It’s now confirmed: Alphabet ( GOOG 0.95% ) ( GOOGL 1.01% ) Alphabet, the corporation that owns Google, has been defeated in a significant antitrust case in Federal court.

Judge Amit Mehta’s ruling on August 5th found Alphabet guilty of anti-competitive behavior in the online search industry. Mehta’s 277-page decision stated that Google has acted as a monopolistic entity to preserve its dominance.

What implications does this have for Alphabet and its stock? This article features a discussion by three Motley Fool contributors on Alphabet’s future opportunities and the appropriate investor response.

Picture credit: Getty Images.

This decision presents a challenging result, but there is at least one positive aspect for Alphabet.

Jake Lerch : In summary, the recent antitrust ruling highlights two main points:

- Alphabet is facing an issue with this decision.

- Nevertheless, it is not a disaster.

Firstly, let’s analyze the reasons why it poses an issue.

It is expected that losing the case will have a detrimental impact on the company. Alphabet will need to invest additional resources in appealing the verdict, a process that is anticipated to prolong for several years.

In the event that Alphabet’s appeals are unsuccessful, the company will have no choice but to either reach a settlement in the lawsuit or abide by the remedies ordered by the judge. Both outcomes are undesirable, as they could result in having to pay substantial fines and legal fees amounting to tens of billions of dollars. Furthermore, the government may push for modifications to Alphabet’s operational methods. More precisely, the government now has the authority to request adjustments to Google Search, which is Alphabet’s most profitable business division.

Overall, this decision brings a considerable amount of unpredictability to Alphabet and its shares.

However, there are positive aspects.

Firstly, the ruling centers on Alphabet’s strategy of compensating other companies to set Google Search as their primary search engine. Apple , for instance, was paid more than $18 billion in 2021 to set Google as the primary search engine on its various platforms. Alphabet has also established agreements with Samsung and many other manufacturers of devices, as well as Mozilla, the non-profit organization responsible for developing Firefox.

The agreements are currently at risk, which could ironically lead to a short-term increase in Alphabet’s profits. By no longer paying device manufacturers such as Apple to set its search engine as the default option, the company stands to save billions annually. The main question is whether Google will suffer a notable decline in search engine usage. market share as a result, which could negatively impact financial performance.

Regardless, there is no indication that Google’s control over search will diminish soon. It is expected that the legal proceedings will be prolonged for a few years. During this period, Alphabet is projected to generate significant revenue and profits. Therefore, despite the concerns raised by this decision, I am optimistic about investing in Alphabet.

Even though Alphabet lost the antitrust case, it still signifies that competition must strive to surpass Google. Best of luck!

Justin Pope : It shouldn’t come as a surprise that Alphabet faced a loss in the antitrust lawsuit, considering that Google dominates over 90% of the global internet search market. The company’s use of anticompetitive strategies, such as paying Apple around $20 billion, played a role in the outcome. annually Setting Google as the primary search engine on iOS devices led to its downfall.

What happens next?

Naturally, Alphabet will be subject to scrutiny, and the legal system will aim to decide on consequences that could include fines or requirements. One potential outcome could be the requirement for the company to sell off its Android division. Nearly all smartphones not made by Apple, which make up roughly 70% of global phone market share, rely on Android operating system. Controlling Android allows Alphabet to influence the majority of smartphones globally to use Google services.

Investors may find this situation daunting because Google generates revenue through digital ads , is Alphabet’s most valuable asset. However, it is important to consider a few key points.

Initially, this procedure will require a significant amount of time, possibly spanning across several years, to reach completion. There is no need to hastily sell Alphabet shares out of fear.

Secondly, Google likely should be given some credit. The majority of individuals who were raised with the internet have only ever utilized Google as their search engine. In fact, individuals do not simply search for information; they often refer to it as “Googling.” This demonstrates the significant influence of the Google brand. Alphabet has further expanded its reach by developing a network centered around Google, which includes widely-used tools such as the Chrome web browser and services like Gmail.

The company has made a strong effort to incorporate artificial intelligence (AI) capabilities into Google and has accumulated a vast volume of user data through years of leading the search market. Dethroning Google will prove to be a challenging task, even with regulations prompting competitors to make attempts.

Although Alphabet’s antitrust loss is significant, it is important to exercise caution and observe the unfolding events. As of now, Alphabet remains one of the most powerful companies globally unless proven otherwise.

Despite the ruling, Alphabet could still be a good investment for the long term.

Will Healy : Investors might be uncertain about the ruling declaring Google’s search engine, owned by Alphabet, as a monopoly. Alphabet made deals with companies such as Apple and Samsung to have Google as the default search engine on their devices. Even though the government deemed these payments as unlawful, consumers do not directly pay Alphabet for using Google Search, leading to questions about the impact of the ruling on everyday users.

With appeals and potential penalties still pending, the future outlook for Alphabet in the short and medium term has become more uncertain. Shareholders may choose to sell their shares or refrain from buying more. Nevertheless, this development could be seen as a reason to consider gradually purchasing shares; let’s explore the rationale behind this.

