Expectations were soaring ahead of Nvidia’s (-2.10%) fiscal 2025 second-quarter financial announcement. The company has emerged as the leading figure in the artificial intelligence (AI) revolution, with its graphics processing units (GPUs) offering the computational power needed for developing large language models (LLMs) that drive generative AI.

The burgeoning demand for AI has sent Nvidia’s stock skyrocketing. It has climbed over 150% this year and surged more than 750% since the rapid adoption of AI began early last year (at the time of writing).

Recently, however, investors have grown apprehensive that Nvidia’s rise has been too swift, sparking concerns about whether the frenetic pace of AI adoption can sustain. Nvidia addressed these concerns affirmatively, but given the stock’s meteoric rise, even stellar results fell short of expectations.

By the Numbers

In the second quarter, Nvidia achieved record revenue of $30 billion, marking a 122% increase year over year and a 15% rise from the previous quarter. This led to adjusted earnings per share (EPS) of $0.68, surpassing analysts’ consensus estimates of $28.6 billion in revenue and $0.64 in EPS. Revenue also exceeded the management’s forecast of $28 billion.

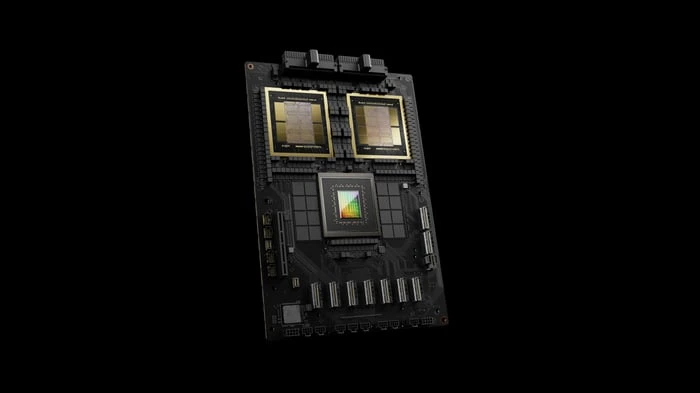

The standout performer was Nvidia’s data center segment, which encompasses chips for AI, as its revenue soared to $26.3 billion, reflecting a 154% year-over-year increase and a 16% sequential rise, driven by robust AI adoption among cloud computing and hyperscale data center operators.

While AI was a significant growth driver, the data center segment overshadowed results from the company’s other segments (all segment gains year over year):

- The gaming segment expanded by 16% to $2.9 billion.

- The professional visualization segment jumped 20% to $454 million.

- The automotive segment rose 37% to $346 million.

- Original equipment manufacturer revenue increased 33% to $88 million.

Nvidia’s gross margin stood at 75.1%, an increase from 70.1% in the previous year’s quarter, primarily due to the company’s substantial pricing power. However, the measure declined sequentially from 78.4% in Q1, as the company had previously indicated that margins would moderate for the rest of the year. CFO Colette Kress attributed the decline to inventory provisions for its Blackwell chips and product mix.

Looking Ahead

CEO Jensen Huang highlighted the strong demand for Nvidia’s current Hopper chip, describing the anticipation for the next-generation Blackwell architecture as “incredible.” He noted that in recent industry tests, Nvidia’s Hopper H200 and Blackwell B200 chips “swept” the MLPerf benchmark results for AI inference. Despite competitors’ efforts, Nvidia’s chips remain the benchmark for AI processing.

Media reports had suggested potential delays of up to three months for the new Blackwell chips due to design flaws, but Nvidia dispelled these concerns. “We shipped customer samples of our Blackwell architecture in the second quarter. We implemented a change to the Blackwell GPU mask to enhance production yield. Blackwell production ramp is slated to begin in the fourth quarter and continue into fiscal 2026.”

A notable by-product of Nvidia’s growth trajectory is the significant cash flow it generates, with free cash flow more than doubling to $13.5 billion. Consequently, Nvidia is increasing its returns to shareholders, with the board of directors approving an additional $50 billion in share buybacks, supplementing the $7.5 billion left on its existing authorization.

These factors have combined to support a robust third-quarter outlook. Management projects revenue of $32.5 billion, representing an 80% year-over-year increase. This marks a slowdown from the triple-digit growth Nvidia has achieved in each of the last five quarters—an unsustainable pace that investors have long anticipated. Yet, the figures suggest some investor disappointment.

Nvidia’s stock dipped around 7% in after-hours trading (at the time of writing), but it’s too soon to predict what the future holds. Stepping back, the company’s results continue to defy expectations, though a slowdown in its exponential growth rate was unavoidable. Nvidia remains a bright star, and its long-term investment thesis is intact.

Collectively, Nvidia’s enduring competitive edge, robust performance, and positive outlook indicate the company has a promising growth trajectory ahead.