Contents

Evaluating Lockheed Martin: A Buy or Not?

The decision to invest in Lockheed Martin is an intriguing one, as it delves into the core of the debate between bullish and bearish perspectives on the defense contractor’s stock. Here’s a comprehensive analysis for long-term investors considering Lockheed Martin.

Why Consider Lockheed Martin Stock?

Stable and Reliable Customer Base

Investors are often drawn to defense contractors like Lockheed Martin due to the reliability of their clientele. The U.S. government, which accounts for approximately 70% of Lockheed Martin’s sales, is a particularly dependable customer. Moreover, defense spending generally remains stable, avoiding the cyclical fluctuations that many other sectors experience.

Growth Prospects

The defense sector is poised for medium-term growth due to various factors. There’s a pressing need to replenish equipment sent to Ukraine, coupled with record U.S. defense budgets and rising global defense expenditures, especially from NATO allies new and old. These elements together create a compelling argument for investing in the stock.

Assessing Lockheed Martin’s Valuation

Current Valuation Metrics

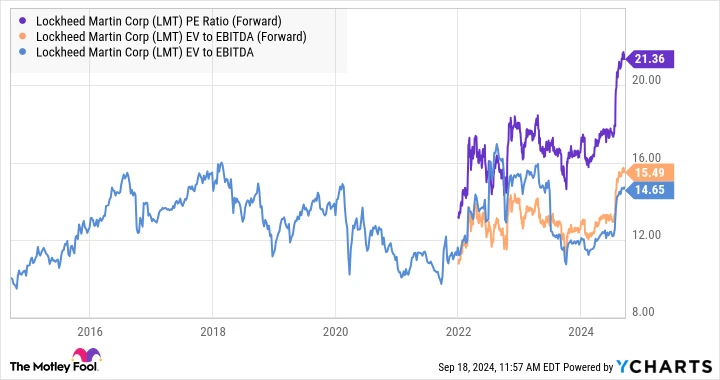

Despite its attractive features, every stock must be evaluated for its price. Lockheed Martin’s current valuation reflects some optimistic assumptions. The stock trades at a forward price-to-earnings ratio exceeding 20 times earnings and possesses an enterprise value to EBITDA metric that appears elevated compared to its historical valuations. Additionally, when examining the price-to-free cash flow, it trades at nearly 22 times the expected free cash flow for 2024.

Market Perception

Lockheed Martin is not being valued as a mature industrial company with modest revenue growth and stagnant margins. Instead, the market seems to be pricing it in for a more robust future.

Future Outlook: Where Will Lockheed Martin Be in Three Years?

Sales Growth Projections

The past couple of years have bolstered Lockheed Martin’s backlog to record levels, and management anticipates further growth in 2024, aiming for a 5% sales increase. However, Wall Street forecasts a slowdown in growth to 4.2% in 2025 and 3.7% in 2026. The company appears to be returning to the industry standard of low-single-digit sales growth.

Margin Challenges

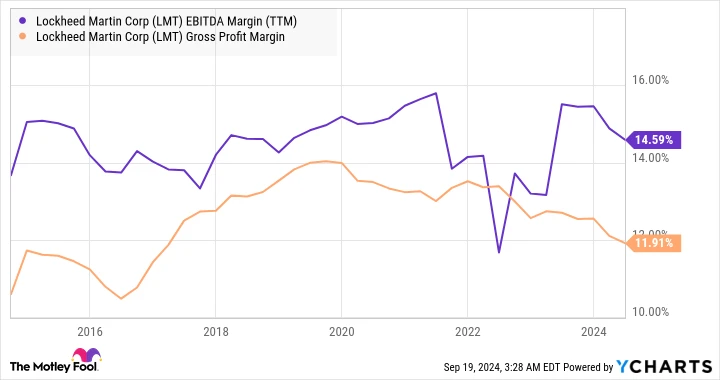

Margin expansion remains a crucial factor, but it’s currently a contentious issue in the defense sector. Major contractors, including Lockheed Martin, face margin pressures from rising raw material costs, supply chain difficulties, and challenging fixed-price development projects.

Structural Concerns

A structural problem may exist with fixed-price projects, as the U.S. government leverages its buying power to push contractors into these agreements, which can squeeze margins.

Opportunities for Margin Expansion

International Sales Potential

At a recent Morgan Stanley conference, CEO Jim Taiclet highlighted international sales, which make up roughly 27% of revenue, as a potential growth avenue. He anticipates these sales could grow between mid-single to high-single digits over the next three to five years. However, these sales typically yield margins similar to U.S. government contracts, implying limited margin improvement.

Future Prospects

Taiclet mentioned that as international sales evolve to meet specific country requirements, there’s potential for increased margins through direct commercial sales. However, given their current minimal contribution to overall sales, significant margin gains seem unlikely.

Conclusion: Is Lockheed Martin a Stock to Buy?

Despite favorable current conditions, Lockheed Martin doesn’t appear poised to dramatically enhance its long-term growth beyond low single digits. Its dependency on the F-35 program and uncertain margins further complicate its appeal.

Investment Consideration

Before investing $1,000 in Lockheed Martin, consider this: The Motley Fool’s Stock Advisor team has identified what they believe to be the 10 best stocks to buy now—Lockheed Martin isn’t among them. The selected stocks have the potential for substantial returns in the future.

For example, Nvidia was recommended on April 15, 2005, and a $1,000 investment then would now be worth $710,860.*

The Stock Advisor service provides a systematic approach for success, including portfolio-building guidance, regular analyst updates, and two new stock picks monthly. Since 2002, the service has outperformed the S&P 500 more than fourfold.*

Explore the 10 stocks ›

*Stock Advisor returns as of September 17, 2024