The journey for The Hershey Company (0.55%) and its investors has been anything but smooth recently. Although the stock has seen a modest increase this year, it remains over 25% below its peak from early 2023. The confectionery titan has faced a series of lackluster quarterly performances, influenced by shifting consumer spending habits and ongoing inflationary cost challenges, which have exerted downward pressure on its shares.

Nevertheless, there are numerous reasons for investors to maintain a positive outlook on Hershey, given its promising long-term prospects. Let’s explore where the stock might be in five years and whether it’s an attractive purchase now.

A Leader in Satisfying Sweet Cravings

Hershey is a globally renowned name for its signature chocolate, boasting a legacy that spans over 125 years. What many may not realize is that the company also owns a diverse range of other iconic candy brands, including Reese’s, KitKat, Jolly Rancher, and Twizzlers.

In recent years, Hershey has broadened its presence in the salty snacks sector through acquisitions like SkinnyPop Popcorn and Dot’s Pretzels, both serving as significant growth drivers. The impressive lineup of brand names and the company’s leadership in its category underscore the stock’s appeal as a potential investment.

A Rocky Start to 2024 for Hershey

Despite these advantages, Hershey has not been immune to the broader economic challenges. The company has observed a trend of consumers cutting back on discretionary spending. In the second quarter, sales plummeted by 16.7%, while earnings per share (EPS) at $1.27 marked a 38% decline compared to the same period in 2023.

While these headline figures are concerning, context is crucial. The introduction of a new enterprise software system and a planned inventory adjustment largely accounted for the downturn. However, a bright spot was the North American salty snacks division, which experienced a robust 9% volume increase from Q2 2023, with Dot’s Homestyle Pretzel brand leading the charge.

The expectation is for seasonal shipments to shift into Q3, with sales anticipated to stabilize in the year’s latter half. Hershey projects net sales growth of around 2% for 2024, with EPS expected to be “down slightly” from the $9.59 achieved in 2023. While the start of the year hasn’t met investors’ hopes, the company’s full-year outlook suggests stable conditions.

A Promising Fundamental Outlook

Looking beyond the short-term quarterly fluctuations, Hershey has several strategies to adapt to changing market conditions, such as reallocating resources across its portfolio or adjusting pricing to support margins. Optimism also exists for the international market segment, which currently contributes just 18% of total sales but presents a significant opportunity for expansion into new markets.

Investors can anticipate Hershey’s continued tradition as a reliable dividend grower. With the exception of 2009, the company has increased its quarterly dividend rate every year since 1988, including a 15% hike to the current $1.37 per share earlier this year, yielding 2.7%. The combination of consistent growth and solid profitability enhances the quality of Hershey’s stock.

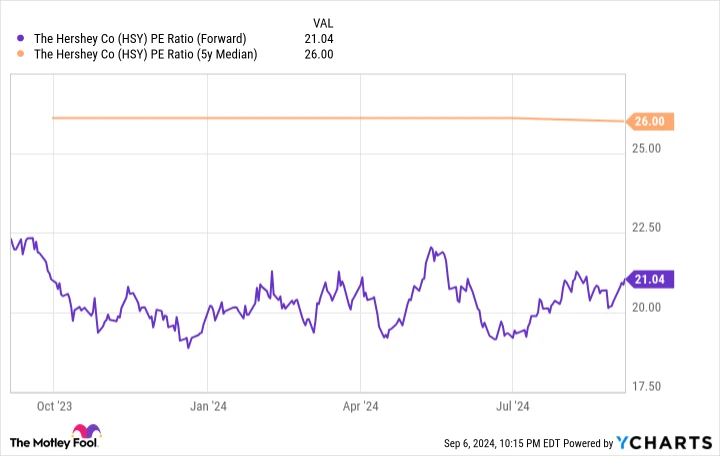

In terms of valuation, Hershey’s shares are trading at a forward price-to-earnings ratio of 21, which is below the five-year average of around 26. This suggests the shares are undervalued, offering a potential bargain for investors if the company can realign with its growth strategy. A few quarters of rebounding sales exceeding expectations could drive the earnings premium higher, acting as a tailwind for the stock.

HSY PE Ratio (Forward) data by YCharts

Where Might Hershey Be in 2029?

I’m optimistic about Hershey’s stock. The management has set a target for adjusted annual EPS growth of 6% to 8% over the long term. I believe the stock should appreciate by at least that rate, with additional upside through valuation expansion as operational and financial momentum improves.

By 2029, I foresee the stock price reaching $300, indicating approximately 50% growth from its current level, alongside additional shareholder returns through dividend income over the period.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Ever feel like you’ve missed the boat on investing in the most successful stocks? Here’s something you should know.

Occasionally, our team of expert analysts issues a “Double Down” stock recommendation for companies they believe are poised for substantial growth. If you’re concerned about having missed your chance to invest, now could be the perfect time to buy before it’s too late. The numbers speak for themselves:

Nvidia: If you invested $1,000 when we doubled down in 2009, your investment would now be $276,036!*

Apple: If you invested $1,000 during our 2008 double down, you’d have $41,791!*

Netflix: If you invested $1,000 when we doubled down in 2004, your investment would be $364,248!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and this opportunity may not present itself again anytime soon.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/10/2024