During a period of declining stock prices focused on major technology companies, Nvidia ( NVDA -0.50% ) The past month has been challenging for Nvidia. After reaching a peak of $135 per share in early July, the stock experienced significant selling pressure and is currently trading at just below $100 per share. This represents a drop of almost 30% from its peak, suggesting that Nvidia stock is now in a bear market.

Although this situation may lead to some investors feeling anxious, it could offer an opportunity for other investors to purchase the stock at a lower price following the initial increase. Therefore, the question arises – should one consider buying Nvidia stock at this point, or is this simply a justifiable price adjustment?

Nvidia’s stock is being affected by two persistent non-influential factors.

The recent decline in the overall stock market is partially linked to a trading tactic where investors borrowed the Japanese Yen at a low interest rate and used the funds to purchase prominent U.S. tech stocks such as Nvidia. With Japan indicating a possible increase in interest rates, individuals who engaged in this strategy are now selling their stocks to repay the borrowed money before the higher interest rates come into effect.

Moreover, there are concerns that the U.S. Federal Reserve is not taking appropriate action and should consider lowering interest rates. As the unemployment rate continues to increase, there is apprehension that we might be entering a recession.

The challenging circumstances currently affecting Nvidia investors may not be favorable, but they present an opportunity for long-term investors to purchase more shares at a discounted price. Despite these obstacles, the growth of artificial intelligence (AI) is expected to continue, making it unnecessary to consider these factors when making long-term investment decisions.

Nvidia is the case due to leading provider of graphics processing units (GPUs The technology that supplies the computational strength needed to develop AI models has seen significant advantages in the last eighteen months due to the increasing competition in the field of AI. This trend is expected to continue without slowing down, making it essential for investors to pay attention to the expansion of AI infrastructure.

Is the drop in price significant enough to justify purchasing shares of Nvidia?

Nvidia’s stock is currently considered a good buy.

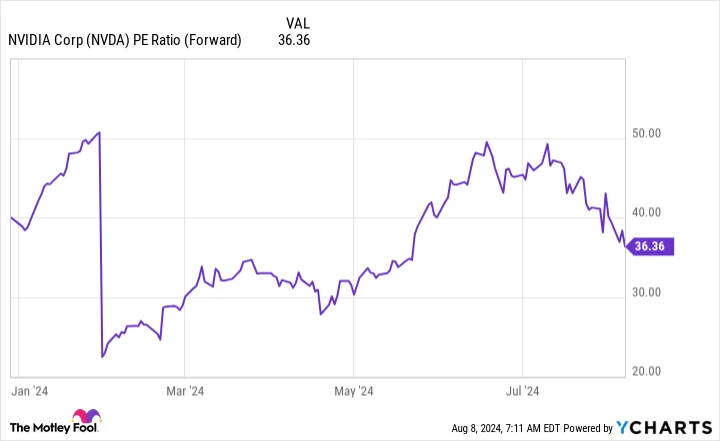

Assessing the value of Nvidia stock is extremely challenging due to its quick expansion and evolution. The most effective approach to determine its value is by utilizing the the method of calculating the price-to-earnings (P/E) ratio in the future The evaluation of Nvidia’s stock relies on analyst forecasts of earnings for the upcoming year. Although not flawless, this approach is considered the most effective for analyzing Nvidia.

Due to the recent decrease in stock value, Nvidia is now trading at a high but more justifiable price of 36 times its projected earnings.

Forward PE Ratio of NVDA data by YCharts.

Although this only brings the valuation back to where it was in late May (prior to the release of its first-quarter earnings report), it is still a reasonable price. Comparing it to its large technology counterparts. Amazon , Apple , and Microsoft The prices of AMD and Intel stocks are not significantly lower than Nvidia’s, with valuation ratios of 35, 31, and 30 times forward earnings, respectively. Additionally, the growth potential of AMD and Intel is not as promising as Nvidia’s. Therefore, it seems that investing in Nvidia may be a wise decision.

For those considering purchasing Nvidia shares, it would be advisable to do so prior to August 28. This is the date when Nvidia will announce its Q2 earnings for the fiscal year 2025, and historically, the company’s stock has experienced an increase following each earnings report since Q1 FY 2024. It is unlikely that any information shared by Nvidia in this upcoming earnings report would cause a decline in the stock value, as statements from cloud computing providers and other companies heavily involved in AI server investments suggest a continued increase in spending over the next year.

This development represents positive news for Nvidia and serves as a compelling justification to invest in the company’s stock at this time. in the midst of the decline in market prices.