Investment goals differ depending on how long someone plans to invest and how much risk they are willing to take. Nevertheless, the majority of diversified investors are likely seeking a mix of growth, income, and value stocks.

When searching for dividend stocks to add to your portfolio, it’s crucial to look beyond just the dividend yield. Focus on investing in reputable companies that show promise in increasing their earnings and dividends over time. Remember, a company without growth potential may lag behind the market, so it’s wise to consider alternative investments like other stocks or a high-yield savings account for generating income.

Walmart ( WMT 0.43% ) , Target ( TGT 1.14% ) , and Clorox ( CLX -0.90% ) For many years, these companies have consistently raised their dividends annually. Additionally, all three companies have the capability to boost profits and appreciate in worth in the long run, meaning that the investment strategy is not solely focused on generating passive income.

Allocating $2,000 to every stock is expected to generate a minimum of $150 in yearly dividend earnings. Here is the rationale behind this for all three stocks. stocks that pay dividends are worth purchasing at the moment.

Credit: Getty Images.

Walmart may keep generating significant profits.

Walmart’s yield at the end of trading on Friday stands at only 1.2%, making it the stock with the lowest yield on the list. This is attributed to Walmart’s remarkable success.

If a stock’s price increases faster than the dividend growth rate, the yield will decrease. Walmart has been the top-performing stock this year, with a gain of over 29% so far. The Dow Jones Industrial Average is a stock market index that measures the performance of 30 large, publicly-owned companies trading on the New York Stock Exchange and the Nasdaq. — better than Microsoft , Apple , and other stocks that are experiencing growth .

Walmart is a Dividend King Having increased its dividend for more than 50 years in a row, the company raised its dividend by 9% in February. There are indications that the rate of dividend increases is expected to speed up.

The fiscal 2025 forecast for Walmart is satisfactory but not outstanding, anticipating a minimum 4% growth in consolidated net sales, a minimum 6% rise in consolidated adjusted operating income, and adjusted earnings per share (EPS) of at least $2.37. If Walmart achieves these figures by the end of its fiscal year on Jan. 31, the current share price would result in a price-to-earnings ratio (P/E) of 28.7.

Nevertheless, earnings per share may not accurately reflect a company’s financial performance if it incurs unusually high one-time expenses that lower its profits, as seen with Walmart. The company’s capital expenditures experienced a significant increase during this period. investments for the purpose of renovating stores over a prolonged period Enhancing its e-commerce Walmart+ delivery service and other initiatives will incur costs that may not result in immediate profits. Nevertheless, there is potential for capital expenditure to represent a smaller portion of sales in the upcoming fiscal year, leading to improved profit margins.

Investors who focus on short-term gains may not be satisfied with Walmart’s low 33% dividend payout ratio and may question why the company doesn’t distribute more profits as dividends. Despite being able to afford a higher dividend, Walmart might provide better long-term benefits to investors by effectively allocating its capital. In the past year, Walmart has invested $20.85 billion in capital expenditures, which is three times higher than its dividend payments. As Walmart is currently focused on growth, investing in the stock is about considering the future direction of the business and potential dividends rather than just its current position.

Walmart may not be a thrilling company, however, it is currently a promising opportunity for investors, particularly if it can sustain its advancements in curbside pickup and delivery services.

Target is starting to stabilize.

Target raised its dividend in June for the 53rd year in a row to $1.12 per share per quarter, marking a modest 1.8% increase from the previous quarter. When companies make minimal dividend increases solely to maintain a streak, it may indicate a slowdown in growth.

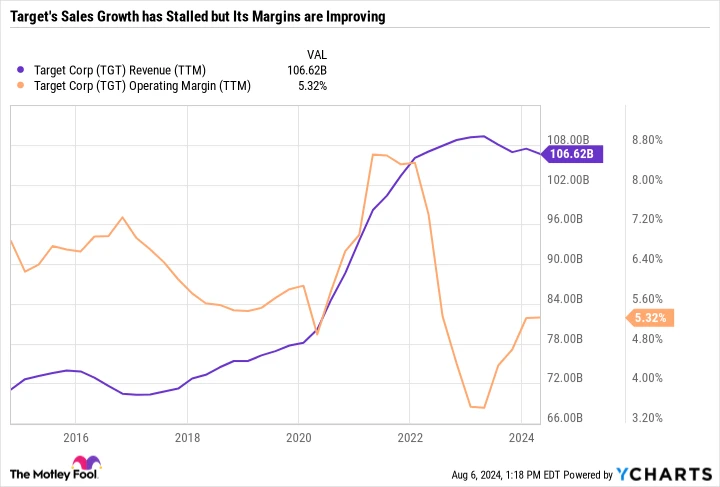

In the case of Target, it was likely appropriate to make a small increase in dividends. This visual representation will offer some insights into the reasons behind this decision.

