ExxonMobil ( XOM 1.39% ) is one of the biggest energy corporations globally. Regardless of whether it operates under the Exxon, Mobil, or Esso brand, you’re likely to find an ExxonMobil gas station nearby. However, size and recognition alone don’t guarantee that the stock will turn you into a millionaire. Here’s what investors should consider before purchasing ExxonMobil shares.

Contents

- 1 1. ExxonMobil is a major player in the industry

- 2 2. ExxonMobil possesses a solid financial base

- 3 3. ExxonMobil is capable of making changes whenever it chooses to do so.

- 4 4. The amount you spend on ExxonMobil is very important.

- 5 Is investing in ExxonMobil a path to becoming a millionaire? The answer is both yes and no.

- 6 Is it a good idea to invest $1,000 in ExxonMobil at this moment?

1. ExxonMobil is a major player in the industry

ExxonMobil possesses a market cap of approximately $500 billion. This is an enormous figure for any corporation, placing Exxon among the leading companies in the energy industry. Significantly, Exxon’s operations cover the entire spectrum of the energy sector, encompassing the upstream (oil and natural gas extraction), midstream (transportation through pipelines), and downstream (chemicals and refining) divisions.

Photo credit: Getty Images.

Due to its size and variety, at least in terms of the power industry Exxon being substantial is beneficial. It signifies that the company has the capacity to significantly invest in large-scale projects typical within the energy sector. Additionally, it indicates that Exxon possesses enough stability in its operations to endure the fluctuations characteristic of the energy industry. Although oil and natural gas prices continue to be the primary factors influencing performance, the highs and lows are not as extreme for Exxon compared to a company solely focused on energy production.

This makes ExxonMobil appealing to long-term investors who prefer a more conservative strategy.

2. ExxonMobil possesses a solid financial base

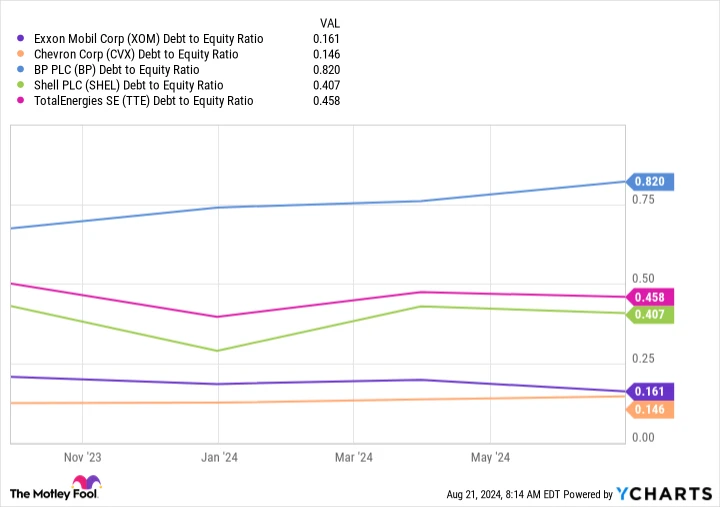

Naturally, simply being large doesn’t guarantee a company’s long-term survival, which is why it’s crucial that ExxonMobil also possesses some of the strongest qualities. balance sheets compared to its nearest competitors. With a debt-to-equity ratio of 0.16, which is considered low for any company, it ranks as the second-best ratio among Exxon’s peer group.

The ratio of debt to equity for XOM (ExxonMobil) data by YCharts

Low leverage provides Exxon with the resources to incur debt during periods of industry decline, allowing it to continue investing in its operations and maintaining its dividend. Remarkably, the dividend has been raised every year for more than forty years, even amid the energy sector’s fluctuations.

This type of adaptability is essential in an industry reliant on commodities, which is recognized for rapid and significant fluctuations in commodity prices.

3. ExxonMobil is capable of making changes whenever it chooses to do so.

In the long run, the main challenge for Exxon isn’t the fluctuation in oil prices, but the worldwide transition toward renewable energy sources Despite experimenting with clean energy initiatives, Exxon has largely decided to remain focused on its traditional oil and natural gas operations. This decision is well-founded, considering that these fuels, although subject to market fluctuations, are expected to continue being essential energy sources for many years ahead.

