One disadvantage of putting money into growth stocks These companies usually offer minimal or zero dividends. The purpose is to plow back profits into the company for expansion, rather than providing shareholders with a short-term dividend. Nonetheless, excessive reinvestment can become inefficient, which is why many growing firms adopt a more moderate strategy towards returning capital to investors.

Microsoft ( MSFT 0.69% ) , Broadcom ( AVGO 0.98% ) , and Visa ( V 0.39% ) These companies were once promising growth companies but have now reached a more mature stage where they no longer have to reinvest all their profits back into their operations. Even though their dividend yields are not high, they are dedicated to paying out dividends. This is why they are all considered good investment opportunities at the moment.

Credit: Getty Images.

Contents

There are several reasons to consider purchasing the stock, with Microsoft’s increasing dividend being a notable one.

Microsoft has consistently raised its dividend by approximately 10% each year, resulting in the dividend nearly tripling over the past decade. Now exceeds $21 billion — but it can easily manage to pay for it.

Microsoft’s dividend payout ratio is low at 25%, indicating that only a quarter of its earnings per share is allocated towards dividends per share. This is considered manageable, particularly for a company like Microsoft, which boasts a strong financial position with ample cash reserves, cash equivalents, and marketable securities compared to its debt obligations.

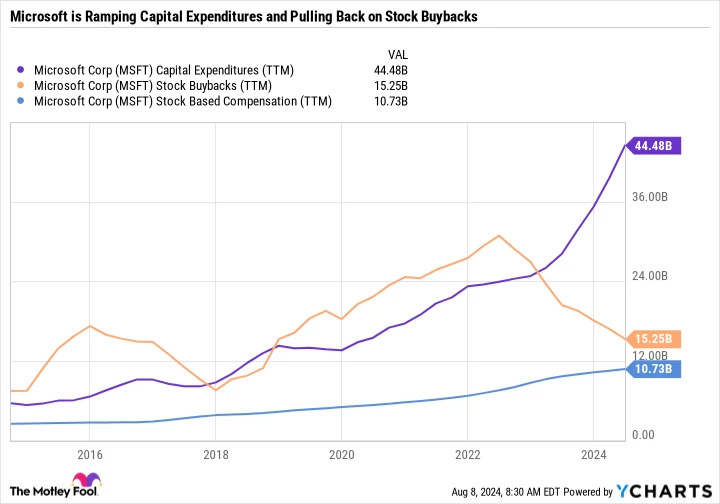

Microsoft has made stock repurchases a central part of its strategy for returning capital to shareholders. Even with increasing expenses related to stock-based compensation, the company has managed to decrease its number of outstanding shares by 10% in the past ten years through buybacks. Nevertheless, there has been a clear change in Microsoft’s approach to returning capital in the past year.

Microsoft is reducing its share repurchases in order to boost capital spending as it increases investment in enhancing products and artificial intelligence (AI). The data displayed in the chart indicates that the company’s stock buybacks have decreased by approximately 50% from a few years ago, while its capital expenditures have significantly increased.

Trailing twelve months capital expenditures for Microsoft. data by YCharts

Microsoft’s effective capital allocation strategy involves utilizing buybacks to generate additional funds for investing in growth opportunities or to scale back growth when necessary. By repurchasing enough stock, the company can counterbalance stock-based compensation and prevent dilution.

The main point to remember is that Microsoft is very successful in terms of making profit. It is able to pay a large and consistently increasing dividend while also allocating funds towards expansion. P/E ratio With a price-to-earnings ratio of 33.8, Microsoft is not considered a very expensive stock, especially when compared to some of its large-cap growth competitors.

Broadcom is not just focused on artificial intelligence.

In just seven years, Broadcom has multiplied its dividend by five, making it one of the top semiconductor stocks in terms of dividend payments. Despite its focus on rewarding shareholders with profits, Broadcom continues to prioritize growth without slowing down.

Broadcom produces a range of physical parts In terms of storage and systems, wireless and wired connections, mainframe and enterprise software, cybersecurity, and other areas, there has been a rise in investment in global connectivity and the demand for increased computing capacity to back AI models. Although Broadcom is not solely focused on AI, it has been performing well even prior to the recent uptick in AI investments. AI chip sales are increasing rapidly. , potentially resulting in AI making up a greater portion of its revenue blend in the future.

