DigitalOcean Holdings refers to the company DigitalOcean Inc. ( DOCN 0.91% ) is not widely recognized. But neither were Amazon and Apple In the early stages of their development, both companies became trillion-dollar entities, greatly benefiting investors who had the vision to foresee their future success.

Will DigitalOcean emulate their success by transforming modest investments in the company now into substantial wealth in the future? Continue reading to find out.

Can you please explain what DigitalOcean Holdings is?

DigitalOcean provides various cloud computing services, although many individuals may not be well-acquainted with the company. Microsoft , Alphabet Google, as well as Amazon mentioned earlier.

It sets itself apart from other players. Unlike Alphabet and Amazon, it is a large corporation catering to a large audience. Cloud computing refers to the practice of using a network of remote servers hosted on the internet to store, manage, and process data, rather than a local server or a personal computer. DigitalOcean is a small business that caters to small and medium-sized clients in the cloud computing industry. It provides a flexible platform for smaller companies to increase their usage as needed and charges them based on the services they actually use. This approach allows smaller clients to avoid making significant upfront investments in a cloud service that may end up being more expensive than necessary.

This market is larger than one may assume. DigitalOcean has over 600,000 customers who pay for their services, and according to Imarc Group, a research company, the small and medium-sized business segment of the cloud computing market is expected to grow by 14.9% annually until 2032.

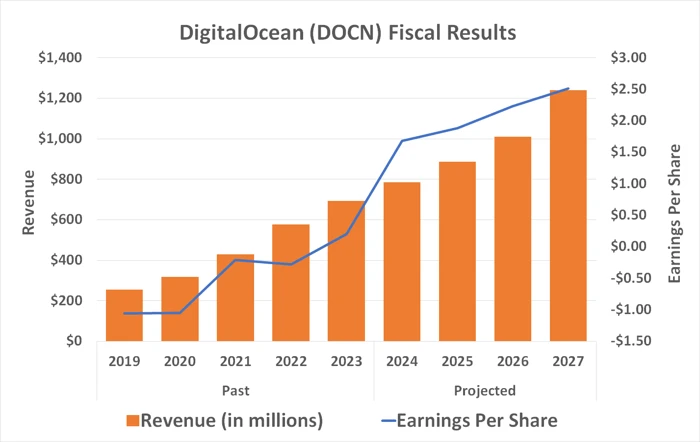

The company is evidently taking advantage of this growth as well. In the first half of this year, DigitalOcean saw a nearly 13% increase in revenue despite facing new economic challenges, following a 20% growth from the previous year. Earnings are increasing at a quicker rate. It is anticipated that both revenue and profit will continue to rise at a similar speed.

Source of information: StockAnalysis.com.

However, does this stock have the potential to make someone a millionaire?

Designed for durability and competitiveness.

Experienced investors are familiar with numerous stories of “guaranteed successful” investments, however, a majority of them do not end up being successful. Examples include Groupon Blue Apron, as well as GoPro When thinking about successful companies, names like Apple and Amazon immediately stand out. While many companies generate excitement upon their launch, not all of them are able to meet the high expectations set for them. Apple and Amazon, on the other hand, have managed to exceed these expectations and become incredibly successful.

Where does DigitalOcean fall on the scale between potential disappointment and remarkable success? It is likely positioned around the middle, or maybe leaning slightly towards the “success” end of the spectrum.

The cloud computing industry is competitive, with leading companies such as Microsoft and Alphabet adopting characteristics similar to DigitalOcean. They are increasingly providing self-service options, individualized features, and smaller-scale services. The major players in the market are not going to allow DigitalOcean to expand freely, as they recognize the potential for small cloud customers to grow into larger ones.

DigitalOcean has a competitive advantage over larger rivals due to its small size and targeted approach towards meeting the cost-effective requirements of small and medium-sized enterprises. This focus caters to the majority of businesses today and is likely to continue in the foreseeable future. While Amazon Web Services, Microsoft, and Google can also cater to these needs, DigitalOcean’s tailored solutions give it an edge in this market segment. market for small businesses However, they need to concentrate on serving the major clients in the industry to meet the expectations of their investors.

Not every investment needs to be a huge success.

However, the question that still needs to be answered is whether a $10,000 investment in the stock could potentially grow to be worth $1 million in the end.

If this stock continues to gain at a consistent rate similar to its recent and anticipated revenue growth of 13%, which is quite possible due to the recurring income structure of its operations, it would take almost four decades for a $10,000 investment in DigitalOcean Holdings today to grow to over a million dollars. Although this timeframe is less than a lifetime, by the time the investment reaches a million dollars, it may not have the same value it holds today. Additionally, there are various factors that could potentially disrupt the company’s current and projected growth trajectory during this period.

However, this does not imply that DigitalOcean Holdings is not a promising investment to potentially hold for the long term.

It is widely acknowledged that the rise of artificial intelligence is fueling an increase in the need for cloud computing services, especially in the coming years. This trend is notably significant for smaller businesses that are acknowledging the permanent presence of AI. Approximately two-thirds of small to medium-sized enterprises in the United States plan to allocate more funds towards this technology in the current year, despite facing new economic challenges. Consequently, they will need to make investments in this area. AI simply to stay ahead in the competition.

Besides artificial intelligence, there is also an increasing demand for fundamental cloud computing services such as customer service applications and basic data storage. This demand is expected to keep growing for many years to come.

Absolutely, this stock increased towards the end of the previous week The company’s performance in the second quarter and its future projections have created a sense of unease for those considering entering the market at this time.

However, it is important to take a broader view. Despite this, the stock remains significantly lower than its peak after going public in 2021, with a decrease of over 70%. Moreover, it has not yet reached the high it experienced last July. Furthermore, it is valued at less than 20 times the projected earnings per share for the next year, making it a great deal in the current market conditions. Additionally, this company caters to a market that is not adequately served.

If you are able to accept and handle the expected fluctuations, then don’t think too much about investing in this company.