Contents

The past five years have been anything but calm. We’ve witnessed a global pandemic, a contentious presidential election, rampant inflation, rapid shifts in interest rates, and even bank failures. Yet, despite these challenges, the S&P 500 has managed to climb nearly 90%. This performance is impressive, all things considered.

MercadoLibre’s Stellar Performance

While the S&P 500 has done well, the stock of MercadoLibre (-0.27%) has surged far beyond, soaring over 280% in the same period. This Latin American company has been a standout performer, leaving broader market returns trailing in its wake.

My Investment Journey with MercadoLibre

MercadoLibre holds the most significant position in my personal Roth IRA. Before delving into why, let me provide some background to avoid any misconceptions. My Roth IRA is relatively new, less than five years old. Previously, my retirement savings were tied up in an employer-sponsored account, which left me with little control over my investments. Upon changing jobs, I transitioned these funds into a Roth IRA, gaining both cash and decision-making freedom.

Recognizing the importance of diversification—a core principle of Motley Fool investing—I quickly spread my investments over 20 different stock positions. In early 2022, I began purchasing MercadoLibre shares, steadily dollar-cost averaging into the position until it comprised about 5% of my Roth IRA’s value. It wasn’t the largest holding at first, but it certainly is now. Despite its growth, I’m not planning to sell any MercadoLibre shares anytime soon, and here’s why:

1. A Growth Trajectory for MercadoLibre

While it’s possible to profit from low-growth industries, focusing on leaders in burgeoning markets is often more rewarding. MercadoLibre thrives in two primary sectors: its e-commerce marketplace and its financial technology (fintech) services. In North America or Europe, competition would be more intense. However, in Latin America, MercadoLibre benefits from its early entry and leading position.

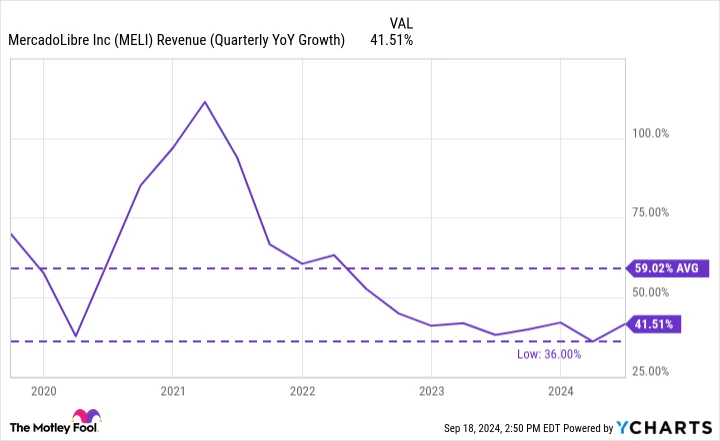

The Latin American markets for e-commerce and digital financial products are relatively immature compared to those in North America. This factor partly explains MercadoLibre’s impressive growth, which seems poised to continue. Over the past five years, the company’s slowest growth rate was 36%, with an average top-line growth nearing 60%. At this pace, MercadoLibre could quadruple in size every three years—a truly astonishing prospect.

While I don’t expect MercadoLibre to maintain this exact pace indefinitely, its growth potential remains substantial. This is the primary reason I’m comfortable with MercadoLibre being the largest holding in my Roth IRA.

2. Pathway to Profitability

Years ago, MercadoLibre made a strategic decision to forgo profit margins to invest heavily in logistics—a sector with significant challenges in its operating regions. Today, this investment has paid off, with over half of its e-commerce orders being delivered on the same or next day, an exceptional level of service in its key markets.

This logistical prowess underpins the long-term growth of MercadoLibre’s e-commerce platform. More third-party sellers are joining, contributing to a high-margin revenue stream and enabling advertising revenue growth, which reached around $250 million in the second quarter of 2024—a 50% year-over-year increase. MercadoLibre’s logistics strength also confers a competitive advantage, often leading to improved margins over time.

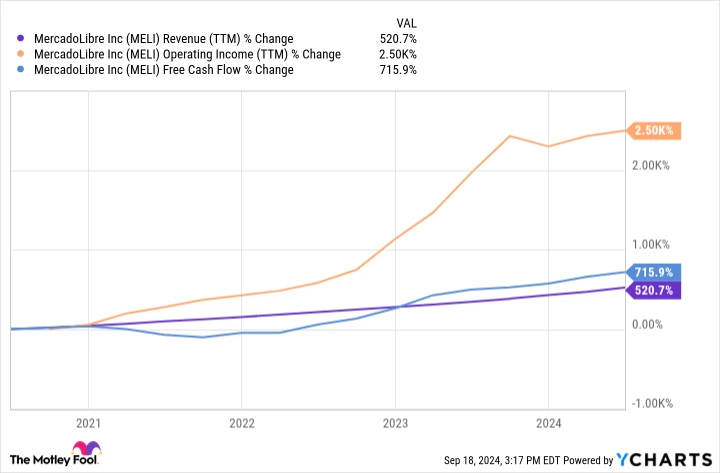

In recent years, MercadoLibre’s revenue growth has been remarkable, but its profit metrics, including operating income and free cash flow, have grown even faster.

If MercadoLibre’s profits continue to expand, the stock is likely to see further gains.

3. The Strategy of Letting Winners Run

Motley Fool’s investing philosophy emphasizes a diverse portfolio and the wisdom of allowing successful investments to continue growing. A diverse portfolio inevitably includes some poor performers, which can weigh down long-term returns. However, a single winning stock can significantly boost overall performance—if given enough time to flourish.

There are valid reasons to sell a stock, but MercadoLibre’s business is thriving, with a promising growth trajectory. For these reasons, I intend to hold onto my top stock, allowing it to elevate my portfolio.

Seizing a Second Chance at Success

Have you ever felt you missed the opportunity to invest in the most successful stocks? Here’s your chance to change that. Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they anticipate will soon surge. If you’re concerned about having missed your investing chance, now is the time to act before it’s too late. Consider these results:

– Amazon: A $1,000 investment during our 2010 double-down would be worth $21,579 now!*

– Apple: A $1,000 investment in 2008 would have grown to $43,170!*

– Netflix: A $1,000 investment in 2004 would have ballooned to $378,059!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and such opportunities may not come again soon. Don’t miss out.

See 3 “Double Down” stocks

*Stock Advisor returns as of 09/22/2024