The The Dow Jones Industrial Average is a stock market index that represents the performance of 30 large publicly traded companies in the United States. slid 6%. The S&P 500 dropped by 8%. The Nasdaq Composite Index is a stock market index that tracks the performance of a wide range of companies listed on the Nasdaq stock exchange. dropped by 13%. bull market The positive experience that investors have had since the end of 2022 seems to be at risk.

Currently, all of these indices are showing signs of improvement. While they have not yet fully recovered, the situation appears much more positive than it did a few days ago.

Is it a good idea to purchase stocks aggressively following the recent market decline? Let’s see what past trends indicate.

Picture credit: Getty Images.

An event that happens frequently.

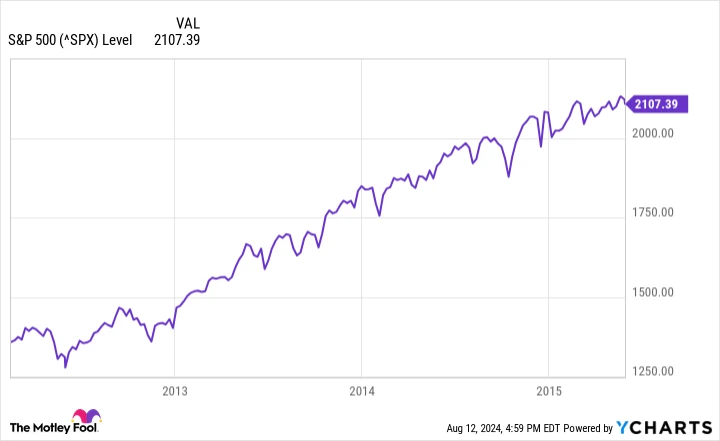

In the 21st century, there have been quite a few instances where the S&P 500 has experienced drops of 8% or more. Following these declines, the market has shown varying patterns of recovery, with some instances of quick rebounds and others where the recovery was slower or non-existent.

During the beginning of 2001, the S&P 500 experienced a decrease of over 8%. Although the index briefly tried to rise again, it ultimately declined once more. Those who purchased stocks during that time would have found it unsatisfactory. It took nearly five years for the S&P to reach its earlier peak value again.

During the third quarter of 2007, the S&P 500 experienced a drop of over 8% before recovering rapidly. However, this recovery was short-lived as the market suffered further declines later in the year due to the collapse of the housing market. This was followed by the financial crisis of 2008, with the S&P 500 hitting its lowest point in the first quarter of 2009.

Following a robust recovery in 2009, the market experienced a significant drop of over 8% in early 2010 but quickly bounced back. However, later in the year, there was another downturn of over 8% which lasted for several months before the S&P 500 regained its upward momentum.

During the middle of 2011, the S&P 500 experienced another drop of over 8%. It took until the following year for the index to reach its previous peak again.

Despite experiencing a sharp decline of over 8% in the second quarter of 2012, the S&P 500 swiftly recovered and began a period of significant growth that lasted for several years.

2015 and 2016 were turbulent years for the market, with the S&P 500 experiencing significant drops in the third quarter of 2015 followed by further declines in early 2016. Despite this, the index managed to regain its losses by the end of the summer of 2016.

Investors experienced favorable market conditions in 2016 and 2017, but faced volatility in 2018 as the S&P 500 dropped by more than 8% on two occasions. Nonetheless, the market started to recover towards the end of 2018 and this positive trend persisted throughout 2019.

Certainly, we are all aware of the events that unfolded in the beginning of 2020. The S&P 500 experienced a sharp decline due to worries surrounding the COVID-19 outbreak. Nevertheless, the index quickly rebounded in a matter of weeks and embarked on a strong upward trend that lasted throughout the entirety of 2021.

The S&P 500 had a tough year in 2022, with a significant drop of over 8% at the beginning of the year followed by continuous decline for the rest of the year.

The poor performance that occurred led to the start of the current bull market in October 2022. Despite a drop of over 8% in 2023, the S&P 500 rebounded and continued to rise until the recent decline.

History lesson

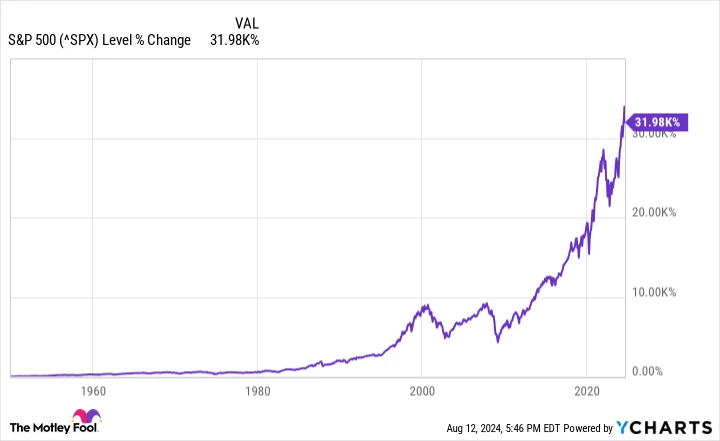

One might believe that the key takeaway from historical events is the unpredictable duration of a particular S&P 500 decline. This assumption is correct. Nevertheless, there is a crucial insight for investors to take away. Presented below is the most significant S&P 500 graph to analyze:

Even though the S&P 500 has experienced drops of 8% or greater on multiple occasions in the past, it has always recovered fully. Those investors who remained patient and stayed invested ended up making significant profits.

Is it advisable to purchase stocks aggressively following the recent decline in the market? portfolio that contains a variety of different investments If you are considering investing in stocks of companies with strong fundamental businesses and keeping them for an extended period, the answer is definitely affirmative.