Trailing Twelve Months Revenue from Target Company data by YCharts

During the fiscal year ending on January 30, 2021, Target reported a remarkable earnings per share (EPS) of $14.10 due to increased consumer spending amidst the height of the COVID-19 pandemic. Encouraged by this success, Target decided to increase its dividend by 20% in June 2022, a decision that was later seen as overly optimistic. However, the following year turned out to be one of Target’s most disappointing periods as difficulties in the supply chain and misjudged consumer demand resulted in unsatisfactory performance.

Following this, there has been no increase in sales growth and profit margins have decreased. While Target has improved from its most challenging period of reduced profit margins, the company is not performing at its best. Target’s projections for the year indicate a modest growth in same-store sales of 0% to 2% and earnings per share in the range of $8.60 to $9.60. This would result in an earnings growth of less than 2% at the midpoint.

Target’s performance has been irregular in recent years, as seen in its fluctuating stock price impacted by investor confidence. Nevertheless, Target is currently a promising investment choice as it is considered a valuable stock. With a payout ratio below 50%, the company is capable of comfortably paying its dividends. Its dividend yield is a substantial 3.3%, surpassing that of Walmart. While Target’s growth rate may not be as rapid as expected, its relatively low P/E ratio of 15.2 makes it an affordable option.

When considering everything, Target emerges as a reliable stock for dividends that is worth investing in at present, particularly if it can achieve a more stable pattern of growth.

Clorox is managing its expenses efficiently.

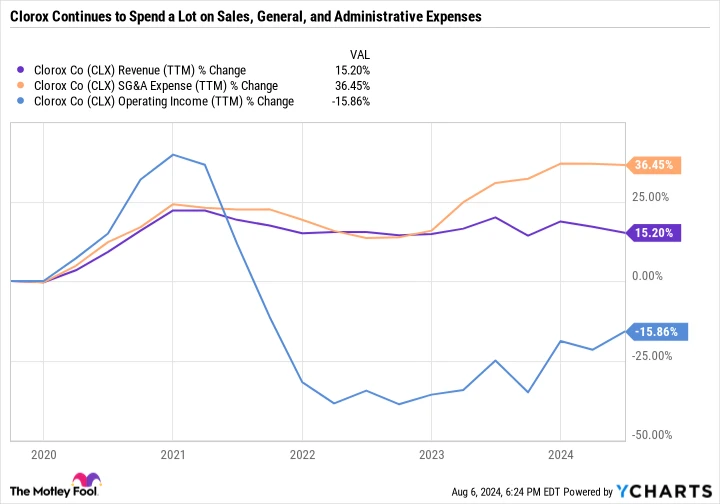

Similar to Target, Clorox has been working on bouncing back in the past few years. The company saw a significant increase in sales at the beginning of the pandemic. The management was optimistic that the increased focus on cleanliness would continue even after the pandemic ended. However, things did not go according to their expectations. In reality, Clorox miscalculated the demand, faced difficulties with the supply chain, inflation, and on top of that, cyberattack The company faced significant challenges in 2023, leading to a departure from the typical business operations at Clorox.

The chart illustrates that Clorox’s sales, general, and administrative costs have increased at a quicker rate compared to revenue. Despite a sharp increase in 2020, the company’s operating profit has declined in the past five years due to slow revenue growth and elevated expenses.

Twelve months trailing revenue of CLX. data by YCharts

Clorox has achieved a more favorable balance in its financial performance, possibly the first time in four years. The company recently released its financial results for the fourth quarter and full year of fiscal 2024, showing improved gross margins and enhanced cost control. In fiscal 2025, Clorox’s forecast indicates a modest 0% to 2% rise in net sales, alongside a 100- basis-point There has been a rise in gross margin and adjusted earnings per share from $6.55 to $6.80, representing a growth of 6% to 10%.

Clorox’s performance has improved slightly, but it is not outstanding. Similar to Target, the current stock price of Clorox already takes into account the difficulties the company is facing, as it is lower than its pre-pandemic level.

Clorox increased its quarterly dividend from $1.20 to $1.22 per share on July 30, marking a slight raise. This adjustment continues the company’s record of paying dividends consistently since 1984.

Clorox, with a 3.4% yield, is a company that is advancing in its transformation and has the potential to provide patient investors with a substantial amount of passive earnings.