Shopify ( SHOP 2.42% ) The stock price has surged by 26% after the remarkable second-quarter earnings report was released on Aug. 7. However, it remains more than 50% lower compared to three years ago. There have been significant developments at Shopify that are keeping investors alert. It is important to assess the current state of the business to determine if it is a favorable moment to invest in its shares.

The growth has exceeded the expectations.

Let’s pause and provide some background to the latest financial report. Shopify, a company that provides e-commerce services under other brands to businesses, has been a pioneer in creating websites and e-commerce solutions for a long time. It offers comprehensive solutions for small businesses to establish an online presence and begin selling rapidly, including design, payment processing, data analysis, and other services. As a dominant player in this market, its stock was already experiencing consistent growth prior to the pandemic. However, with a sharp increase in revenue during the COVID-19 outbreak, Shopify’s stock price also experienced a significant surge.

Despite the temporary surge in growth due to the pandemic, the company continues to expand steadily and exceeded expectations in the second quarter. Revenue saw a 21% increase compared to the previous year. The gross merchandise volume (GMV), representing the total sales volume handled by the client stores, also went up by 22%. This performance is noteworthy given the challenging economic conditions marked by inflation and concerns about a possible recession.

Shopify has successfully broadened its range of services by introducing integrated solutions for large businesses, in-person payment options, services for business-to-business transactions, and international sales. These additional services are fueling the company’s growth, with offline sales rising by 27% compared to the previous year in the second quarter, and the gross merchandise volume (GMV) for business-to-business transactions increasing by 140%.

The majority of Shopify’s earnings are generated from handling payments, and with a growing number of customers using the platform, the proportion of Gross Merchandise Volume (GMV) it manages has increased. This includes a 350 basis point growth to reach 61% in the second quarter.

It is continuously striving to achieve consistent profitability.

Shopify does not provide logistics services to clients, but they made an effort to address this by acquiring a logistics operation named Deliverr in 2022. This acquisition aims to help Shopify offer a comprehensive service to clients and enhance its competitiveness in the market. Amazon Nevertheless, the company experienced rapid growth that was deemed unsustainable, prompting management to reveal in May 2023 their intention to divest their logistics division and concentrate on essential services. Additionally, they implemented job cuts to better align the business with market needs and enhance cost-effectiveness.

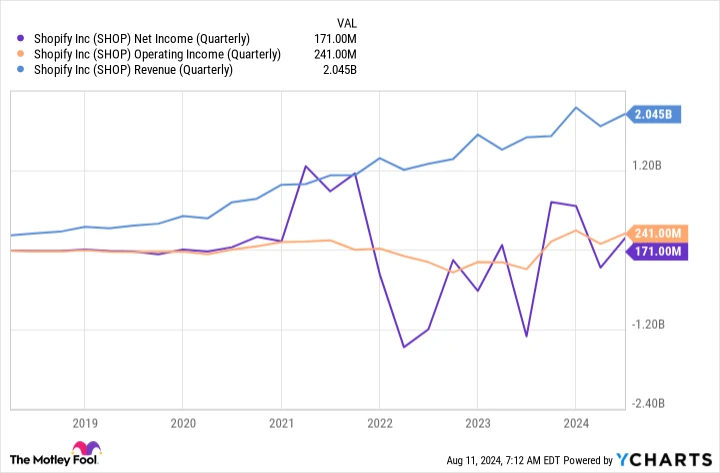

These actions are yielding positive results. Income derived from the core business operations of a company, calculated by subtracting operating expenses from gross profit. The company earned $241 million in revenue during the second quarter, resulting in an 11.8% profit margin, and recorded a net income of $171 million. Free cash flow The amount rose from $97 million in the previous year to $333 million.

Despite the impressive numbers, Shopify has yet to demonstrate consistent profitability, and the advantages of its withdrawal from the logistics sector are still unfolding.

This chart provides a graphical illustration of the current situation.

Data by YCharts .

While revenue is consistently increasing, the stability of operating and net income has been fluctuating. However, these numbers are improving, and if Shopify can maintain its growth without logistics impacting its profitability, this positive trend is expected to persist.

The price of Shopify stock remains high.

The stock of Shopify is currently being traded at a certain price. The ratio of a company’s market capitalization to its total sales revenue. around 12, which is near the typical value it has had in the last two years. The price-to-earnings (P/E) ratio based on future earnings. is 52.

Investors who are willing to take risks and have a long-term investment outlook may find Shopify stock appealing. Although it comes with a high price tag, stocks tend to be priced higher when the market recognizes their potential for growth and opportunities. With the company making positive advances, this growth-oriented stock has the potential to increase in value over the long run. Nevertheless, there may be periods of fluctuation in the stock’s value.