Nonetheless, investors should recognize how rapidly Exxon could transform if it chose to. Exxon’s most recent acquisition was the approximately $60 billion purchase of Pioneer Energy, aimed at broadening its presence in the onshore U.S. energy market. However, there’s no specific reason Exxon couldn’t invest a similar amount or even more to acquire a clean energy company. Such a decisive action could propel Exxon into the top ranks of the clean energy industry. For comparison, Brookfield Renewable Partners is an organization focused on renewable energy investments and operations. is a significant and internationally diversified clean energy company, yet its market capitalization is approximately $15 billion.

Exxon’s capacity to secure large deals provides it with a competitive advantage that most other companies cannot rival.

4. The amount you spend on ExxonMobil is very important.

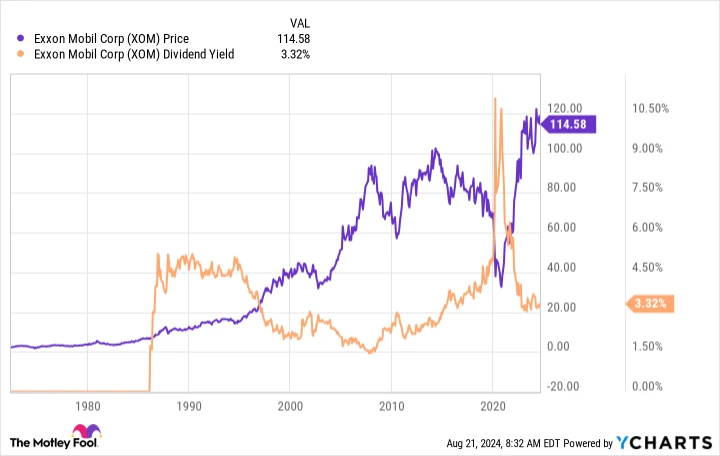

ExxonMobil appears to have the potential to help investors achieve millionaire status over time. However, a significant issue highlighted in the points above is the unpredictability of energy markets. Since Exxon’s revenue and profits are largely affected by the significant fluctuations in energy prices, its stock value often experiences substantial and sudden changes as well.

As indicated by the chart above, the current stock price of Exxon is relatively elevated. Its dividend yield is relatively low, roughly 3.3%. When energy prices decline, Exxon’s stock value can plummet, significantly increasing the yield. If you’re considering Exxon to cover the energy sector in a diversified, wealth-building portfolio, it might be wise to wait until the energy sector is unpopular before making a purchase. This timing could offer the most favorable deal on the stock, presenting the best chance for substantial long-term gains and a solid income flow.

The timing of purchasing ExxonMobil is crucial due to the unpredictable fluctuations in energy prices.

Is investing in ExxonMobil a path to becoming a millionaire? The answer is both yes and no.

Exxon might not be the sole investment that will make you a millionaire due to its focus on the cyclical and unpredictable energy sector. However, thanks to its large scale, diverse operations, financial stability, and capacity for significant initiatives, it can be an essential component of a broader investment portfolio. It offers substantial exposure to the energy sector and the flexibility to adapt to shifts in global energy demand when necessary.

To increase your chances of success, consider purchasing Exxon shares when the energy sector faces a downturn. This strategy involves planning in advance and buying when others are offloading their stocks. Historical trends indicate that declines in the oil market are typically succeeded by recoveries. By exercising patience and adopting a contrarian mindset, Exxon might just be the key to achieving a seven-figure portfolio.

Is it a good idea to invest $1,000 in ExxonMobil at this moment?

Prior to purchasing shares in ExxonMobil think about this:

The Motley Fool is a financial and investing advice company. Stock Advisor The analyst team has just pinpointed what they consider to be the 10 best stocks for investors to purchase at this time… and ExxonMobil wasn’t included among them. The 10 stocks that were selected have the potential to generate significant returns in the upcoming years.

Consider when Nvidia created this list onIf you had invested $1,000 following our suggestion on April 15, 2005, you would possess $792,725 !*

It’s important to mention Stock Advisor the overall average return is765% — a market-beating performance when compared to 165% for the S&P 500. Be sure to check out the most recent top 10 list.

*Performance of Stock Advisor as of August 22, 2024