Electric vehicles have the potential to transform transportation, but there is still progress needed in the development of EV batteries before they become widely accepted.

QuantumScape ( QS -1.04% ) A leading company in battery advancement is dedicated to pushing boundaries in battery technology. Its goal is straightforward: to address the constraints of current lithium-ion batteries and facilitate a greener, more electric future. The company gained attention earlier this year for achieving promising outcomes in a durability trial, and it has recently obtained funding to prolong its operations for a few additional years.

Given these advancements, would it be wise to consider investing in the electric vehicle battery company at this point in time? Let’s explore the company further to determine the answer.

The innovative battery technology developed by QuantumScape

QuantumScape made a big impact on the market with its sudden rise. The first public sale of company shares occurred in November 2020. The stock price surged to an impressive $132 per share within a brief period due to high investor enthusiasm for the prospect of electric vehicles dominating the market in the future.

QuantumScape’s innovative technology has generated enthusiasm and optimism among investors. The company is focused on addressing the current constraints of traditional batteries by creating advanced solid-state lithium batteries for electric vehicles. These batteries are designed to offer higher energy capacity, quicker charging capabilities, and improved safety features.

A major challenge for the widespread adoption of electric vehicles is their restricted driving distance. QuantumScape contends that in order for electric vehicles to effectively rival traditional gasoline-powered cars, they need to offer a minimum range of 300 miles on a single charge.

EVs The distance that electric vehicles (EVs) can travel on a single charge has been steadily increasing. Recent data from Bloomberg shows that the average range of EVs made by U.S. car manufacturers has reached 291 miles, which is approximately one-third more than the worldwide average. Despite this progress, EVs still have a significant gap to bridge in order to match the current median range of 413 miles for gasoline-powered vehicles.

Photo credit: Getty Images.

The upcoming years are extremely important for QuantumScape.

Volkswagen The company has shown strong support for QuantumScape by investing close to $300 million in the company and establishing a 50-50 partnership to assist in expanding its production to an industrial scale.

In the recent past, PowerCo, a division of Volkswagen, conducted a durability assessment of QuantumScape’s solid-state battery. The results showed that the battery could endure over 1,000 charging cycles and maintain its range for more than 500,000 kilometers without any significant degradation.

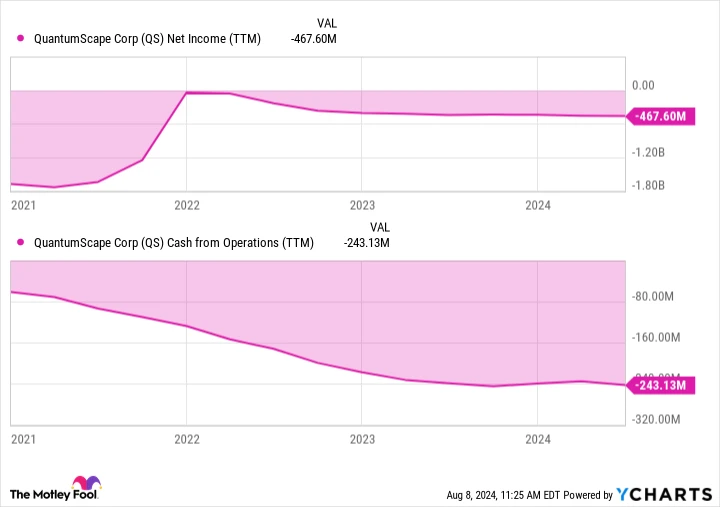

Nevertheless, QuantumScape still faces challenges, resulting in the stock’s inability to make progress over the past few years. This is mainly due to the fact that the company has not started generating revenue yet, as it is focusing on advancing its technology and getting ready to increase manufacturing. Costs are continuously increasing, and the company is still spending money at a high rate. In the past year, QuantumScape reported a net loss of $468 million.

The trailing twelve months net income of QS. data by YCharts.

The company is progressing towards production and has recently engaged in. a contract with PowerCo In order to advance its battery technology on a large scale, PowerCo has obtained a license from QuantumScape to produce batteries using their technology. The agreement allows PowerCo to manufacture a maximum of 40 gigawatt hours annually, with the possibility to increase production to 80 gigawatt hours per year. This capacity would be sufficient to supply power to one million vehicles annually.

The agreement enables QuantumScape to prolong its financial stability by receiving a $130 million advance on royalties from PowerCo. Additionally, it permits the company to utilize a business model with minimal capital requirements and accelerate its expansion to reach gigawatt-hour production levels more quickly compared to its previous arrangement. This is expected to further extend the company’s available cash reserves. by the middle of 2028 .

Is QuantumScape suitable for your needs?

QuantumScape is a promising company with significant growth opportunities. Nevertheless, it encounters strong competition. competition from others developers working on battery technology Toyota and Nio The company is currently in the early stages of development and has not yet started generating revenue. As a result, it is considered a high-risk, high-reward investment option that is more suitable for investors who are comfortable with taking on significant risks and have a long-term investment outlook.

The stock is expected to experience fluctuations and may not be a suitable investment for many investors. However, if you are interested in its potential for the future, consider monitoring it closely and observing how it develops as it moves towards operating on a larger scale. This should offer a clearer picture of its journey towards becoming profitable.