The next company to reach a value of $1 trillion is expected to be a successful player in the field of artificial intelligence, as this sector offers significant growth opportunities compared to other areas of the economy.

The focus has mainly been on the ” Seven magnificent individuals A large company that produces both semiconductors and software. Broadcom ( AVGO -0.33% ) Broadcom has become an important participant in the competition surrounding artificial intelligence. Due to their rapid growth fueled by AI, diversified portfolio, and a rising 1.4% dividend, Broadcom appears to have a promising future ahead.

Despite the fact that the stock has already increased by 40% this year, it has reached a value of around $700 billion. market cap There is an argument to suggest that its value could rise by another 40% to achieve a market capitalization of $1 trillion by the following year.

Contents

The assessment of Broadcom’s worth.

Even though Broadcom’s trailing price-to-earnings ratio is high at 63, this may not accurately reflect its true value. One reason for this is that Broadcom recently acquired VMware, and therefore its financial results for this segment are not yet fully incorporated. Additionally, Broadcom’s acquisition approach involves significant deductions for amortization of intangible assets and other costs related to acquisitions, leading to a reduction in its generally accepted accounting principles. GAAP Net income is important, but it may not reflect the complete picture of the business as a whole.

Looking ahead to the fiscal year ending in October 2025, Broadcom’s trading value is currently low. Earnings adjusted forward 25 times. This is a more realistic assessment, indicating that there may still be potential for further growth for this unexpectedly successful performer.

Growth driven by artificial intelligence

Broadcom, as its name suggests, is a multifaceted company involved in various sectors such as infrastructure chips and software. However, its AI division is rapidly growing and gaining dominance. The AI portfolio of Broadcom is primarily divided into two segments. One segment focuses on networking switching and routing chips, network interface connectors, and optical transceivers that facilitate the transfer of data within and between AI data centers. The demand for these networking solutions has been increasing significantly recently because of the substantial data transportation requirements of AI technologies.

Furthermore, Broadcom possesses unique ASIC intellectual property that is utilized by various major cloud companies to develop their own accelerators. It is evident that this particular sector is also experiencing significant growth.

Broadcom reported that its revenue from artificial intelligence (AI) in areas such as networking and application-specific integrated circuits (ASICs) made up approximately 15% of its total semiconductor revenue in fiscal year 2023, which ended in October of the previous year, totaling about $4.2 billion. However, in the current year, the company’s management has increased its projections for AI revenue in the last two earnings reports, now anticipating AI-related revenue to exceed $11 billion for the current fiscal year, nearly tripling from the previous year.

Currently, AI revenue appears to be growing faster than what management typically predicts. With AI-related chip revenue becoming a larger part of Broadcom’s semiconductor revenue, estimated at around 30% this year, the chip segment of Broadcom is expected to expand more rapidly and receive a higher valuation.

