While it’s common to see a single hot trend capturing Wall Street’s and investors’ focus, it’s quite unusual to witness two such trends occurring simultaneously. Currently, investors are not only enthusiastic about stocks linked to the artificial intelligence (AI) boom but are also showing significant interest in companies announcing stock splits.

A stock split is a strategic tool used by publicly traded companies to modify their share price and the number of outstanding shares proportionally. Despite these adjustments, stock splits are merely formal changes that do not alter a company’s market capitalization or its operational performance.

Stock splits can be executed in two ways: reverse-stock splits, which increase a company’s share price, and forward-stock splits, which decrease it. However, the majority of investors tend to favor forward splits. Companies opting for forward splits are often outperforming their industry counterparts, which contributes to an increase in their stock value.

In 2024, 13 prominent companies have either announced or completed a stock split, with all but one being a forward-stock split. Today marks the first trading day for one of these remarkable companies at its new post-split price.

This company, with a staggering gain of nearly 125,000%, has just completed its sixth split since going public.

Sirius XM Holdings, a satellite-radio operator, had its moment earlier this week as the only notable reverse-stock split of 2024. However, the spotlight today, September 12, is on Cintas, a provider of corporate identity uniform and business services.

On May 2, Cintas’ board revealed plans to execute a 4-for-1 split following the close of trading on September 11. With shares closing above $816 on September 10, this significant split will bring the share price down to just over $200.

Since its initial public offering (IPO) in 1983, Cintas has achieved a total return of almost 125,000%, including dividend payments and cumulative share returns, and has completed six stock splits:

– April 1987: 2-for-1 forward split

– April 1991: 3-for-2

– April 1992: 2-for-1

– November 1997: 2-for-1

– March 2000: 3-for-2

– September 2024: 4-for-1

The primary driver behind this growth is the expansion of the U.S. economy. While recessions are a natural and expected part of the economic cycle, historical data shows these downturns are typically brief. Since the end of World War II, only three of twelve U.S. recessions have lasted a year or longer.

Conversely, periods of economic expansion often last for several years. A growing economy generally increases the demand for corporate uniforms and the diverse products and services offered by Cintas, such as towels, floor mats, and safety kits.

In addition to macroeconomic factors, Cintas has capitalized on a series of strategic acquisitions. The purchases of Zee Medical and G&K Services exemplify Cintas’ efforts to broaden its product and service range, attract new clients, and enhance cross-selling opportunities with existing customers.

Innovation is another crucial aspect of Cintas’ strategy. Continuous development of rental uniforms and other business products helps maintain customer loyalty.

Finally, Cintas boasts a client base exceeding one million corporate customers, ensuring that no single client is critical to its success or could jeopardize its stability.

Despite Cintas’ long-term achievements, expecting significant short-term gains might be optimistic.

While Cintas has a solid foundation for future growth, primarily due to its close ties to the U.S. economy, the prospect of further stock appreciation in the next few years appears challenging.

Concerns are rising about a potential U.S. recession. Indicators such as the first significant decline in U.S. M2 money supply since the Great Depression and the longest yield-curve inversion in history suggest potential economic and market weaknesses.

Although stock movements are not always in sync with the U.S. economy, Cintas is inherently cyclical. Many of its clients are likely to be affected if economic growth slows or contracts, which could, in turn, decelerate Cintas’ growth rate.

Additionally, both the broader market and Cintas are currently considered expensive.

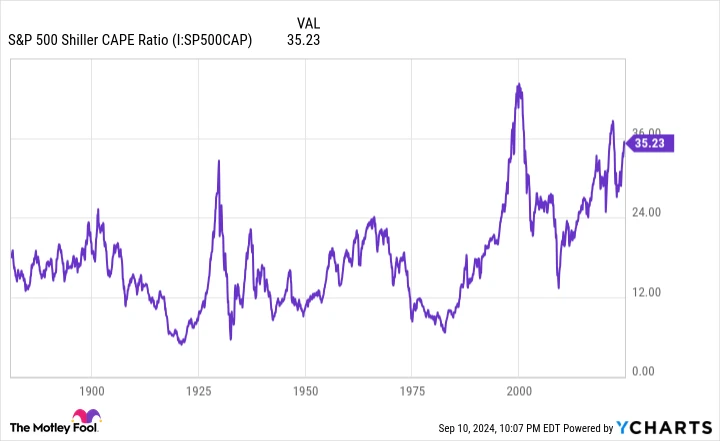

According to the S&P 500’s Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted price-to-earnings (CAPE) ratio, the stock market has only reached its current valuation levels twice before, dating back to January 1871.

On September 10, the S&P 500’s Shiller P/E, based on average inflation-adjusted earnings over the previous decade, stood at 35.33—more than double the 153-year average of 17.16. Historically, when the S&P 500’s Shiller P/E surpassed 30 during a bull market rally, it was often followed by declines of at least 20%.

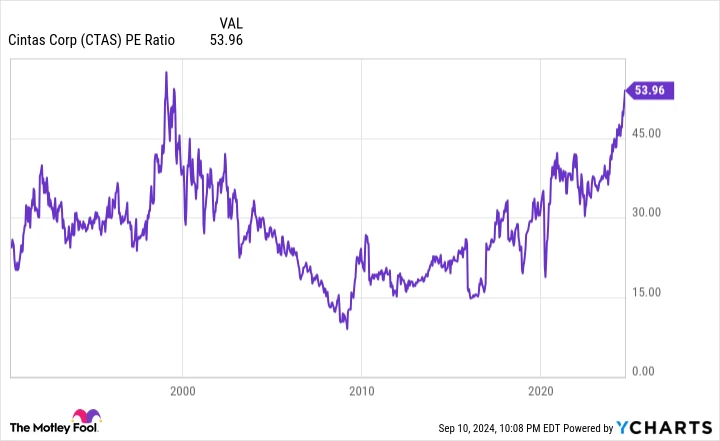

Cintas concluded September 10 at approximately 54 times its trailing 12-month earnings per share (EPS) and an elevated 44 times forward-year EPS. The last time Cintas was valued at 54 times TTM EPS was in the late 20th century.

Although a projected sales growth rate of 7% for the current and upcoming year is commendable for a company of its size, it doesn’t sufficiently justify a forward P/E ratio of 44.

This represents a rare scenario where a fundamentally strong business is not an attractive buy at present.

Contents

- 1 Buy Alert: Consider Doubling Down on These Stocks Today

- 2 – Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $280,262!*

- 3 – Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $363,277!*

- 4 – Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,639!*

Buy Alert: Consider Doubling Down on These Stocks Today

The Motley Fool Stock Advisor service has surpassed the performance of the S&P 500 by more than four times since its inception in 2002*, and the analyst team is adept at identifying when to double down on stocks. They have previously re-recommended a select few stocks, resulting in exceptional returns.

– Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $280,262!*

– Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $363,277!*

– Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,639!*

The opportunity is presenting itself once again. Are you ready to seize it?

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/12/2024