One of the most significant factors affecting your retirement finances is the age at which you choose to start receiving benefits. Social Security is a government program that provides financial assistance to individuals who are retired, disabled, or survivors of deceased workers. .

The majority of individuals become eligible to receive retirement benefits at the age of 62. However, opting to claim these benefits at the earliest opportunity results in a smaller payment. In order to receive the highest payment amount from Social Security, the majority of retirees choose to delay claiming until they reach the age of 70. A growing number of older adults have concluded that it is beneficial to wait until this age to claim their benefits.

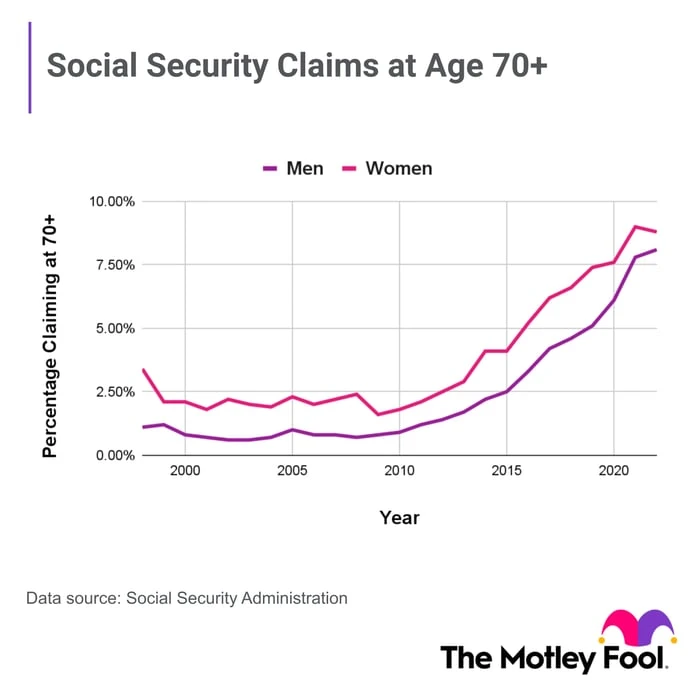

The number of older individuals postponing the commencement of benefit collection until the age of 70 has significantly increased since the beginning of the 21st century. There is a clear rationale behind this trend, and it is expected to become an even more appealing choice in the upcoming years.

Here is the information that older adults should be aware of.

The significant shift in the process of determining ages.

In the past 25 years, there has been a notable rise in older individuals choosing to wait until they reach the age of 70 before claiming their Social Security benefits. This trend has been gaining momentum, especially in the last 15 years. In 2009, only a small percentage of men (0.8%) and women (1.6%) who claimed Social Security were 70 years old or above. However, by 2022, these percentages had significantly increased to 8.1% for men and 8.8% for women.

However, the significant change in the eligibility age started before the year 2000. It dates back to 1983 when Congress enacted significant Social Security changes.

Two main aspects of the reforms led to a shift in retirees’ actions. Initially, there was a gradual rise in the the age at which a person is eligible to receive full retirement benefits Individuals born before 1938 would receive their full benefits at age 65, while those born after 1938 would experience a gradual increase in the full retirement age by 2 months for each year after 1938 until it reaches 66 for individuals born in 1943 or later.

Another round of raises would commence for individuals born after 1954, with the retirement age increasing by 2 months each year until it reaches 67 for those born in 1960 or beyond.

Raising the retirement age led to a higher reduction in benefits for individuals who chose to claim them at age 62. For instance, individuals with a full retirement age of 65 would get 80% of their regular benefits if they claimed at 62, whereas those with a full retirement age of 67 would only receive 70% of their normal benefits if they claimed at 62.

Picture credit: Getty Images.

Another consequence is that retirees have a reduced time span to receive increased benefits for delaying retirement past the full retirement age until age 70. To address this issue, the changes also involved raising the amount of the delayed retirement credit.

In the past, retirees were able to boost their benefits by 3% annually, for a maximum of 5 years (from 65 to 70). This allowed them to receive a maximum of 115% of the benefit they would get at age 65. With the 1983 changes, the increase in delayed retirement credit was slowly raised to 8% per year. This change allowed individuals born between 1943 and 1954 to potentially receive up to 132% of their full benefit.

Encouraging a postponement of Social Security benefits.

The modifications provided retirees with strong reasons to delay claiming benefits. Previously, individuals could start receiving 80% of their benefits at age 62. This would only rise to 115% at the age of 70, resulting in a 44% boost in the amount of their payment for waiting eight years.

Individuals who were considering filing for retirement benefits in the early 2000s were faced with a choice: receive 75% of their full benefit in 1999 or wait for eight years to receive 132% of the value, which represented a 76% increase.

Currently, there is a new change taking place related to the second set of increases in the full retirement age, although this change is not as significant. Individuals who reach the age of 62 in 2024 will have a full retirement age of 67. As a result, if they choose to claim their benefits this year, they will only receive 70% of their full retirement benefit. However, if they delay claiming until they reach the age of 70, they will receive 124% of their full benefit, representing a 77% increase. Therefore, the rewards for delaying claiming retirement benefits are becoming more appealing.

Another reason causing elderly individuals to delay

In addition to the growing financial benefit of postponing Social Security, it is becoming a wiser choice for a larger number of individuals each year to wait until they reach the age of 70. This is mainly due to the fact that the average lifespan of elderly individuals is consistently increasing.

One of the main considerations in deciding whether to claim benefits early or postpone is your life expectancy. If you have health issues that may reduce your lifespan, it is usually advisable to claim benefits sooner. On the other hand, if you are in good health, it is generally more beneficial to wait longer before applying for Social Security benefits in order to receive a higher amount over the course of your lifetime.

For couples, the decision is often more intricate, but it is generally advisable for the spouse with the higher income to delay claiming benefits until they reach the age of 70. This strategy ensures that if the higher-earning spouse dies, their partner can still receive their benefits. benefits for individuals who have survived a particular event or situation These can increase the monthly payment for the surviving spouse to match the higher of the two spouses’ initial benefits.

Due to the increasing motivation to postpone benefits and the higher probability of living long enough for that decision to be beneficial in the future, it is becoming more common for seniors to wait until they reach the age of 70 to apply for Social Security benefits. It is recommended that most individuals also consider following this trend.