Do you appreciate simplicity in investing? You should, as often the simplest strategies yield the greatest returns. Investors who avoid overcomplicating their decisions frequently achieve better results than those who do.

With this in mind, anyone in search of a well-rounded stock addition to their portfolio should consider The Coca-Cola Company (-0.07%). Here are three compelling reasons to consider a significant investment in this straightforward and dependable company.

1. Coca-Cola’s Portfolio of Influential Brands

While Coca-Cola is best known for its iconic cola, its brand portfolio extends far beyond that. The company also owns Powerade sports drinks, Minute Maid juices, Costa coffee, Gold Peak tea, Dasani water, and Barq’s root beer, among over 200 brands. This extensive selection ensures Coca-Cola has something for everyone, regardless of shifting consumer tastes. Many of these products are also leaders in their respective categories, just like their flagship soda.

What makes Coca-Cola stock particularly appealing isn’t only its vast array of leading brands but also how it achieved this status.

Coca-Cola excels in both the art and science of marketing. Its lifestyle branding has embedded its flagship name into pop culture, and the company’s sheer size and financial resources allow it to out-market competitors. While this might give Coca-Cola an edge that seems unfair, investors prefer companies that can continue to outperform their rivals.

2. Coca-Cola’s Business Model Ensures Consistent Results

To see Coca-Cola’s market dominance, one need only examine its historical performance. However, its success might not stem from the reasons you expect.

Contrary to popular belief, Coca-Cola likely didn’t bottle or distribute the beverage you enjoy. Instead, it outsources most of this work to third-party bottlers who purchase flavored syrups directly from Coca-Cola. This approach generates slightly less revenue for the company but results in more stable profits and wider margins since production costs and risks are absorbed by the bottlers.

This model has proven especially advantageous amidst rising costs of, well, everything. Consumers still crave their favorite drinks. It’s the bottlers who primarily shoulder the challenge of maintaining affordability, even if it means accepting slimmer margins.

3. Coca-Cola’s Dividend is Both Dependable and Growing

The outcome of Coca-Cola’s steady revenue and inflation-related growth is a continually increasing income stream that supports rising dividends.

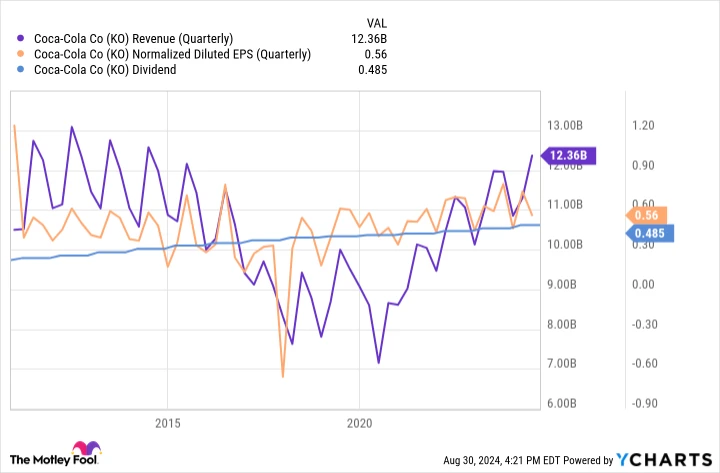

Remarkably, since divesting its in-house bottling operations in 2017, Coca-Cola hasn’t missed a quarterly profit. This includes the early 2020 period when the pandemic significantly impacted revenue. Since then, per-share earnings have rebounded above the quarterly dividend, and there’s every indication this trend will continue.

KO Revenue (Quarterly) data by YCharts

The chart above doesn’t entirely capture how consistently Coca-Cola grows its bottom line, ensuring its ability to enhance payouts. As of February this year, Coca-Cola has raised its annualized dividend for 62 consecutive years without compromising its competitive edge. You can tap into this growth trend with the stock’s current yield of 2.7%.

Consider the Company, Not Just the Stock

Value-focused investors may hesitate at Coca-Cola’s forward price/earnings ratio of 25 or its current trading price slightly above analysts’ consensus target of $71.29. These figures suggest limited immediate upside potential.

However, that’s not entirely how the stock market operates, particularly for companies like Coca-Cola. You should anticipate paying a premium for quality, just as you can expect this stock to lead analysts rather than follow them.

Ultimately, since Coca-Cola is best viewed as a long-term investment, short-term price and valuation metrics hold little significance. Long-term investors aren’t merely buying stocks; they’re acquiring stakes in companies. As Warren Buffett famously stated, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Coca-Cola indisputably qualifies as a wonderful company.

Incidentally, Coca-Cola is the fourth-largest holding in Warren Buffett’s Berkshire Hathaway portfolio, which speaks volumes about its quality and potential.