Nike shareholders have faced a challenging two-and-a-half years. Just as it seems the stock might be poised for recovery, it hits new lows. Currently, shares are valued at 53% less than their peak in late 2021, and there appears to be potential for further decline.

Yet, as the saying goes, it’s always darkest before dawn. In other words, although it may feel uncomfortable, now might be the ideal time to invest in a new stake in Nike. A long-anticipated resurgence in the brand’s strength is underway; it’s preferable to enter the market too early rather than too late.

A Shift from the Nike Consumers Once Knew

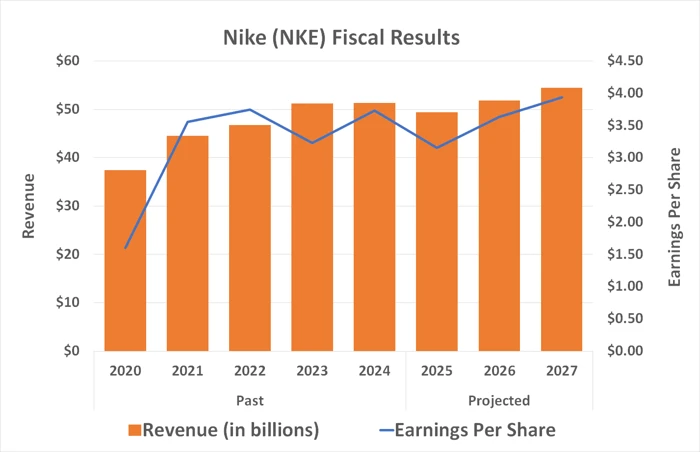

For a brief recap, Nike was performing well leading up to the COVID-19 crisis. It even prospered during the pandemic’s initial phase. However, this period also marked significant shifts in the athletic apparel retail sector. Consumers developed an affinity for competing shoe brands like On and Hoka, supply chain disruptions posed inventory challenges, and after years of robust growth, China emerged as a particularly difficult market. Nike also realized, perhaps too late, that it still needed the wholesale partners it had been distancing itself from, to complement its direct-to-consumer (DTC) strategy.

Both the company and its investors are still recovering from these challenges.

Nonetheless, there is hope on the horizon as Nike systematically addresses each of these obstacles.

Addressing the Issues

Consider the recent return of Tom Peddie as an example. After a 30-year tenure with the company, he retired in 2020 and has now returned as vice president of marketplace partners. His primary role is to strike the right balance between Nike’s wholesale and DTC initiatives.

Nike is also aiming to rekindle genuine interest in its brand through enhanced innovation.

While it wouldn’t be accurate to claim the company ceased innovating in recent years, something has been amiss, possibly more on the marketing side than in product design.

This likely explains why Nike executives mentioned “innovation” over 40 times during the fiscal 2024 fourth-quarter earnings call in late June, each instance accompanied by context suggesting increased efforts. One notable product from this renewed focus is Dynamic Air, which is more than just a sneaker; it’s a comprehensive platform designed to enable further creative advancements in air-based foot cushioning. Consumer reactions to Dynamic Air and other recent innovations have been positive.

Other improvements, though more technical, are equally significant.

Consider inventory management. Nike began fiscal 2023 with an inflated inventory of nearly $9.7 billion. It took significant discounting efforts last year to clear excess product, but the company has since reduced inventory to a more manageable $7.5 billion. A key component of this strategy involved distributing more goods through third-party retailers.

The 3% year-over-year rise in China revenue last quarter can also be attributed to a 15% growth in the wholesale channel. Full-year fiscal 2024 revenue in the region increased by 4%, reversing the 4% decline from the previous year.

A Strong Option for Aggressive, Risk-Tolerant Investors

So, can these developments be trusted as indicators that Nike is on the mend?

While there are no guarantees in investing, if you take these signals at face value, they suggest Nike is capable of, and likely will continue, its turnaround. Management has identified the issues and is taking decisive steps to address them. Ultimately, the leadership team benefits from stewarding one of the world’s most renowned brand names.

Even if you’re optimistic about the company’s recovery, it’s not the best foundational choice to occupy a large portion of your portfolio. It still represents above-average risk and is likely to remain volatile.

However, with the stock having more than halved from its all-time high, the potential upside significantly outweighs the potential downside from current levels. Nike represents a strong candidate for the growth segment of a portfolio.