Contents

Nvidia’s Impressive Investment Journey

Achieving a 147% return within a few months is no easy feat, yet Nvidia (-1.92%) managed to accomplish this remarkable milestone through a multimillion-dollar investment this year. This investment was one of several made in AI companies that Nvidia had previously collaborated with, suggesting a deep familiarity with these entities. Despite the substantial profit, Nvidia appears to be holding onto its relatively recent stock acquisitions, providing a potential cue for investors seeking maximum growth opportunities.

A Promising AI Stock with Massive Potential

Less than a year ago, Nvidia invested $3.7 million in SoundHound AI (NASDAQ: SOUN) stock, which has since surged by 147%. However, the potential for further growth remains significant, with projections suggesting the stock could increase tenfold in the long term. Before diving in, there are crucial factors to consider.

SoundHound AI’s Core Mission and Achievements

SoundHound AI is dedicated to integrating AI into sound-related applications, from voice assistants to drive-thru ordering systems. The company aims to have its technology present whenever you interact with a speaker. With over a decade of experience, SoundHound AI boasts more than 200 patents and a continually expanding roster of esteemed clients.

In 2022, SoundHound AI inked a seven-year contract with Hyundai to enhance the automaker’s voice-driven AI capabilities. This technology allows drivers to interact with their vehicles for tasks such as sending messages, obtaining directions, adjusting climate controls, and even diagnosing maintenance issues. The potential to replace traditional car manuals with simple conversations between the driver and vehicle is indeed impressive.

Expanding Across Industries

Beyond the automotive sector, SoundHound AI has ventured into various industries, including the restaurant and fast-food sectors. Companies like Applebee’s and White Castle are piloting its technology to streamline order processing and reduce operational costs. This application of AI is poised to become a common part of our daily interactions.

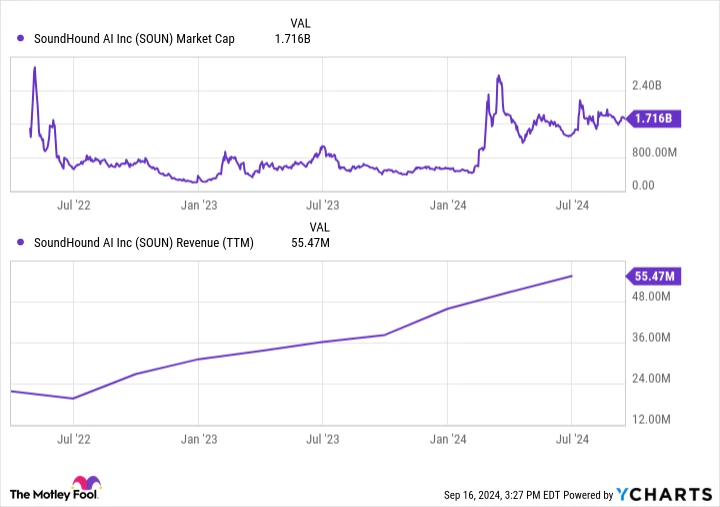

Despite a robust tech portfolio and a growing customer base, SoundHound AI’s market capitalization remains just under $2 billion. To achieve a 1,000% increase in value, it would need to reach a $20 billion valuation—a feasible target in the rapidly evolving AI industry, which holds the potential to be one of the most significant growth opportunities of our time.

Currently, shares trade at a price-to-sales ratio of 22, with revenue growth exceeding 150% over the past two years. If SoundHound AI can maintain this growth trajectory, shares could trade between 5 and 6 times the projected 2026 revenue, offering a more attractive valuation for patient investors.

Considerations for Investing in SoundHound AI

The potential of SoundHound AI’s target markets alone could support a $20 billion valuation. The voice AI market, with a total addressable market size of at least $140 billion, offers vast possibilities for SoundHound’s unique technology across diverse industries. Its early entry into this space positions it well to capture a growing market share.

However, SoundHound AI’s current market cap of $1.7 billion reflects some challenges. The company is still operating at a loss, requiring ongoing financing to remain solvent. This situation limits its capacity to invest significantly in research and development, an area crucial for long-term success.

In 2023, SoundHound AI’s R&D spending was approximately $56 million, marking a 30% reduction from peak levels. In contrast, tech giants like Apple and Alphabet are pouring billions into this sector, presenting fierce competition. It’s uncertain whether SoundHound AI has the financial resources to sustain and grow in this competitive landscape.

For those seeking a speculative growth stock with substantial long-term potential, SoundHound AI could be an attractive option. Nvidia’s backing adds credibility, but investors should be prepared for high volatility and significant risks. This investment is best suited for those with a high risk tolerance willing to embrace a possible boom or bust scenario.

A Second Chance to Maximize Returns

The Motley Fool Stock Advisor boasts an impressive total average return of 755%, significantly outperforming the S&P 500’s 165% since its inception in 2002. The analyst team excels at identifying opportunities to “double down” on promising stocks, which have historically yielded remarkable returns.

– Nvidia: A $1,000 investment when the team doubled down in 2009 would now be worth $299,706.

– Netflix: A $1,000 investment when doubled down in 2004 would have grown to $381,230.

– Apple: A $1,000 investment when doubled down in 2008 would be valued at $41,011 today.

Currently, “Double Down” alerts are being issued for three exceptional companies, presenting a rare opportunity that may not come again soon.

Explore the stocks ›

Stock Advisor returns as of 09/19/2024