Despite its logo being prominently featured on Olympic uniforms, widely recognized commercials, and shoes worn by millions, not everything has been smooth for Nike (-1.72%). This year, the stock has declined by over 24%. Fortunately, the leading sportswear manufacturer offers investors a reason to stay patient during this challenging time: a dividend yield of approximately 1.8%, which is above average.

While this dividend doesn’t completely offset the stock’s price challenges, it certainly provides some relief. For long-term investors seeking a dividend stock to hold onto, Nike presents an intriguing opportunity at its current valuation.

When uncertain, rely on the brand

Nike’s stock performance may be faltering, but this hasn’t translated into a decline in its brand value. Few names in the fashion and apparel industry are as iconic as Nike. Even fewer, if any, can rival Nike’s brand strength, particularly in footwear. Whether for sports, casual wear, or lifestyle, Nike has been the go-to brand for decades.

A world-class brand can serve as a life buoy when a company faces turbulent times. It ensures customer loyalty and pricing power, which help maintain strong financials. This is partly why Nike’s revenue figures remain robust.

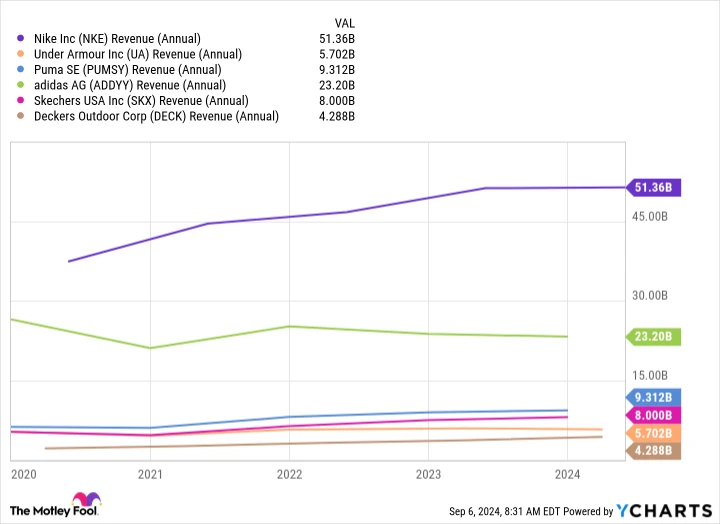

In its fiscal year 2024, which concluded on May 31, Nike reported $51.4 billion in revenue. Although this was only a 1% increase from the previous year, it still surpassed the combined revenues of Adidas, Puma, Under Armour, Skechers, and Deckers Outdoor (the maker of UGG and Hoka).

NKE Revenue (Annual) data by YCharts

Nike is recognizing the significance of wholesale

With the rise of online orders and the popularity of its app, SNKRS, Nike anticipated that its direct-to-consumer (D2C) business would propel the company forward. This led to severing ties with numerous major retailers, a decision that, in hindsight, proved to be a significant error.

Wholesale sales declined due to these terminated partnerships, and the growth in D2C sales fell short of compensating for the loss. In a classic “that was a huge mistake, please forgive us” move, Nike has been working to rekindle some of these wholesale/retail partnerships.

In the spring of 2021, Nike announced plans to end partnerships with companies like Macy’s, Designer Brands (DSW), Urban Outfitters, and several others. By the fall of 2023, it had reversed this decision. Admitting a business misstep may not have been easy, but it’s better to acknowledge it late than never.

Since re-establishing many of these relationships, Nike’s wholesale business has experienced a revival. In its most recent quarter, wholesale revenue rose by 8% year over year to $7.1 billion (5% when accounting for currency exchange impacts).

In recent years, Nike focused excessively on where its products were sold rather than maximizing all available channels. It’s promising to see that this mindset may be changing.

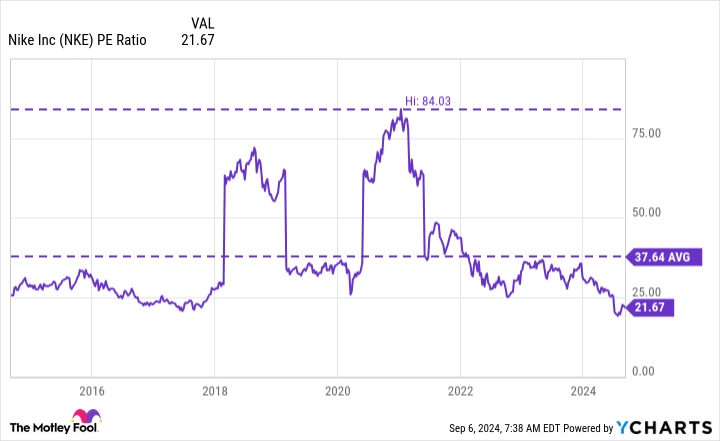

Its valuation suggests significant potential for growth

Long-time Nike investors might find this recent downturn unsettling, as the stock has lost over half its value since November 2021. However, for those considering investing in Nike, the current moment offers one of the better opportunities in recent history.

Around three years ago, Nike’s price-to-earnings (P/E) ratio was in the 80s. Recently, it has been in the low 20s, significantly below its average over the past decade.

NKE PE Ratio data by YCharts

A low P/E ratio alone doesn’t make Nike a must-have, but it offers a chance to invest with fewer risks associated with stocks priced at a premium.

Couple this with Nike’s above-average dividend, strong balance sheet, and the commanding power of its brand, and it becomes much easier to trust that the company will eventually regain its footing. For those looking to buy and hold Nike stock for the long term (which is advisable), the potential upside seems to outweigh the downside.

Buy alert: Double down on these stocks today

The Motley Fool Stock Advisor service has outperformed the S&P 500 more than fourfold since its inception in 2002*, and the analyst team knows when to double down. They have re-recommended a select few stocks in the past, and some of those have delivered impressive returns.

Nvidia: Investing $1,000 when we doubled down in 2009 would now be worth $276,036!*

Netflix: Investing $1,000 when we doubled down in 2004 would now be worth $364,248!*

Apple: Investing $1,000 when we doubled down in 2008 would now be worth $41,791!*

Opportunity is knocking again. Want to open the door?

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/10/2024