Broadcom offers a stable business model and increasing dividend, along with a reasonable valuation as indicated by its forward P/E ratio of 28.7. Despite a seemingly modest 1.5% yield, it is actually relatively higher than expected. S&P 500 Broadcom currently has a yield of 1.3%. Additionally, the reason for Broadcom’s low yield is primarily due to its strong stock performance rather than a lack of dividend increases. Over the last three years, Broadcom’s stock has increased by almost three times. If not for this rise, the yield would be more than 4%.

When considering everything, investing in Broadcom is an excellent option to enter the AI market without having to pay a high price for a stock with an inflated valuation.

Visa has the potential to succeed regardless of the state of the economy.

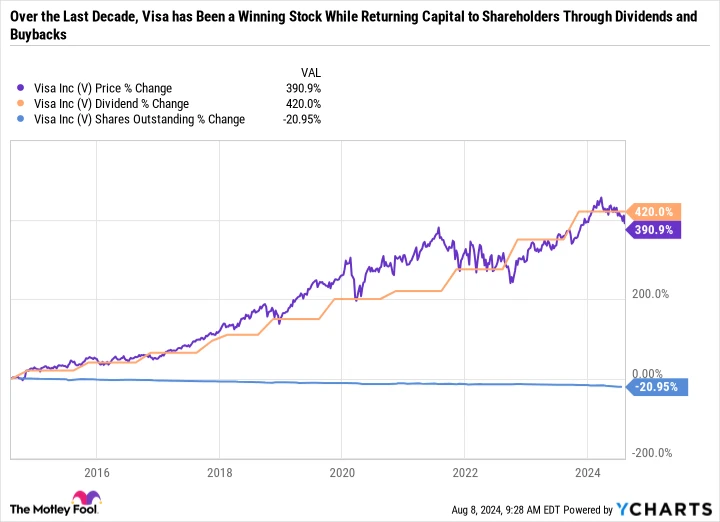

Visa serves as a prime illustration of a company that has transformed to embody growth, income, and value. Visa has consistently raised its dividend. 16 years in a row — The dividend has surged by 420% in the past ten years. However, Visa’s yield remains low at 0.8% primarily because of its strong stock performance.

Although Visa’s dividend increases are remarkable, they are not the sole method through which the company gives back to its shareholders. Over the past ten years, Visa has decreased its number of outstanding shares by 21%. The chart below illustrates various factors contributing to Visa’s success as an investment during this period, including a stock value increase of almost 400% along with an expanding capital distribution plan.

Although Visa has a strong track record, investors are more interested in the future direction of the company rather than its past performance. Luckily for Visa investors, the company is well-positioned. appears to be more powerful than before .

Visa imposes fees on merchants when customers use Visa credit and debit cards for transactions. Despite benefiting from increased spending, Visa does not behave like a cyclical stock that is closely tied to the economic cycle and capital investment.

It is important to mention that Visa is highly resilient to inflation, and in fact, it can benefit from it as inflation leads to higher nominal spending. Additionally, it is improbable that Visa’s expenses would rise at a similar pace.

Visa also gains from the positive impact of lower interest rates that stimulate economic expansion.

Ultimately, Visa benefits when larger sums of money are exchanged.

Visa has taken advantage of the shift from using cash to using mobile and digital payments, as well as focusing on digital currency conversions rather than cash conversions.

Visa’s highly successful business continues to thrive without any indication of slowing down. Additionally, the stock is reasonably priced, as reflected by its P/E ratio of 27.5.

Affordable pricing for high-quality companies

Microsoft, Broadcom, and Visa operate in diverse industries, yet they share a common characteristic as stocks. Each of these companies is capable of paying dividends without hindering their potential for growth. With strong foundational aspects and prominent market positions, all three stocks are also priced at reasonable levels.

In conclusion, Microsoft, Broadcom, and Visa are poised to become strong sources of passive income and are recommended for investors seeking top companies at a reasonable price.