand.

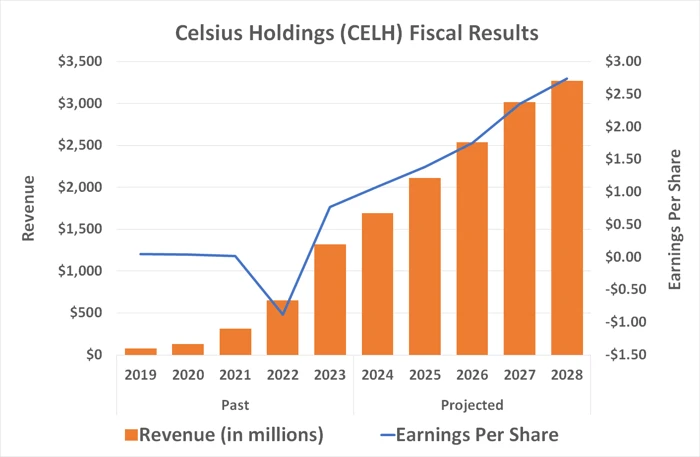

The company has experienced rapid growth ever since its products gained popularity in 2019, following CEO John Fieldly taking over. A significant factor in this growth has been Fieldly’s focus on placing the company’s products in more convenience store coolers, targeting customers who are likely to make impulsive purchases. This strategic move has significantly increased the company’s annual revenue from $30 million in the past to over $1.3 billion currently. In the last quarter, the company recorded a top line of $402 million. increased by 23% compared to the previous year , setting a new record for the second quarter.

Its collaboration with PepsiCo Definitely, it is also beneficial. As a result of a significant financial investment in Celsius in 2022, PepsiCo has also been distributing its energy drinks.

There are many more possibilities in store for this emerging brand.

The positive case for holding onto this high-growth stock

It will be challenging for Celsius Holdings to match its previous growth rate, which reached 102% last year. The company is not likely to achieve such rapid growth again in the near future. This anticipated decrease in sales is believed to have contributed to the stock’s susceptibility to a sell-off this year.

Frequently, investors tend to overreact, but despite this, Celsius is performing better than what the stock’s recent performance indicates.

One of the main reasons for optimism is that even though revenue growth is decelerating, earnings growth is increasing rapidly and is expected to maintain this trend in the future.

Information obtained from StockAnalysis.com. Chart created by the writer.

The main reason for this is the relatively lower operating costs. While significant expenses such as marketing and advertising are increasing, they are not increasing at the same rate as revenue, highlighting the importance of scale in a competitive environment. business that interacts directly with customers like this one.

Fieldly is currently considering a few new business concepts that have the potential to significantly boost growth. While it will take some time before the company can enter these markets, the CEO highlighted in a recent interview with FoodDive.com that health-focused food and water are areas of interest. For now, the company is concentrating on increasing its brand’s visibility in the crucial convenience store sector, especially in the international market where Celsius is gaining traction.

According to a forecast from Straits Research, the global energy drinks market is projected to increase by 8.5% annually until 2032. This growth rate is considered steady, rather than extremely high.

In a market where younger customers seek alternatives to popular brands that are often high in sugar, Celsius has strategically positioned itself as a fitness-focused option, positioning it to attract a significant portion of this expanding market.

Celsius stock has significantly decreased due to unfavorable circumstances.

What is the reason for this? growth stock Has a fantastic story been reduced by more than 50% in under three months?

A decline in market conditions is largely attributed to the recent period of weakness, although a significant portion can be attributed to just volatility In February and March, the bulls continued to push the market up from the significant gains made the previous year without allowing for a necessary cooldown. Currently, sellers are leading a correction that was postponed during that time.

This stock is expected to mirror the growth potential of the company it represents. There are numerous opportunities on the horizon as Celsius focuses on catering to the primary customers of the energy drink industry, especially their health-conscious needs.

Even though Celsius Holdings does not attract a significant number of analysts, more than half of them who track the company view the stock as highly favorable. The agreed-upon target price of $76.53 by analysts is almost 90% higher than the current price of Celsius stock. Investors willing to take on risks may find it advantageous to enter the market now since the stock is already backed by a strong consensus from Wall Street analysts, making it a promising opportunity for a new trade.