Contents

- 1 Market Challenges and Opportunities for Dividend Stocks

- 2 Potential in Oil Stocks: Occidental Petroleum and ConocoPhillips

- 3 UPS: A Turnaround Opportunity with Strong Dividends

- 4 Toyota: Investing in the Future

- 5 Estee Lauder: A Turnaround Candidate with Timeless Brands

- 6 The Common Thread: Patience and Potential Rewards

- 7 Investment Considerations: Is Occidental Petroleum a Buy?

Market Challenges and Opportunities for Dividend Stocks

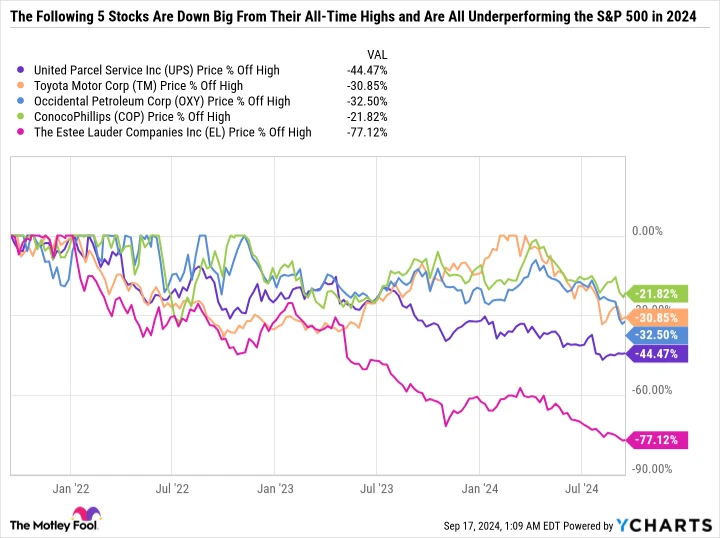

Occidental Petroleum (-0.75%), ConocoPhillips (-0.61%), United Parcel Service (-2.67%), Toyota Motor (0.33%), and Estee Lauder (-2.78%) have all experienced notable declines from their peak valuations. Despite these setbacks, each of these dividend stocks presents compelling investment opportunities, even amidst their respective challenges.

Potential in Oil Stocks: Occidental Petroleum and ConocoPhillips

Occidental Petroleum, also known as Oxy, holds a significant position as the sixth-largest stock in Warren Buffett’s Berkshire Hathaway’s public equity portfolio. Meanwhile, ConocoPhillips stands as the leading U.S.-based exploration and production (E&P) company by market capitalization. Despite these credentials, both firms have faced sell-offs in recent months, influenced by West Texas Intermediate crude oil prices falling below $70 per barrel.

Financial Resilience Amidst Price Fluctuations

As oil prices dip, Oxy and ConocoPhillips face narrower profit margins. Nonetheless, both companies maintain the ability to generate free cash flow at much lower price levels. Oxy’s break-even point is below $50 per barrel, and ConocoPhillips aims for positive free cash flow at just $35 per barrel.

Oxy’s $12 billion acquisition of CrownRock in August and ConocoPhillips’ announcement to acquire Marathon Oil for $22.5 billion in May could appear less favorable if oil prices continue to decline. However, these market conditions offer a buying opportunity for investors looking to acquire top E&P stocks at discounted prices. Oxy offers a dividend yield of 1.7%, while ConocoPhillips pays a regular dividend of $0.58 per share per quarter, alongside a variable dividend based on business performance. This variable dividend has consistently been $0.20 per share over the last three quarters, making ConocoPhillips’ estimated dividend yield approximately 3%.

UPS: A Turnaround Opportunity with Strong Dividends

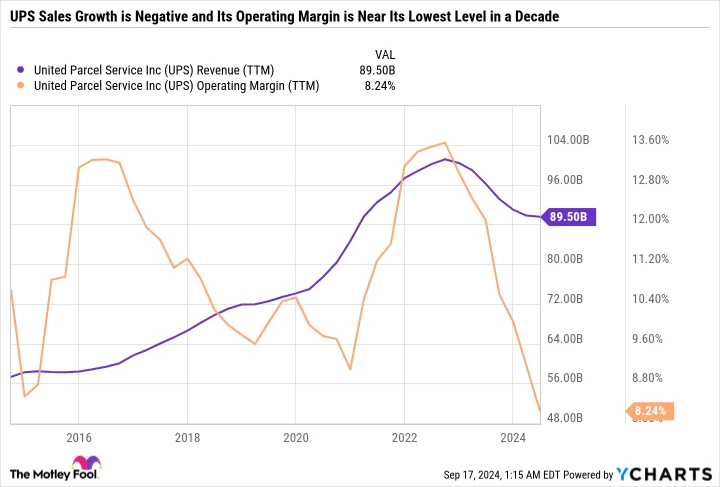

A glance at the chart below reveals why UPS’s stock is down about 45% from its all-time high and is lingering near a four-year low.