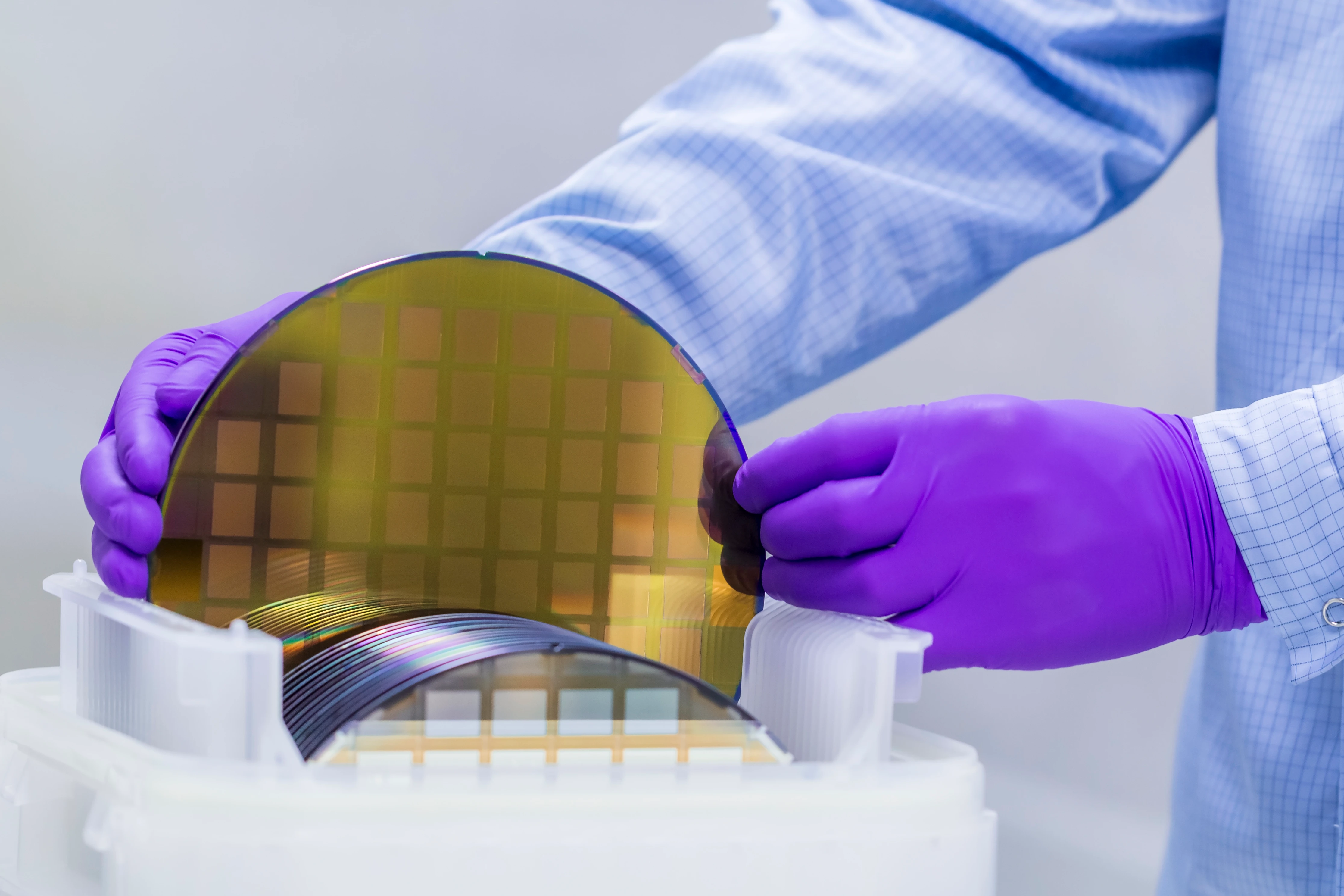

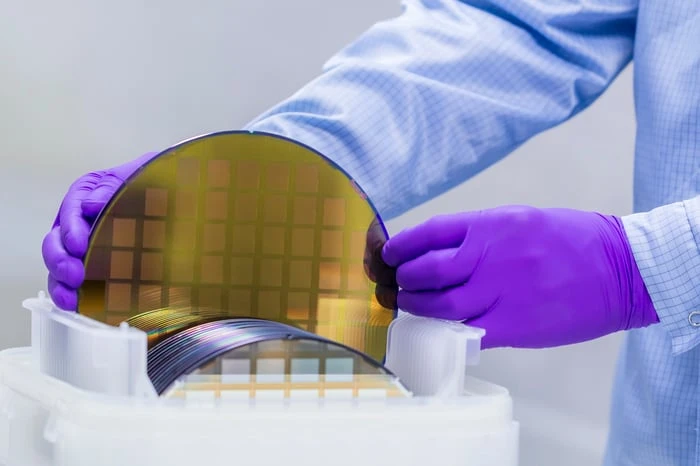

Picture credit: Getty Images.

The acquisition of VMware has the potential to significantly impact the industry.

In the meantime, it seems that Broadcom’s purchase of VMware in November is proving to be successful. The $69 billion acquisition was finalized last November, and Broadcom has already managed to reduce unnecessary expenses, streamline its product offerings, and boost its earnings.

The launch of vSphere by VMware has been well-received as it virtualizes various components of contemporary data centers, not just computing. This product enables big companies to streamline their in-house data centers to mirror the simplicity of public cloud services, a feature that is particularly appreciated as the integration of artificial intelligence applications adds complexity to their IT environments.

VMware experienced a significant revenue increase by shifting from a one-time licensing model to a subscription model. The company’s revenue rose from $2.1 billion in the quarter ending in February to $2.7 billion in the quarter ending in May, marking a 29% growth from quarter to quarter. CEO Hock Tan anticipates VMware to achieve $4 billion in quarterly revenue soon. Along with implementing cost-saving measures, Tan foresees that VMware, which previously had modest profit margins as an independent company, will achieve… profit margin following the historical software developed by Broadcom.

The software division of Broadcom, excluding VMware, achieved an impressive operating margin of 74% last year. If this trend continues at a $16 billion annual rate, Broadcom could potentially earn $12 billion in operating profit from VMware by the following year, considering they acquired the company for $69 billion. This reflects a substantial return on their investment.

Purchasing a new company could push Broadcom’s value to $1 trillion.

The combination of AI revenue and VMware could enhance earnings and increase Broadcom’s value even more. However, reaching a $1 trillion valuation may require the company to make another acquisition.

Tan has successfully implemented a strategy of growth through acquiring unique technology businesses in the field of communication chips and infrastructure software. He buys these businesses, reduces expenses, and allows each one to concentrate on its core competencies.

Broadcom has been assertive in this approach, aiming for larger and more significant goals, as well as expanding into the software sector. With a variety of hardware and software companies to choose from, Tan and his team have numerous opportunities to pursue.

Unlike many other companies that make acquisitions, Broadcom’s valuation may increase when it announces its next acquisition, as it has a history of successful acquisitions.

Although Broadcom has been performing well lately, there is a strong possibility that it could reach a market valuation of $1 trillion in the near future.