Shares of e.l.f. Beauty ( ELF -2.16% ) The stock price dropped following the cosmetic company’s uninspiring guidance, despite still showing a significant increase of more than 40% over the last year even with the recent decline.

Let’s delve deeper and determine whether the stock’s decrease in value presents a favorable chance to purchase shares.

Robust first-quarter revenue growth on the fiscal front

In the first quarter of its fiscal year, e.l.f. exceeded the predictions of analysts by a large margin, as its sales for the quarter increased by 50% to reach $324.5 million by June 30. This surpassed the expected sales figure of $305 million. The company experienced growth in both traditional retail sales and online sales through its e-commerce platform.

The earnings per share (EPS) did not change from the previous year, remaining at $1.10, but exceeded the analyst’s estimate of $0.84. Adjusted earnings before interest, taxes, depreciation, and amortization. (EBITDA) Increased by 4% to reach $77.4 million.

The increase in the company’s profits did not match the significant rise in its revenue due to the higher spending on marketing and other expenses to sustain its operations.

In the quarter, E.l.f. performed significantly better than the mass-market color cosmetics sector, as its consumption increased by 26% compared to a 1% decline in the overall market. Nielsen It saw a significant growth in its market share, which rose by 260 basis points to reach 12.3%.

Within the mass skincare segment, the company saw a 45% increase in consumption, elevating its position to become the 9th most popular mass skincare brand in the United States. Despite this growth, the company currently holds only a 2% market share in the category.

The company is experiencing significant international growth, with a 91% increase in revenue compared to the previous year. It has achieved the position of being the fourth largest mass cosmetic brand in the United Kingdom and Canada, and the leading mass cosmetic brand in Italy and the Netherlands.

Enhanced direction

E.l.f. has raised its annual forecast and is now anticipating a growth in sales of 25% to 27%.

The company has raised its anticipated profits, with a new estimate of adjusted EBITDA falling between $297 million to $301 million and adjusted EPS expected to be in the range of $3.36 to $3.41.

Investors were let down by the revenue projection since the middle point fell short of the analyst consensus of $1.3 billion. Interestingly, the company had initially estimated a revenue increase of 22% to 24% last year. However, it consistently raised its projections as the year progressed, ultimately achieving a remarkable sales growth of 77%.

In contrast to last year, the company’s upward guidance revision after the first quarter was more significant. The company increased the upper limit of its guidance by $82 million, or over 11%, from $720 million to $802 million last year. This year, the increase was more modest at $50 million, or 4%.

Is it advisable for investors to purchase stocks when their prices have dropped?

e.l.f. has achieved remarkable success in recent years by quickly capturing a significant portion of the mass-market cosmetics sector in the United States. Their approach of imitating popular high-end brands and leveraging influencers has appealed to a younger audience. By expanding their presence in stores and increasing their product range, the company has experienced impressive growth.

The company has significant growth potential in the skincare sector, where it is a relatively new entrant. By following the successful playbook used for color cosmetics, the company looks poised for promising expansion. Moreover, the company is making notable progress in its international market ventures, presenting another significant growth avenue. In the future, there is also potential for the company to explore additional related markets like fragrances.

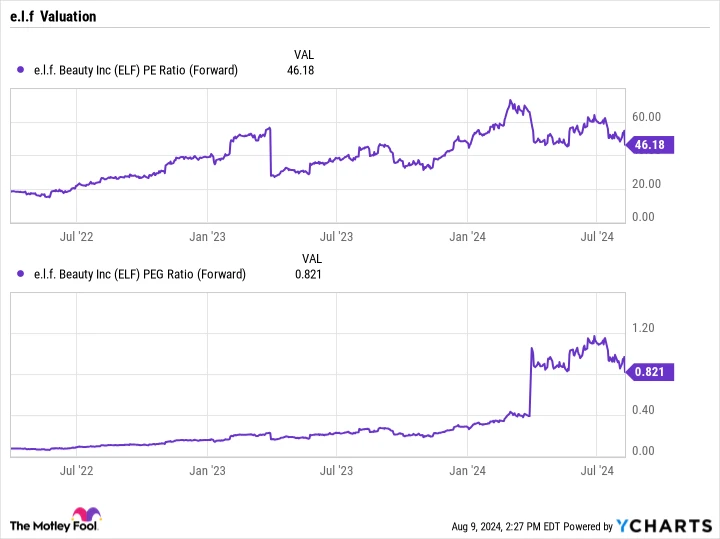

E.l.f.’s Future price-to-earnings ratio (P/E) While purchasing 46 units individually may seem expensive, the company offers a discount. The PEG ratio is a financial metric that compares a company’s price-to-earnings ratio to its growth rate. With a price-to-earnings ratio of just 0.8, and considering its past performance and trend of raising forecasts, the stock appears to be a good value following its recent drop in price.

Forward Price-to-Earnings Ratio of ELFs data by YCharts

Considering the potential for future growth and the excellent implementation so far, I recommend purchasing this. growth stock on the dip.