Challenges and Optimism for Growth

UPS has experienced declining revenue and margins reaching 10-year lows, primarily due to increased costs from overextended routes and rising operational expenses. However, the company is poised for a return to growth in U.S. package deliveries. Although UPS has assured investors of the dividend’s security, it has indicated that dividend increases may not be forthcoming due to the high dividend expense relative to earnings. With a dividend yield of 4.9%, UPS stands out as an attractive option for investors confident in its growth prospects.

Toyota: Investing in the Future

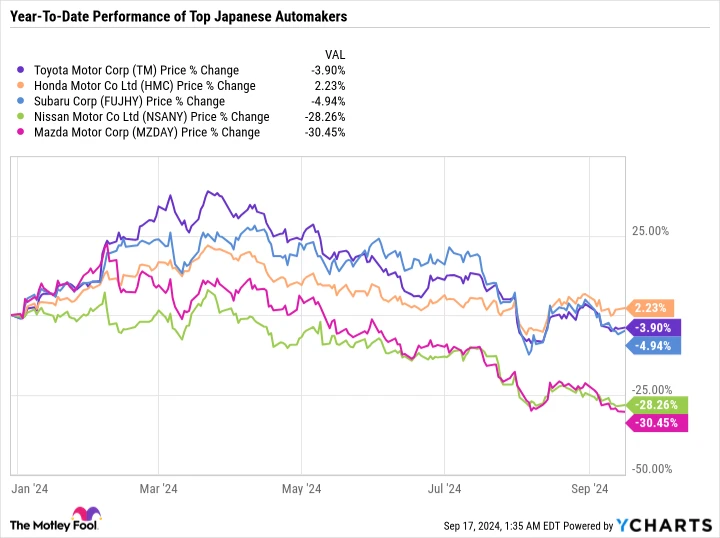

After an impressive start to 2024 and achieving a new all-time high in March, Toyota’s stock has seen a significant downturn.

Strategic Positioning for Long-term Success

Toyota’s sales in Japan and China have declined, affecting its overall performance. Despite this, the company’s trailing twelve-month sales, operating margins, and diluted earnings per share are at decade highs. Concerns linger over potential growth slowdowns, especially if interest rate cuts fail to stimulate U.S. new car sales. Nonetheless, Toyota is making strategic investments in hybrid vehicles and new low-carbon engine designs. The company’s growing dividend further underscores its potential as a valuable investment, especially given its status as the world’s largest automaker by global sales volume.

Estee Lauder: A Turnaround Candidate with Timeless Brands

Estee Lauder’s stock has suffered a significant drop recently, struggling with several adverse trends.

Estee Lauder relies heavily on consumer discretionary spending, which has faced obstacles due to inflationary pressures and rising interest rates. The company’s dependence on in-person shopping in boutique outlets, airports, and malls adds to its challenges, especially in China. Despite these hurdles, Estee Lauder’s portfolio of timeless brands minimizes the risk of losing consumer favor compared to trend-based brands. By refining its marketing strategy and managing costs, Estee Lauder could emerge as a promising turnaround candidate for passive income investors, given its current eight-year low and a 3% dividend yield.

The Common Thread: Patience and Potential Rewards

Despite their distinct challenges, Occidental Petroleum, ConocoPhillips, UPS, Toyota, and Estee Lauder share a common narrative: each company faces valid reasons for their current downturns yet possesses the potential for recovery, rewarding patient investors.

Oxy and ConocoPhillips have the financial resilience to maintain profitability despite fluctuating oil prices. Investors should closely watch their integration of recent acquisitions and navigation through volatile periods.

UPS needs to demonstrate a clear path toward increasing margins and growth in package delivery volumes.

Toyota must adeptly handle macroeconomic challenges while pursuing innovations in low-carbon internal combustion engines, electric vehicles, and hydrogen-fueled cars.

Estee Lauder must revitalize its sales strategy to fully leverage its brand portfolio.

Investing in turnaround companies requires understanding key indicators and having the patience to weather volatility. Dividend-paying stocks offer an incentive to maintain patience, making Occidental Petroleum, ConocoPhillips, UPS, Toyota, and Estee Lauder appealing choices for long-term investors.

Investment Considerations: Is Occidental Petroleum a Buy?

Before considering an investment in Occidental Petroleum, take note of this:

The Motley Fool’s Stock Advisor analyst team has identified what they believe are the 10 best stocks to invest in right now, and Occidental Petroleum isn’t on that list. The selected stocks are poised for substantial returns in the upcoming years.

For instance, when Nvidia was recommended on April 15, 2005, a $1,000 investment would have grown to $710,860.*

The Stock Advisor service provides investors with a straightforward blueprint for success, featuring guidance on portfolio building, regular analyst updates, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500 more than fourfold since 2002*.

See the 10 stocks ›

*Stock Advisor returns as of September 17, 2024.