Contents

Federal Reserve’s Interest Rate Cut: Implications for Investors

As anticipated, the Federal Reserve reduced the U.S. baseline interest rate on Wednesday. The Fed Funds rate was decreased by 50 basis points, causing a ripple effect that pulled most other interest rates down. The committee responsible for these decisions hinted at further rate cuts in the near future, a move aimed at stimulating the economy without sparking inflation. This development has been met with enthusiasm by investors, who view the rate cuts and accompanying rhetoric as positive signs.

Not All Companies Benefit Equally

However, not every company is likely to thrive in this low-interest environment. Charles Schwab, a prominent brokerage firm, stands to face more challenges than gains in the foreseeable future. Investors should temper their expectations for Schwab, and here’s why.

Schwab’s Revenue Under Pressure

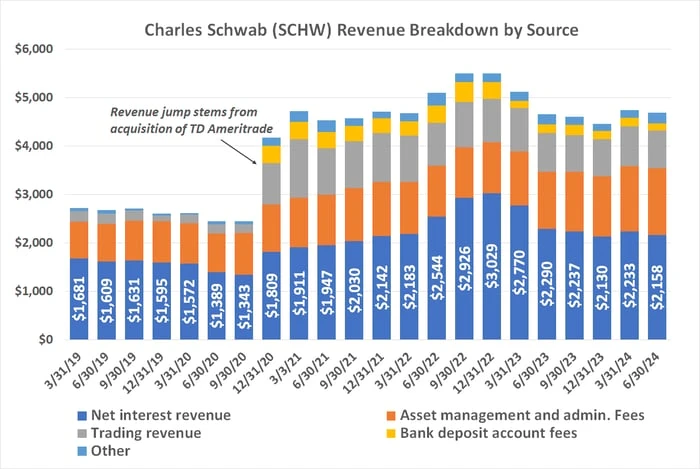

While Charles Schwab is widely recognized as a leading online broker, trading activities are not its primary revenue source. The same goes for investment management, retirement plan administration, and its banking operations. In fact, Schwab’s largest revenue stream is interest income, which constitutes nearly half of its total revenue—this is after accounting for its own interest expenses.

This reliance on interest income surprises many, given the nature of Schwab’s business. It’s a cyclical issue that Schwab will likely grapple with for some time. The company earns more net interest income when rates are high, as the spread between interest earned and interest paid widens. Currently, this spread is narrowing, and the Fed’s recent actions indicate that this trend might persist.

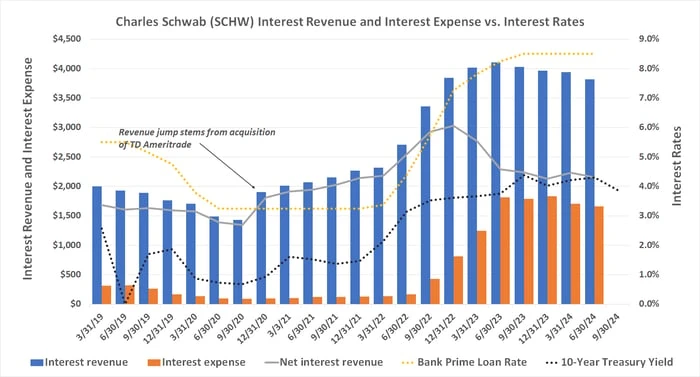

The chart above illustrates part of the story, comparing Schwab’s interest revenue against its expenses to highlight net interest revenue. Notably, net interest revenue hit its peak in late 2022, even before interest rates themselves peaked. Since then, Schwab’s net interest revenue has dwindled, and this decline is expected to continue with further rate cuts anticipated by the Federal Reserve.

Why This Matters

In the second quarter of this year, Schwab’s net interest revenue accounted for 46% of its total revenue, driven by products such as margin loans and cash holdings, including money market funds. However, the $2.16 billion net interest revenue of that quarter marked a nearly 30% drop from the over $3 billion earned in Q2 2022, when this revenue stream made up more than half of Schwab’s total revenue.

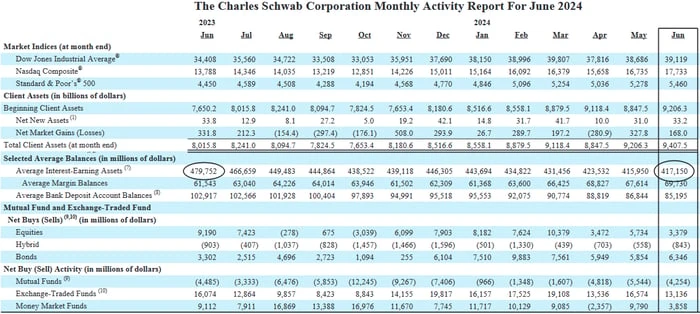

This downward trend is likely to continue as interest rates fall further. Despite a rise in margin loan balances, Schwab’s average level of interest-earning assets is approaching a multi-year low, over 16% below its 2023 peak.

In essence, Schwab’s clients are currently investing in fewer cash-generating instruments for the broker, opting instead for more stocks and bonds. These investments typically yield only a single commission charge or bid/ask spread gain at the time of the trade.

Current Market Conditions: Not Ideal for Schwab

Despite these challenges, Schwab is still attracting new customers and accumulating assets. By the end of August, the firm was managing an impressive $9.74 trillion in client assets, a 20% year-over-year increase. Even if only a small fraction of these assets generate recurring revenue, they are still held by Schwab, ready to be monetized when conditions improve.

However, the current economic landscape does not favor Schwab or other brokers. While borrowing costs are declining, inflation keeps money tight, contributing to a rise in corporate bankruptcies beyond pre-pandemic levels. Stock trading activity isn’t expected to surge either, as the overall economy stabilizes post-pandemic. Consequently, new investor inflows might slow, reflecting in Schwab’s financial performance.

Conclusion: A Long-Term Hold with Short-Term Challenges

In summary, while Schwab remains a solid long-term investment, its near-term outlook is less promising. Investors seeking immediate returns might want to explore other, potentially more lucrative opportunities.

Investment Consideration

Before considering an investment in Charles Schwab, reflect on this: The Motley Fool Stock Advisor team recently identified what they believe to be the 10 best stocks for investors to buy now, and Charles Schwab wasn’t among them. These top 10 stocks could potentially yield significant returns in the coming years. For instance, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, your investment would have grown to $710,860!*

The Stock Advisor service offers investors a strategic roadmap for success, complete with portfolio-building guidance, regular analyst updates, and two new stock recommendations each month. Since 2002, Stock Advisor’s returns have more than quadrupled the S&P 500.*

See the 10 stocks ›

*Stock Advisor returns as of September 17, 2024