Manufacturer of equipment for making chips ASML Holding ( ASML 5.53% ) has issue additional shares of its stock The stock has split five times previously, however, it has been a long time since the last split. Currently, the stock is trading at approximately $870 and it may be a good opportunity to divide the market capitalization of $343 billion into more shares.

Stock splits are basic accounting transactions that do not alter the overall value of the company or provide any additional benefits to current shareholders.

Sometimes, a stock split can remain a viable option. One of the key advantages is that the split makes shares more inexpensive, making them accessible to a broader range of potential investors. Expensive stocks can present difficulties for investors with limited purchasing power. shares of a company’s stock that are less than a whole unit by means of their broker.

Contents

The historical record of stock splits at ASML.

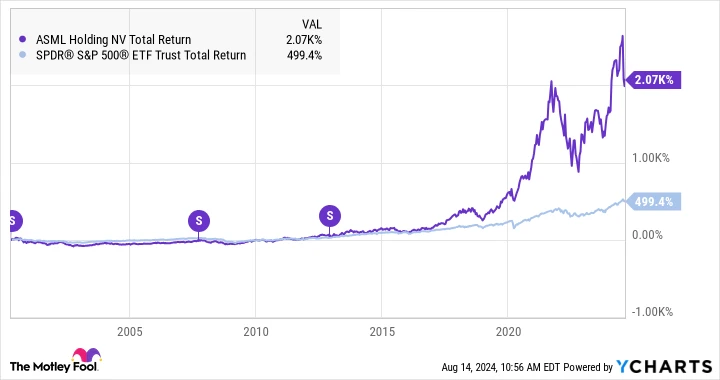

ASML’s stock has experienced a significant increase in value over the past few years. Although there was a notable decrease in 2022 and the returns so far in 2024 have been moderate, the stock price has increased fourfold in the span of five years.

Consequently, the price increased from $212 to $872, reaching a high point of $1,022 in July. Investors who have a restricted budget and cannot purchase fractional shares may need to save up for some time in order to buy a single share.

The recent two stock splits of ASML were somewhat unusual, with a ratio of 8 shares for every 9 held. reverse split ASML underwent multiple stock splits over the years, including a 77-for-100 reverse split with a cash element in 2012. Its most recent split was a 3-for-1 on April 17, 2000. If you owned one ASML share just before this split, you would now have approximately 2.05 shares. The stock was trading at a split-adjusted price of $109 per share before the 2000 split, which dropped to $36.30 the following day.

And the shares’ price total returns increased by 2,070% following the split.

ASML’s overall performance in terms of return. data by YCharts.

The stock price is currently rising much higher than the levels that led to its previous split. It is possible that the board of directors may decide to introduce a new split in the near future if they anticipate further increases in the stock price.

ASML’s present perspective indicates that a split is likely to happen soon.

Following a significant increase in sales in the explosion in artificial intelligence (AI) In 2024, ASML experienced a decrease in revenue. This was a result of its customers pausing their efforts to expand their chip production facilities because of economic uncertainties and excess chip inventories in warehouses.

In this context, ASML’s stock price has fallen by 15% from its highest point. The company’s management anticipates a stronger performance in the latter part of the year due to improvements in the overstocked inventory situation and a decrease in global inflation. Additionally, the demand for ASML’s advanced equipment is expected to increase as the AI market propels sales of microchips.

The company is currently sending its newest and most advanced High Numerical Aperture Extreme Ultraviolet (High-NA EUV) lithography system to top customers. Semiconductor company based in Taiwan. ( TSM 2.35% ) and Intel ( INTC 3.87% ) Priced at $380 million each, these machines are expected to increase ASML’s revenue in the upcoming quarters.

In contrast, ASML does not exhibit typical indications of long-term management confidence. Currently, its dividends are not increasing, and the amount spent on buying back stocks is decreasing. Normally, an increase in dividends and buybacks reflects strong belief in future business prospects, so the limited investments in these initiatives might be concerning.

Partially, the lackluster cash management is influenced by geopolitical tensions. The company, which is of Dutch-American origin, derives approximately half of its revenue from the Chinese market. Both the Netherlands and the United States have implemented tariffs and trade limitations on China.

Simultaneously, I am considering an investment in a stock that is quite costly. In addition to having a high price and a substantial market capitalization, ASML is trading at a very elevated level. ratios used to assess the value of a company or investment for example, a price-to-earnings ratio of 48 and a free cash flow multiple of 109.

While a stock split is not a major concern, the company may want to strengthen its financial position before proceeding with this accounting change. Pairing a stock split with strong sales and increased profits would enhance ASML’s image, which is not currently the company’s situation.

Reasons why ASML could postpone its upcoming stock split

ASML is hesitant to announce a stock split, even as its share price nears $1,000. It may be prudent to wait until the situation with China resolves and customer demand picks up before making any decisions.

Regardless of whether stock splits are planned, the company remains a strong investment in the semiconductor industry and the AI sector. Valuation metrics are currently increasing due to temporary factors, but the company’s long-term outlook is promising. If the high share prices are within your investment budget or if you can purchase a fraction of a share, it is advisable to consider investing in this company. Including ASML’s shares in your investment portfolio during this market downturn. .