Over the past five years, Nvidia (-4.08%) has provided remarkable returns for its investors. The semiconductor company’s shares have skyrocketed, driven by impressive increases in revenue and earnings, alongside significant catalysts such as advancements in video gaming and artificial intelligence (AI).

A mere $100 investment in Nvidia shares five years ago would now be valued at an astounding $2,850, reflecting a 2,750% increase. This performance has far outpaced the S&P 500 index’s 93% rise over the same timeframe. However, with Nvidia now ranking as the world’s third-largest company, boasting a market capitalization exceeding $2.9 trillion, anticipating the stock to multiply 25 to 30 times over the next five years seems unrealistic, as this would elevate its market cap to an extraordinary $80 trillion.

For context, the global economy was estimated to be worth around $105 trillion last year. Nevertheless, Nvidia continues to possess robust growth drivers that could support substantial growth over the next five years.

In this article, we’ll delve into those catalysts to evaluate the potential upside this semiconductor stock could offer in the coming years.

Nvidia’s AI-Driven Growth Shows No Signs of Slowing

Nvidia unveiled its fiscal 2025 second-quarter results on August 28, covering the three months ending July 28. The company exceeded expectations, with revenue surging 122% year-over-year to $30 billion and non-GAAP earnings per share rising by an impressive 152% from the same quarter of the previous year to $0.68 per share.

Wall Street analysts had predicted earnings of $0.65 per share on $28.7 billion in revenue. The positive surprises continued, as Nvidia projected its fiscal Q3 revenue to reach $32.5 billion, surpassing the $31.7 billion consensus estimate, which would represent an 80% year-over-year increase.

Despite reporting such outstanding growth and providing strong guidance, the stock has experienced a slight decline. Nonetheless, this dip presents a buying opportunity for investors, as an in-depth analysis of the quarterly results indicates robust growth across all its divisions.

The data-center segment, which saw a remarkable 154% year-over-year increase and achieved record revenue of $26.3 billion, is significantly benefiting from the high demand for Nvidia’s graphics processing units (GPUs) used in training and deploying AI models. Notably, customers continue to purchase Nvidia’s Hopper architecture-based GPUs, even as the company is set to commence production of its next-generation Blackwell chips in the following quarter.

CFO Colette Kress highlighted during the latest earnings call:

> The Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal year ’26. In Q4, we expect to receive several billion dollars in Blackwell revenue. Hopper shipments are anticipated to increase in the second half of fiscal 2025. Hopper supply and availability have improved. Demand for Blackwell platforms exceeds supply, and we expect this trend to persist into next year.

Importantly, Nvidia anticipates that next-generation AI models will require 10 to 20 times more computing power, suggesting ongoing growth in demand for its data-center GPUs. One estimate projects that the AI chip market could generate $311 billion in annual revenue by 2029, up from this year’s estimate of $123 billion.

Nvidia generated nearly $49 billion in data-center revenue in the first half of its current fiscal year, indicating the potential to conclude fiscal 2025 (encompassing 11 months of calendar 2024) with approximately $100 billion in revenue from this segment. Given the $123 billion estimate of the overall AI chip market, Nvidia’s market share could reach around 80% by the end of this year.

Even if Nvidia’s AI chip market share drops to 70% over the next five years due to rising competition, it could still generate $217 billion in annual data-center revenue after five years (based on the $311 billion market size). In simpler terms, Nvidia’s data-center revenue could potentially double over the next five years.

Considering the growth in the company’s other business segments, it wouldn’t be surprising to see Nvidia become an even larger entity over the next five years. For instance, revenue from the gaming and AI personal computer (PC) segment increased 18% year-over-year to $2.6 billion.

Gaming has historically been Nvidia’s core business, but it now contributes less than 10% to its overall revenue. However, investors should focus on the broader picture, as the demand for AI PCs is expected to surge over the next five years, creating opportunities for Nvidia to generate substantial revenue from the gaming and PC segment.

Additionally, the company’s professional-visualization revenue grew 45% year-over-year to $427 million, driven by increasing demand for its digital-twin solutions. As Kress noted during the earnings call:

> The world’s largest electronics manufacturer, Foxconn, is using NVIDIA Omniverse to power digital twins of the physical plants that produce NVIDIA Blackwell systems. Additionally, several large global enterprises, including Mercedes-Benz, have signed multiyear contracts for NVIDIA Omniverse Cloud to build industrial digital twins of factories.

This presents another promising growth avenue for Nvidia, as the digital-twin market could generate $131 billion in revenue by 2029, compared to $26 billion this year, according to Mordor Intelligence. Overall, there are multiple reasons why Nvidia could prove to be a strong investment over the next five years.

What Level of Upside Can Investors Anticipate?

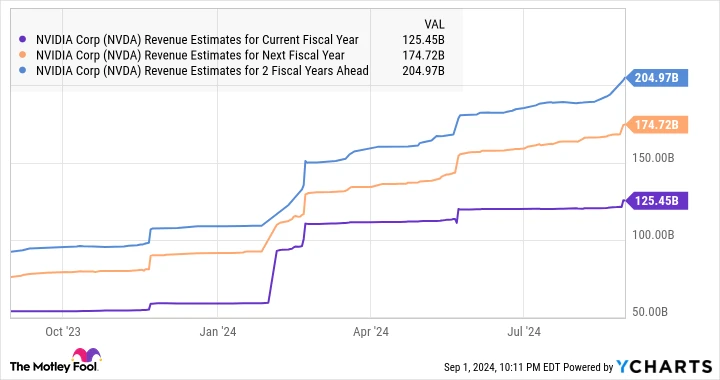

Nvidia’s promising outlook has prompted analysts to revise upward their revenue growth expectations for the current fiscal year and beyond.

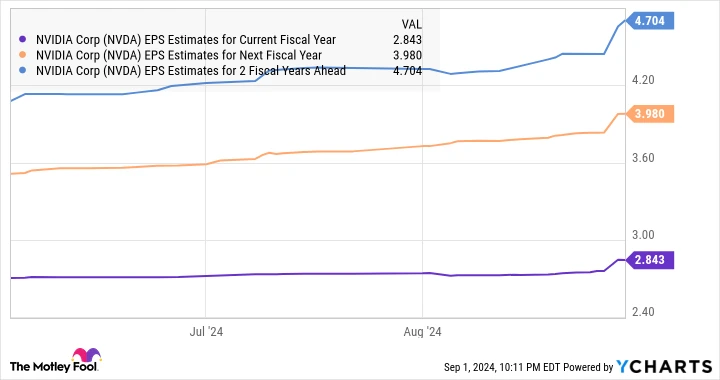

Similarly, expectations for its bottom-line growth have also increased.

Encouragingly, Nvidia is projected to achieve annual earnings growth of 52% over the next five years. Based on the fiscal 2025 earnings-per-share estimate of $2.84, its earnings could soar to $23 per share after five years. Currently, the stock has a forward-earnings multiple of 45. However, even if it trades at a discounted 29 times forward earnings after five years, consistent with the Nasdaq-100 index’s forward-earnings multiple (using the index as a proxy for tech stocks), its stock price could reach $667.

This would represent an increase of over five times from current levels, suggesting that this AI stock could continue to enhance investors’ wealth over the next five years.