The Federal Reserve has officially indicated that the cycle of interest rate hikes has reached its peak, and reductions in interest rates are anticipated to commence this year. Since the onset of 2022, the Federal Reserve in the U.S. has raised the interest rates it charges banks, consequently increasing the interest rates offered to customers on banking and savings products.

Higher interest rates generally render slow-growth dividend stocks less appealing, all other factors being equal. The rationale is that if one can achieve similar returns in a savings account, why assume the risk associated with a dividend stock that might depreciate in value? This sentiment explains why ultra-high-yield tobacco stocks like British American Tobacco (0.31%) and Altria Group (-0.80%) remained stagnant for several years. However, this summer marked a turning point, with both stocks surging over the past three months, significantly outperforming the broader market, represented by the S&P 500, during this period.

So, is it too late to invest in these high-yield tobacco stocks, or is the favorable trend just beginning as interest rates are poised to decrease soon?

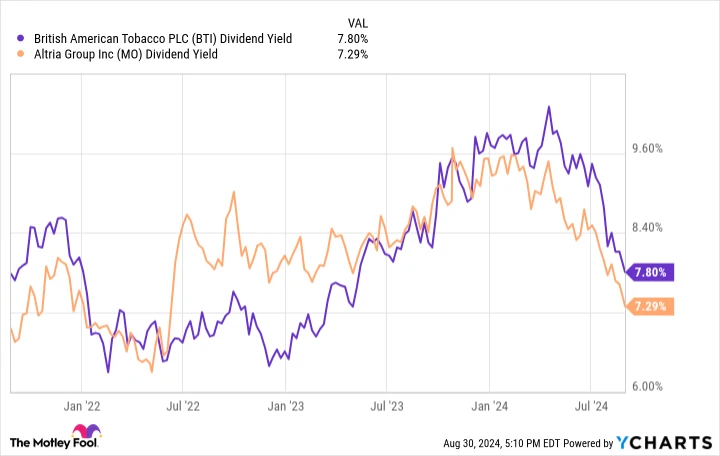

BTI Dividend Yield data by YCharts

Altria Group: Facing a 7.3% Dividend Yield Amidst a Challenging Consumer Landscape

Altria Group, the owner of the leading premium cigarette brand Marlboro in the U.S., also controls the NJOY nicotine vaping brand, Middleton Cigars, On! nicotine pouches, and holds a substantial stake in Anheuser Busch. Currently, it boasts a 7.29% dividend yield, although this has decreased from over 9% earlier this year.

Investors are concerned about declining Marlboro volumes in the U.S., as smoking rates continue to fall in the country. This year alone, Marlboro’s shipment volumes have decreased by over 10%, with no indication of slowing down—a trend observed for many years. Nonetheless, Altria’s operating income has surged by 51.8% over the past decade. The reason? Its ability to leverage pricing power for cigarette packs. This pricing dynamic could persist for several more years.

Additionally, Altria has several growth avenues that can bolster earnings. Cigar volumes are not declining as rapidly and also benefit from pricing power. Meanwhile, vaping and nicotine pouches are expanding markets and are expected to offset Marlboro’s volume reductions in the future. When combined, these factors suggest that the worries about Marlboro’s volume decline may be exaggerated.

Moreover, Altria’s share repurchase program is noteworthy. The number of shares outstanding has decreased by 13.7% over the past decade, facilitating dividend per share growth. Free cash flow per share, crucial for dividend payments, has increased by 125% in the same timeframe. As long as the company continues to raise prices and transition consumers to new products while reducing its share count, free cash flow per share is likely to keep rising.

British American Tobacco: A Higher Yield with Greater Potential Upside?

British American Tobacco, another top dividend payer, offers a 7.8% yield and shares some similarities and differences with Altria Group.

Like Altria, it has exposure to the rapidly declining U.S. market, owning brands such as Dunhill and Lucky Strike. To maintain profitability in the U.S., the company must increase prices and enhance its profit margins.

However, British American Tobacco differentiates itself with its international market exposure. These markets generally experience slower volume declines than the U.S., benefiting the company. Nonetheless, it faces foreign currency risks that can affect U.S. investors. If the U.S. dollar appreciates, it could pose a challenge to British American Tobacco’s earnings. Despite this, the international segment offers potential for sustained profit growth, provided the U.S. dollar remains stable.

British American Tobacco is outperforming Altria in the realm of tobacco-free nicotine products, with robust brands like Vuse (vaping) and Velo (nicotine pouches) becoming increasingly significant to its business. In fiscal 2023, these smokeless products accounted for 16.5% of revenue and transitioned from losses to profitability. These divisions show no signs of slowing and can drive cash-flow growth, supporting or enhancing the dividend.

Is It Too Late to Invest in These Dividend Payers?

Depending on your tax situation—which can be a key consideration for dividend stocks—owning dividend stocks with yields exceeding those of savings accounts or U.S. Treasury bonds is advantageous. This is particularly true if Treasury rates are expected to decline. Both Altria and British American Tobacco offer dividend yields over 7%, far surpassing what savings accounts provide.

The critical question is: Are these dividend yields sustainable? I believe they are. Despite declining volumes in the U.S., both companies can mitigate these impacts with price hikes and increased contributions from new divisions. Consequently, it’s unsurprising that Altria recently increased its quarterly dividend payout by 4% to $1.02.

In conclusion, I believe both stocks are well-positioned to consistently grow their dividend-per-share payouts over the next five to ten years. If this materializes, income-focused investors who purchase shares at current prices will likely be pleased.