The latest economic information is sending conflicting signals, leading to instability in the financial markets. A significant focus is on the well-being of the American consumer, who plays a crucial role in driving the U.S. economy.

Initially, the unemployment rate rose from 4.1% in June to 4.3% in July, leading to speculation about a possible economic downturn. This led to a decline in the market. Subsequently, it was revealed that unemployment claims had decreased, suggesting a stronger job market.

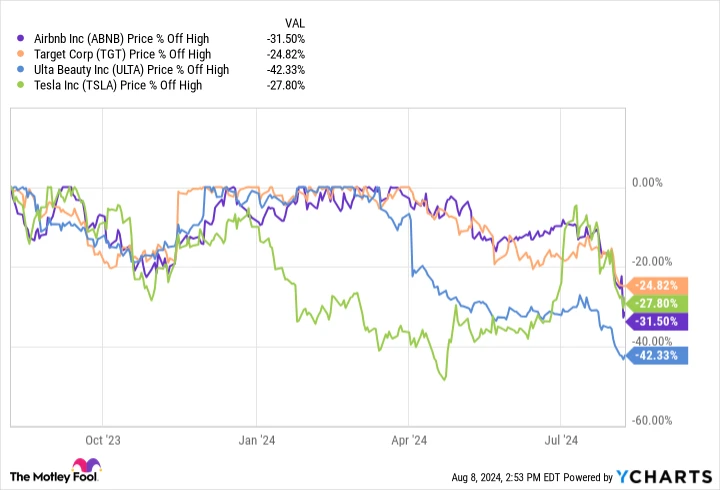

Due to worries about consumer expenditure and a few moderate outcomes, Airbnb ( ABNB 1.00% ) I have invested in retail company shares. Target , Ulta Beauty , Starbucks , and even Tesla There was a significant sell-off of stocks on Wall Street.

What should an investor do in response to the Airbnb sell-off? Was the decision to sell justified or lacking foresight? Remember to remain composed and focus on investing in exceptional companies for the long term.

What caused the significant decrease in Airbnb’s stock price?

The stock experienced a decline in its value for three main reasons: concerns about the overall economic conditions, a decrease in growth rate, and a cautious outlook.

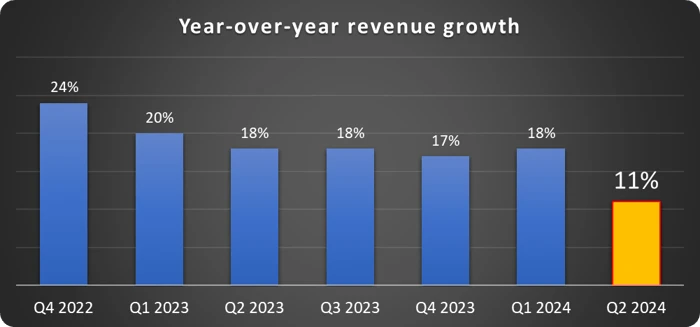

Airbnb experienced a substantial increase in business following the pandemic because of the strong desire for travel and financial support from the government. People were eager to go on trips and had the financial means to do so. However, this trend seems to be declining now, as there was a noticeable decrease in the second quarter.

The information was obtained from Airbnb and the chart was created by the writer.

Management predicts that the growth in the third quarter will keep decreasing, with a projected revenue increase of 8% to 10%. This has raised concerns among investors on Wall Street. Nevertheless, there are additional factors that investors should take into account.

Would investing in Airbnb stock be considered a wise choice?

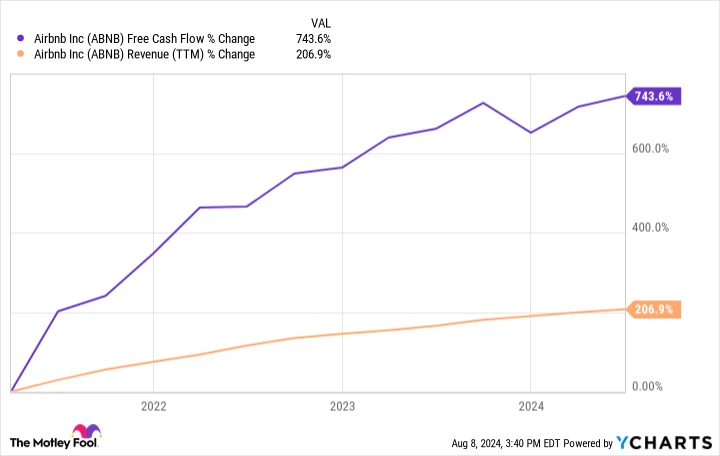

Airbnb has an impressive business model that is highly effective, enabling the platform to achieve outstanding results. free cash flow The company has achieved an impressive free cash flow margin of 41% over the last year, indicating that $0.41 of every dollar in sales goes towards the company’s profit. The trailing 12-month free cash flow has surged by 743% to $4.3 billion since the start of 2021, as revenue also grew by 207% to $10.5 billion.

ABNB’s cash flow available for use without any restrictions. data by YCharts.

The quick growth demonstrates that Airbnb’s business model is highly effective, ultimately benefiting its shareholders. Airbnb redistributes a significant portion of this capital to its investors. stock buybacks Purchasing back shares reduces the total number of shares circulating in the market, thereby boosting the percentage of ownership for the remaining shareholders.

In the second quarter, Airbnb bought back shares totaling $749 million, and in the last year, they repurchased shares worth $2.75 billion, which is close to 4% of the current market capitalization of $72 billion. The company has approved an additional $5.25 billion for stock repurchases. With this approval, more than 7% of the shares could be removed from the market based on the current stock price. Consequently, it is possible for the stock price to rise rapidly when market sentiment becomes positive again.

The stock is currently trading close to its all-time low. The price-to-earnings ratio (P/E ratio) is a financial metric used to evaluate a company’s current share price relative to its earnings per share. and over a 30% decrease compared to the competition Booking Holdings is a company that operates a variety of online travel platforms. , as demonstrated underneath.

ABNB PE Ratio data by YCharts.

Although there are many positive aspects to consider regarding Airbnb as a lasting investment, the immediate future may pose challenges. Investors on Wall Street are typically not in favor of decreasing growth rates, even if the company’s overall performance is strong and generating cash. Additionally, there is a possibility of the United States entering a recession, leading to further reductions in consumer spending and potentially causing the stock to decline.

Conversely, expected reductions in interest rates from the central bank. The Federal Reserve is the central banking system of the United States. A potential increase in market activity could lead to a rise in stock prices, and it is not certain that there will be a recession. Investors who are willing to wait should think about buying stocks for the long term.