At least six financial experts from Wall Street reduced their estimated price goals. The Home Depot ( HD 0.28% ) The stock experienced a significant increase following the company’s earnings announcement for the second quarter on August 13th. UBS The analyst chose to change their perspective and increased their price target to $425 from $400, while still recommending to buy the stock.

An analyst’s outlook becomes more positive.

It is rare to observe an analyst increasing a rating. price target after the management emerges lowers Home Depot’s management has adjusted its projections for sales and earnings for the full year. They anticipate a 3%-4% decrease in comparable sales, which is a change from the previous estimate of a 1% decline. The company also expects a 2%-4% decrease in diluted earnings per share, in contrast to the previous guidance of a 1% increase.

However, it is widely known that elevated interest rates have limited the housing The buying and investment in products related to homes, involving various businesses, such as Whirlpool and Pool Corp. Mentioning the worsening conditions in the final markets, the optimists believe that a lot of negative information is already reflected in the stock price of Home Depot. They anticipate that the stock will increase, while interest rates are expected to decrease.

According to UBS analyst Michael Lasser, Home Depot is strategically preparing for a future economic rebound. A key strategy in achieving this is the recent purchase of SRS, a distributor of roofing, landscape, and pool products, to increase sales in the professional sector.

Credit: Getty Images.

The discussion between bulls and bears.

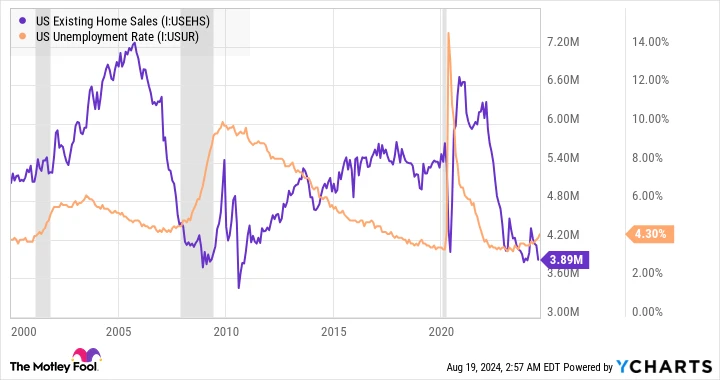

The latest UBS target suggests a potential increase of 17% from the current price, indicating an optimistic perspective that reduced interest rates will positively impact the housing market. On the other hand, pessimists argue that the recovery might be slower than anticipated by many.

The argument will continue, but bullish investors can find comfort in the low levels of unemployment, which usually help the real estate market. Although there are concerns about the short-term performance of Home Depot’s stock, the outlook appears optimistic in the long run.

Sales of previously owned homes in the United States data by YCharts