Contents

- 1 The Appeal of Dividend-Paying Stocks for Passive Income

- 2 Understanding Payout Ratios for Better Investment Decisions

- 3 Northrop Grumman: A Passive Income Powerhouse

- 4 Overview of Northrop Grumman’s Business and Growth

- 5 Dividend Potential and Growth Prospects

- 6 Strategic Involvement in Defense Programs

- 7 An Attractive Option for Passive-Income Seekers

- 8 Howmet Aerospace: Renewed Focus on Dividend Growth

- 9 Howmet Aerospace’s Market Position and Business Model

- 10 Recent Dividend Developments and Growth Potential

- 11 Market Demand and Dividend Outlook

- 12 Two Top Passive Income Candidates

- 13 Investment Considerations

The Appeal of Dividend-Paying Stocks for Passive Income

Dividend-paying stocks have consistently been a fundamental element in many passive income strategies. However, not all dividend stocks are created equal; some stand out as particularly advantageous additions to a passive income portfolio.

Understanding Payout Ratios for Better Investment Decisions

Research indicates that companies with payout ratios below 75% are more reliable in sustaining their dividends, reducing the likelihood of cuts or suspensions. Furthermore, stocks with payout ratios under 50% may provide an added sense of security and the potential for future dividend increases.

In the aerospace and defense sector, two notable stocks exemplify this principle: Northrop Grumman and Howmet Aerospace. These companies are characterized by their conservative payout ratios, with Howmet’s significantly below 50% and Northrop’s nearing this threshold. This fiscal prudence hints at a robust foundation for consistent dividend payments and the possibility of significant growth in dividends over time.

Here’s why investors seeking passive income might consider adding these two dividend stocks to their portfolios.

Northrop Grumman: A Passive Income Powerhouse

Overview of Northrop Grumman’s Business and Growth

Established in 1939, Northrop Grumman ranks among the world’s largest defense contractors and serves as a prominent source of passive income. The company boasts a diverse product lineup that includes aircraft, defense, mission, and space systems. With annual revenues projected to surpass $40 billion this year, Northrop Grumman continues to demonstrate robust growth within the aerospace and defense industry.

Dividend Potential and Growth Prospects

Northrop Grumman’s stock is noteworthy for its strong passive income potential, currently offering a yield of 1.58% and boasting a five-year annualized dividend growth rate of 7.27%. The company’s conservative payout ratio of 49.8% suggests that there is room for future dividend increases, enhancing passive income opportunities.

Strategic Involvement in Defense Programs

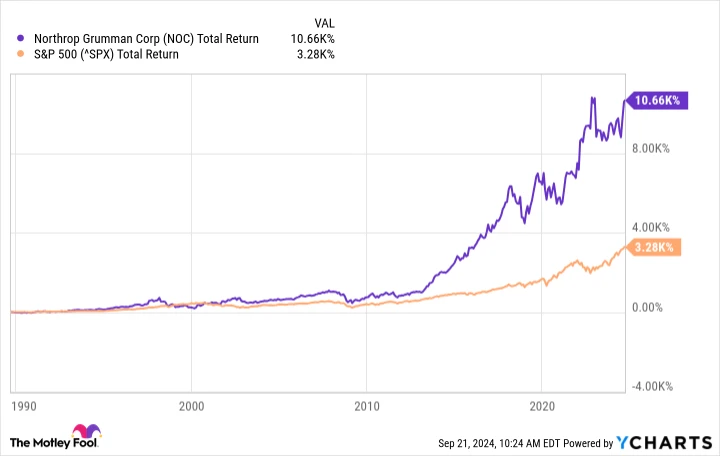

The company’s long-term growth is supported by its participation in significant military projects, such as the Ground Based Strategic Deterrent program and the development of the B-21 bomber. Although Northrop Grumman’s revenue is heavily reliant on government defense spending—introducing an element of political risk—this risk is mitigated by the historical trend of increasing global defense budgets.

Northrop Grumman has consistently leveraged this trend to deliver market-beating returns. With global defense spending on the rise, the company appears well-positioned to sustain its strong performance.

An Attractive Option for Passive-Income Seekers

Northrop Grumman’s combination of a growing dividend, involvement in long-term defense projects, and exposure to emerging aerospace technologies makes it an appealing choice for those seeking passive income. The company offers the potential for both steady income and long-term growth.

Howmet Aerospace: Renewed Focus on Dividend Growth

Howmet Aerospace’s Market Position and Business Model

Howmet Aerospace is a leading provider of advanced engineered solutions within the aerospace and transportation industries, operating through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels.

Recent Dividend Developments and Growth Potential

The company’s recent 60% dividend increase, coupled with its established market position, makes it an intriguing option for passive income investors. Currently, Howmet Aerospace offers a modest yield of 0.33% with an ultra-conservative payout ratio of 8.44%, indicating ample room for future increases in its quarterly cash distribution.

Market Demand and Dividend Outlook

Howmet Aerospace’s business is driven by the demand for its engine products and fastening systems, particularly from aircraft manufacturers responding to the surge in air travel demand. This strong market position has enabled the company to raise its full-year forecasts and increase its quarterly dividend in recent years.

Despite a past dividend cut during the pandemic to preserve cash, Howmet Aerospace’s recent dividend increase and improved outlook suggest a potential return to robust dividend growth.

Two Top Passive Income Candidates

Northrop Grumman and Howmet Aerospace emerge as compelling choices for a passive income portfolio. These two defense stocks offer a compelling mix of current yield, dividend growth potential, and sustainability—key attributes of the best passive income stocks.

Investment Considerations

Before investing in Northrop Grumman, consider the following:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now, and Northrop Grumman was not among them. The 10 selected stocks could potentially deliver significant returns in the coming years.

For instance, when Nvidia was recommended on April 15, 2005, an investment of $1,000 at that time would have grown to $710,860.*

The Stock Advisor service offers investors a straightforward success blueprint, including portfolio-building guidance, regular updates from analysts, and two new stock picks each month. Since 2002, Stock Advisor has more than quadrupled the S&P 500’s return.*

See the 10 stocks ›

*Stock Advisor returns as of September 17, 2024