Contents

Nio’s Struggle and Potential for Growth

Investing in a company that has incurred nearly $1.5 billion in operational losses in just the first half of this year might not seem appealing. Nio, the Chinese electric vehicle (EV) manufacturer, has yet to turn a profit. This financial struggle partly explains why Nio’s stock has plummeted by over 80% in the past three years. However, the company’s recent second-quarter report included some optimistic news, leading to a resurgence in its stock value. Over the last month, Nio’s American depositary shares have soared by more than 40%.

Currently, Nio’s market capitalization stands at approximately $11 billion, and the company concluded the quarter with $5.7 billion in cash and equivalents. This financial backdrop presents an opportune moment to consider Nio’s upcoming strategic moves and evaluate whether its stock deserves a place in your investment portfolio.

Progress Towards Profitability

In the second quarter, Nio made significant strides in improving its vehicle profit margin, which is determined by the revenue and costs associated with new vehicle sales. The margin rose to 12.2%, compared to a mere 6.2% in the same period last year, fueled by a near doubling of revenue year-over-year.

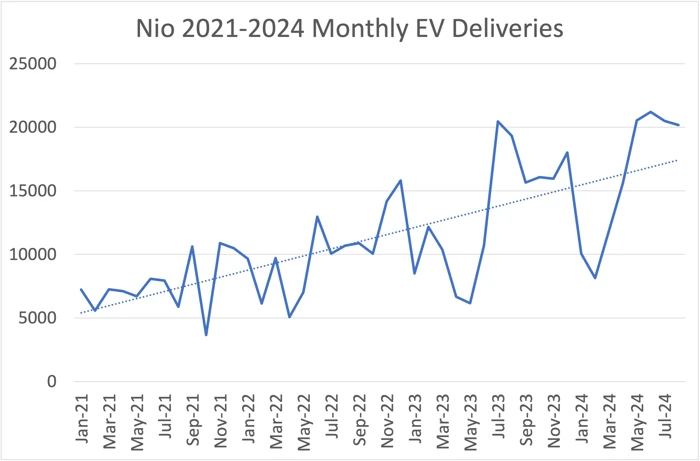

After years of fluctuating performance, Nio seems to have found its rhythm in vehicle production and sales growth. Amidst increasing global competition in the EV sector, Nio has consistently sold over 20,000 EVs for four consecutive months. This achievement has helped Nio gain market share and enhance its profit margins.

In the latest quarter, Nio set a new record by shipping over 57,000 units. The company has projected third-quarter vehicle deliveries to range between 61,000 and 63,000 EVs. According to Nio’s CEO, William Li, the second-quarter sales volume enabled the company to capture more than 40% of the market share within China for EVs priced above approximately $42,000. Nio aims to expand further by focusing on the luxury segment of the market, positioning itself against Chinese EV leader BYD, which dominates the lower-priced sector.

Tackling Range Anxiety

Nio has been proactive in addressing the range anxiety associated with EVs by expanding its battery charging and innovative battery swapping infrastructure. The company’s battery swap stations offer EV buyers the option to reduce initial vehicle costs through a monthly subscription to its Battery as a Service (BaaS) plan. These stations allow drivers to quickly swap out depleted batteries for fully charged ones, a process that takes just minutes.

Recently, Nio unveiled a new initiative to enhance its charging and battery swapping network throughout China. The “Power Up Counties” plan aims to expedite the development of these networks.

By August 31, Nio had established over 2,500 battery swap stations worldwide, with more than 800 strategically placed along China’s expressways. With over 577,000 Nio vehicles on the road, the company has facilitated more than 50 million battery swaps. Its ambitious plan is to have power swap stations in thousands of Chinese counties by the end of next year. Additionally, Nio intends to construct a new factory capable of producing up to 1,000 power swap stations annually.

Mass Market Ambitions with Onvo

Nio’s new Onvo brand is set to capitalize on the growing charging and swapping infrastructure. Targeting the mass market, Onvo aims to compete directly with Tesla’s Model Y. The Onvo L60, a mid-size SUV, starts at approximately $30,000.

The introduction of Onvo, alongside Nio’s expanding charging technology and infrastructure, could serve as a catalyst for the company’s growth and stock performance. Investors with an appetite for risk might consider investing in Nio now, anticipating the growth potential with Onvo. Alternatively, more cautious investors could monitor Onvo’s market traction for signs of success before making a move.

Is Nio a Worthwhile Investment?

Before deciding to invest $1,000 in Nio, consider the following:

The Motley Fool’s Stock Advisor analyst team has recently identified what they believe are the 10 best stocks for investors to buy now, and Nio wasn’t among them. The 10 selected stocks have the potential for substantial returns in the coming years.

Reflect on when Nvidia made this list on April 15, 2005—if you had invested $1,000 at the time, your investment would now be worth $722,320!*

The Stock Advisor service provides investors with a clear strategy for success, offering guidance on portfolio building, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.*

See the 10 stocks ›

*Stock Advisor returns as of September 17, 2024