For $200, an individual can purchase numerous lottery tickets, one of which might be a winner. Yet, the likelihood of winning a significant amount through the lottery is exceedingly slim. On the other hand, investing in the stock market may not offer overnight riches like the lottery, but it provides a pathway to potentially substantial returns over time. With $200, investors can buy shares in companies poised for long-term growth. Let’s explore two such stocks priced under $200: Novo Nordisk and DexCom.

1. Novo Nordisk

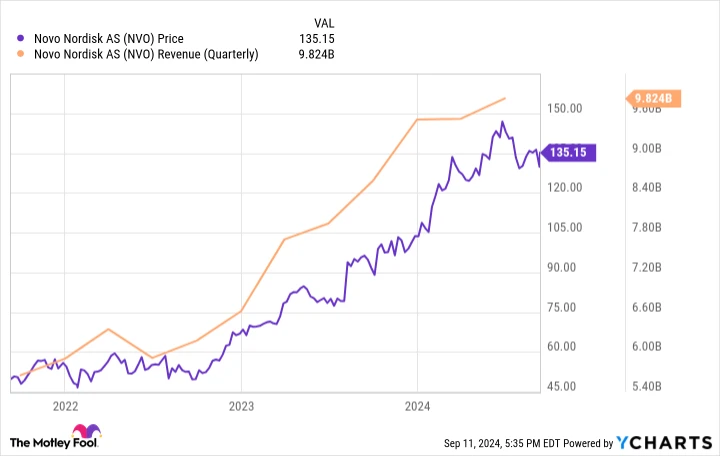

In the pharmaceutical industry, success thrives on innovation, and Novo Nordisk has excelled in this regard in recent years. The company has been a leader in developing GLP-1 medications for weight loss. Its portfolio, which includes the weight loss drug Wegovy and the diabetes treatment Ozempic, has driven impressive financial performance and above-average returns.

NVO data by YCharts.

Investors are also optimistic about Novo Nordisk’s pipeline. Despite the influx of competitors eager to enter the weight loss market, the Danish pharmaceutical giant boasts some of the most promising candidates in development. The standout among them is CagriSema, a compound that combines semaglutide (the active ingredient in Wegovy and Ozempic) with cagrilintide, another GLP-1 medication. In a phase 2 study, CagriSema demonstrated greater efficacy than its individual components.

Currently, CagriSema is undergoing phase 3 trials. Evaluate Pharma projects that the therapy could generate up to $20.2 billion in annual revenue by 2030. While this may seem ambitious, given the rapid growth of Ozempic and Wegovy, the rising popularity of this class of medicines, and CagriSema’s potential enhanced effectiveness, such projections are not surprising. These factors suggest that Novo Nordisk will continue to be a dominant player in the diabetes and obesity care sectors, sustaining its momentum.

Additionally, Novo Nordisk is diversifying its portfolio with developments in other therapeutic areas, aiming to complement its existing lineup. Currently, over 90% of its revenue comes from diabetes or obesity products. While this concentration hasn’t posed a problem yet, it could become an issue if the market for approved GLP-1 products expands significantly. However, Novo Nordisk is preparing for this possibility, providing reassurance to investors. As of this writing, its shares are priced at approximately $137, making it a solid long-term investment.

2. DexCom

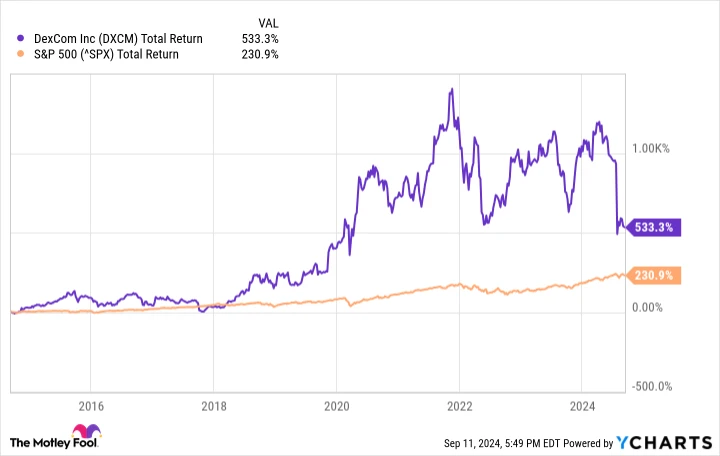

DexCom’s share price declined by about 40% in July following the release of its second-quarter results. While this might initially seem concerning, it’s important to delve deeper. Here are three reasons why DexCom remains a promising investment. Firstly, the company’s stock has historically been volatile, experiencing sharp declines multiple times. Nevertheless, it has consistently delivered market-beating returns to dedicated long-term shareholders, making this situation par for the course.

DXCM Total Return Level data by YCharts.

Secondly, the recent drop in DexCom’s stock price was largely due to short-term issues. During the rollout of its latest continuous glucose monitoring (CGM) system, the G7, in the U.S., patients utilized rebates at a higher rate than anticipated. The company’s third-quarter outlook fell short of investor expectations for high-growth stocks, with DexCom’s forward price-to-earnings (P/E) ratio remaining a lofty 33 even after the decline. The healthcare industry’s average forward P/E is 19.2, suggesting a correction might have been due. However, if DexCom’s financial results remain strong, a rebound is likely.

Lastly, DexCom’s global opportunities are vast. As a leader in CGM technology, alongside Abbott Laboratories, DexCom has significant potential for growth. Abbott reports around 6 million users worldwide. Even assuming DexCom has a comparable user base, the combined 12 million users fall short of capturing even 10% of the approximately half-billion adults with diabetes globally. To expand its market, DexCom must continue developing new CGM options and exploring new territories, a strategy it has historically pursued. Following the recent decline, DexCom’s shares are priced at approximately $69, allowing for the purchase of two shares with $200, leaving room for further investment.

Buy alert: Double down on these stocks today

The Motley Fool Stock Advisor service has outperformed the S&P 500 more than fourfold since its inception in 2002*, and the analyst team knows when to double down. They have re-recommended select stocks in the past, resulting in remarkable returns.

Nvidia: If you invested $1,000 when we doubled down in 2009, you’d now have $308,911!*

Netflix: If you invested $1,000 when we doubled down in 2004, you’d now have $370,385!*

Apple: If you invested $1,000 when we doubled down in 2008, you’d now have $42,142!*

Opportunity is knocking once more. Ready to answer the call?

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/14/2024