Contents

Federal Reserve’s Rate Cut: Impact on Select Stocks

On September 18, the Federal Reserve decided to lower interest rates for the first time in four years. This move presents an opportunity for certain stocks to benefit, but expectations should be managed carefully.

Before diving into specific stocks, it’s crucial to understand that interest rates are notoriously unpredictable. Even Federal Reserve voting members often miss the mark on interest rate forecasts a year in advance. Most investors don’t possess more insight than the Federal Reserve itself, making long-term interest rate predictions akin to a coin toss.

Furthermore, interest rates alone won’t rescue poorly performing businesses. Investors should remain diligent in identifying robust secular trends and strong businesses within those sectors.

Stocks Poised to Benefit

Despite the unpredictability, some solid businesses stand to gain from the recent rate cut. Among them, Floor & Decor, Driven Brands, and Tanger appear well-positioned for potential growth.

Floor & Decor

Floor & Decor, akin to Home Depot, operates large warehouse-style home improvement stores. However, it specializes in flooring materials like tile and hardwood. This niche market allows the company to carve out a distinct position.

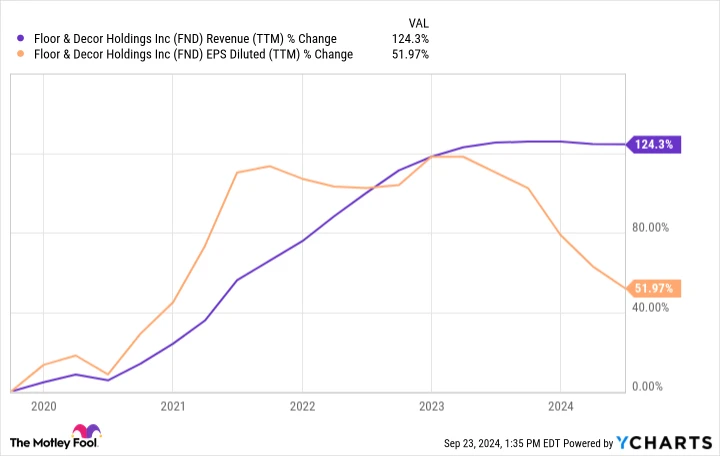

As of the second quarter of 2024, Floor & Decor expanded to 230 locations, up from just 133 at the end of 2020. The company plans to add over 20 more stores by the year’s end, supporting both revenue and profit growth.

Their ambitious goal of reaching 500 locations by decade’s end signals ample growth potential, possibly driving significant stock gains. That said, a recent sales slowdown, a common issue among home improvement retailers, has occurred. High interest rates deter remodeling activity since people are less likely to move or take out home equity lines of credit. However, with rates now declining, the home improvement sector, including Floor & Decor, might see renewed vigor.

Driven Brands

Driven Brands offers essential automotive services, with over 1,800 maintenance shops and more than 1,100 car washes. Routine car maintenance is unlikely to be abandoned, making Driven Brands’ business model resilient.

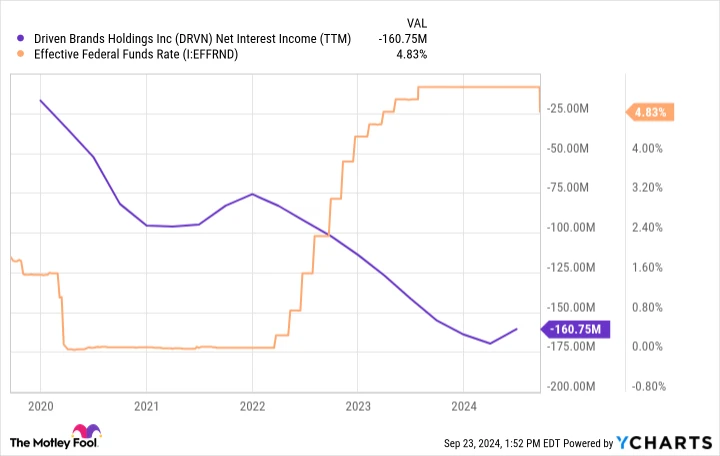

The company does carry substantial debt—around $2.9 billion as of mid-2024—against $2.3 billion in revenue over the past year. Rising interest rates increased its interest payments significantly.

With the Federal Reserve cutting rates again, Driven Brands should find some relief in servicing its debt. Despite this, the company remains profitable, earning $283 million in adjusted EBITDA in the first half of 2024. Management targets at least $535 million in adjusted EBITDA for the year, and the company is already more than halfway there. Given its current enterprise value of $5.2 billion, the stock trades at less than 10 times this year’s adjusted EBITDA, suggesting it may be undervalued.

Tanger

Tanger, a smaller real estate investment trust (REIT), operates 38 outlet malls as of mid-2024. Monitoring occupancy levels is crucial, and Tanger’s strong occupancy rate of over 96% indicates tenant stability.

This stock benefits indirectly from lower interest rates. As a REIT, Tanger must distribute a significant portion of profits as dividends, often resulting in a high-yield dividend. High interest rates reduce demand for dividend stocks like Tanger, as investors prefer safer bond returns. Consequently, dividend stock prices may fall until yields justify the risks. The reverse is true when rates decline, making REIT yields more appealing.

Despite its 40% rise over the past year due to anticipated rate cuts, Tanger’s 3.5% dividend yield remains attractive. Future rate cuts could further enhance the stock’s appeal.

Beyond Interest Rate Cuts

In conclusion, while interest rate predictions should not form the entirety of an investment thesis—since they remain unpredictable and can’t transform weak businesses—Floor & Decor, Driven Brands, and Tanger represent fundamentally strong companies. These businesses may receive an additional boost from lower rates, making them noteworthy considerations for investors.

Embracing Second Chances

Feel like you’ve missed out on top-performing stocks? Here’s why you shouldn’t worry.

Occasionally, our expert analysts issue “Double Down” stock recommendations for companies poised for significant growth. If you fear missing out again, now might be the perfect time to invest before it’s too late. The numbers speak volumes:

– Nvidia: A $1,000 investment during our 2009 “Double Down” would now be worth $303,362!*

– Apple: A $1,000 investment in 2008’s “Double Down” would be $42,793!*

– Netflix: A $1,000 investment in 2004’s “Double Down” would be $380,810!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies. Opportunities like these may not come around often.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of October 2, 2024