Nu Holdings, a digital bank from Brazil, operates under the brand NuBank and is active in three Latin American nations. While it might not be widely recognized yet, investors should pay attention to its rapid growth and corresponding stock gains. Could it be a part of a portfolio that creates millionaires?

Contents

The Bank Customers Have Been Anticipating

Though banking has a long history, digital banks are revolutionizing the sector by offering user-friendly services that attract millions. Nu is leading this digital banking transformation in Latin America.

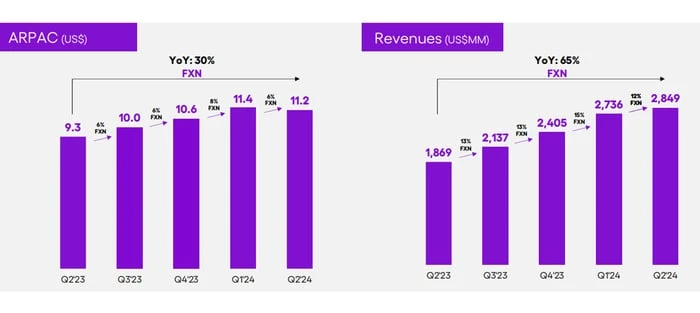

Operating in Brazil, Mexico, and Colombia, Nu is expanding swiftly. In the second quarter, revenue surged 65% year-over-year to $2.8 billion. Despite this being a deceleration from previous quarters of triple-digit growth due to inflation, it remains impressive given the high-interest-rate environment. Net income more than doubled, reaching $487.3 million.

Nu’s core strategy revolves around providing an enhanced customer experience over traditional banks, particularly through low-fee offerings. Once customers engage with the platform, they are inclined to try more products, boosting revenue while reducing acquisition costs.

This strategy is evident in Nu’s reporting of average revenue per active customer (ARPAC) as a key growth metric.

Customers are increasingly interacting with the platform, and the monthly activity rate remains consistently high at 83%.

The Future Holds Vast Potential

While past achievements are noteworthy, the future presents even greater opportunities. In Q2, Nu welcomed over 5 million new members, reaching a total of 104.5 million. Most of this growth is from Brazil, where it already serves over half of the adult population. The company is just beginning its journey in Mexico and Colombia, with potential expansion into other regions. In Q2, 60% of monthly active users favored Nu as their primary banking platform.

Nu is also advancing its credit business significantly. The total credit portfolio grew by 49% year-over-year in Q2. Although delinquencies are rising, they align with expectations under current pressures. Deposits increased by 64% year-over-year, with the cost of deposits staying below the blended interbank rates in its operating countries. Net interest income (NII) rose 77% year-over-year, and management is optimistic about future NII growth through strategic credit management.

This Stock Has the Potential to Persist

Nu is gaining market share by leveraging its digital infrastructure to create a superior system and attract new clients. Its stock performance reflects this progress, having risen over 100% in the past year.

However, there are risks associated with Nu stock. The company is still young, introducing new products, and hasn’t yet achieved profitability outside Brazil. It operates in countries with volatile economies, which, while currently managed well, present undeniable challenges.

Can Nu alone create millionaires? While some stocks have transformed ordinary investors into millionaires, this isn’t the typical path to investment success. Most investors are more likely to achieve millionaire status by retirement through investing in a well-diversified portfolio early and consistently. Nu is a promising growth stock for individual portfolios.

Nu appears to have remarkable potential, and if it maintains its strong growth trajectory, it could be a valuable stock for any investor.

Before Investing in Nu Holdings, Consider This:

The Motley Fool’s Stock Advisor team recently highlighted what they believe are the 10 best stocks for investors to purchase right now, and Nu Holdings was not among them. The selected 10 stocks may offer substantial returns in the coming years.

Consider when Nvidia was recommended on April 15, 2005—if you had invested $1,000 then, it would now be worth $716,375!*

Stock Advisor’s total average return is notably 741%—a significant outperformance compared to the S&P 500’s 162%. Don’t miss the latest top 10 list.

See the 10 stocks

*Stock Advisor returns as of September 9, 2024