Google is commonly viewed as the top search engine. Therefore, if it is no longer able to financially incentivize companies to have it as the default search engine, investors should not automatically think that it will lose the majority of its market dominance. Currently, Google holds a market share of 91%, as reported by StatCounter.

Additionally, Alphabet has gradually shifted its focus from depending on income generated from advertisements, primarily through Google Search. The proportion of revenue coming from advertising decreased from 87% in 2017 to 78% in 2023. Consequently, although the decision may hasten the shift away from advertising, reducing the dependency on search was already part of the company’s strategy.

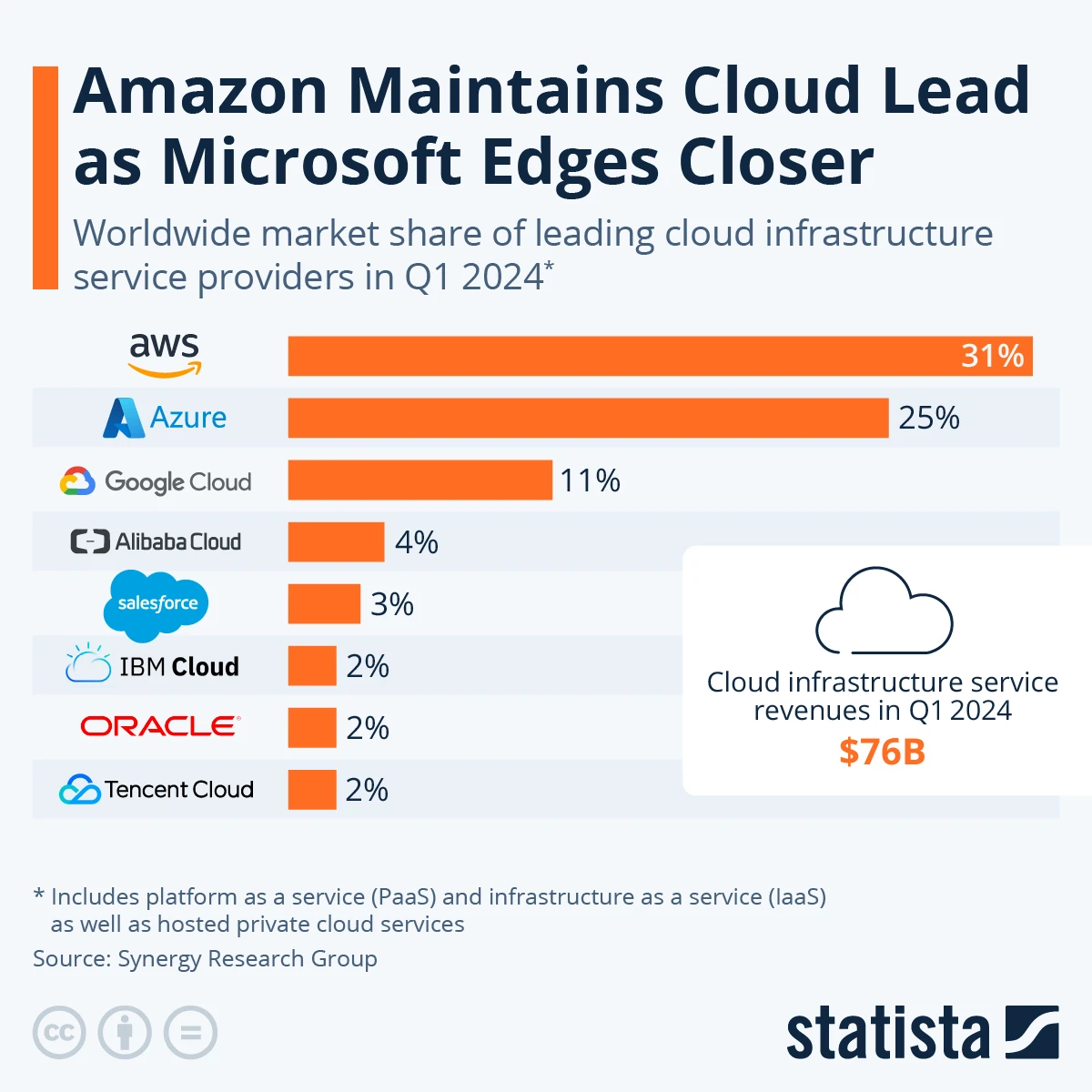

Alphabet’s endeavors to expand beyond search have been characterized by advanced technology and substantial funding. AI Google Cloud, which has been existing in some capacity since 2001, is the third-largest cloud infrastructure provider globally and is the biggest segment of Google that is not related to advertising.

Moreover, Alphabet has $101 billion in liquid assets that it can utilize for investing in and developing these different ventures.

Undoubtedly, shareholders face the challenge of patiently waiting for the appeal outcome to understand the potential impact of any penalties on the company in case Alphabet fails once more. Despite this, due to the sustained success of Google Search and the company’s strong diversification away from its advertising sector, investors may want to contemplate acquiring more shares if there is a notable decline in the stock price.