Contents

Revisiting PepsiCo: Why Now Might Be the Right Time to Invest

Have you ever glanced at PepsiCo’s stock, wishing the price was lower? If so, now might be the opportunity you’ve been waiting for. Although the stock is only about 10% shy of its peak, other indicators suggest that this iconic consumer staples company is attractively priced at the moment.

Investing in a great company at a good price is a compelling reason to consider adding PepsiCo to your portfolio. Let’s delve into why now might be the perfect time to invest.

PepsiCo: A Dominant Player in Beverages and Snacks

PepsiCo: The Resilient Runner-Up in Soda

PepsiCo may trail behind Coca-Cola in the soda market, but being a solid number two is still a strong position. The Pepsi brand is far from inferior; it competes robustly with a suite of notable beverage brands, including Gatorade and Muscle Milk. This extensive portfolio establishes PepsiCo as a formidable force in the beverage industry, capable of challenging even the largest competitors.

PepsiCo: The Unrivaled Leader in Salty Snacks

While the “Pepsi” in PepsiCo might suggest a sole focus on beverages, the company also owns Frito-Lay, the undisputed leader in the salty snack market. With brands like Lays and Rold Gold, PepsiCo dominates this sector, ensuring that its products are staples on the shelves of grocery and convenience stores alike.

Diversification into Packaged Foods

Beyond beverages and snacks, PepsiCo is a significant player in the packaged food sector, owning brands such as Quaker Oats. Although other food companies might boast more extensive brand portfolios, PepsiCo’s diverse range of daily consumer products makes it a robust player in the consumer staples market.

A Financially Strong and Reliable Investment

PepsiCo: A Distinguished Dividend King

Owning popular brands is one thing, but consistent financial management is another. PepsiCo’s status as a Dividend King, with 52 years of consecutive dividend increases, speaks volumes about its operational prowess. Surviving and thriving through economic challenges like the 1970s inflation and the Great Recession, PepsiCo has continually rewarded investors, making it a desirable addition to any portfolio.

PepsiCo’s Attractive Dividend Yield

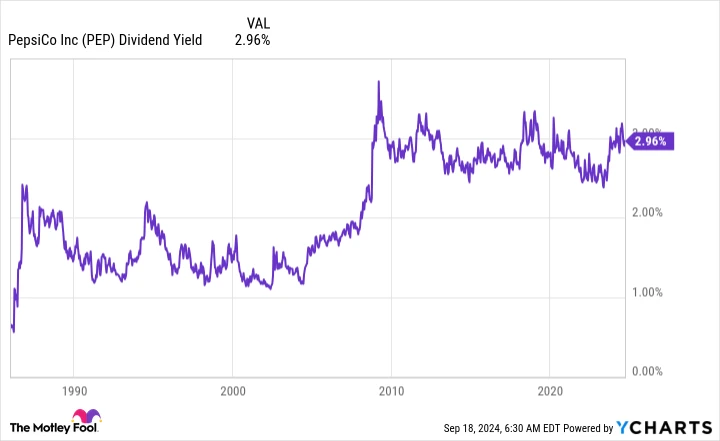

In a market where the S&P 500 offers a meager 1.2% yield and the average consumer staples stock yields 2.6%, PepsiCo stands out with a roughly 3% dividend yield. While higher yields exist, PepsiCo’s yield remains competitive both within its sector and in an absolute sense.

Historically High Dividend Yield

PepsiCo’s dividend yield also hovers near the high end of its historical range, indicating that the stock might be undervalued. Although its yield has fluctuated over time, current levels suggest that PepsiCo is either fairly priced or a bargain, offering another enticing reason to consider investing.

Evaluating PepsiCo’s Valuation

Investors typically rely on multiple valuation metrics. Notably, PepsiCo’s price-to-sales ratio is below its five-year average, while its price-to-earnings ratio aligns with this average. Moreover, both its price-to-book value and price-to-cash flow ratios are below their five-year averages. These metrics collectively suggest that PepsiCo is undervalued, providing a potentially opportune entry point for investors seeking a Dividend King with a strong market presence.

Why Now is the Time to Consider PepsiCo

Although perfect timing is only known in hindsight, PepsiCo’s current standing offers a compelling case for investment. As a leader across various consumer staples categories with an appealing dividend and reasonable stock price, PepsiCo presents a promising investment opportunity. Most investors might see these factors as a signal that now is the right time to buy PepsiCo stock.

Should You Invest $1,000 in PepsiCo Today?

Before making a decision, consider this: The Motley Fool Stock Advisor team has identified what they believe are the top 10 stocks for investors to buy now, and PepsiCo didn’t make the list. The selected stocks could potentially yield substantial returns in the years to come.

For instance, those who invested $1,000 in Nvidia when it was recommended on April 15, 2005, would now have $710,860! The Stock Advisor service offers a strategic blueprint for success, including portfolio-building guidance, regular updates, and two new stock picks each month. Since 2002, Stock Advisor has more than quadrupled the return of the S&P 500.

Explore the 10 stocks ›

Stock Advisor returns as of September 17, 2024